Yesterday and today Federal Reserve bankers, Collins, Goolsbee and Barkin. Overall, the tone of those remarks was quite mixed, but Fed rates cuts in autumn this year seems to be obvious.

Fed Collins

- It's appropriate to begin easing soon if the data is as expected.

- The timing and pace of cuts is to be based on data.

Fed Goolsbee

- If we're too tight for too long, we need to watch the real economy. Policy is tight.

- We are getting back to more normal conditions in the US economy.

- We need to see more than payrolls and more than one month.

- The question is if the job market will hold, or keep worsening.

- The Fed watches the markets, but they don't drive policy.

- Whatever the Fed does, somebody is going to say they don't like it.

Fed Barkin

- The US may be heading into a long-term worker shortage.

- The financial markets are looking not just at the modal outlook but also at the tails.

- The equity markets don't feel like there's a big cataclysmic event that just happened.

- For me, the case for lowering in July would have been either absolute conviction that the labour market was on the precipice, or if you thought you had inflation under control.

- What would make you more worried is if job growth started to disappear.

- The math of that suggests the unemployment rate goes up.

- Job growth has settled down, but still adding jobs, there's a lot more labour supply than was thought a year or two ago.

- No hiring, no firing, that's what we see in the data, and from here it could go either way.

- What I hear from folks on the ground in the labour market is people are cutting back on hiring, but not firing.

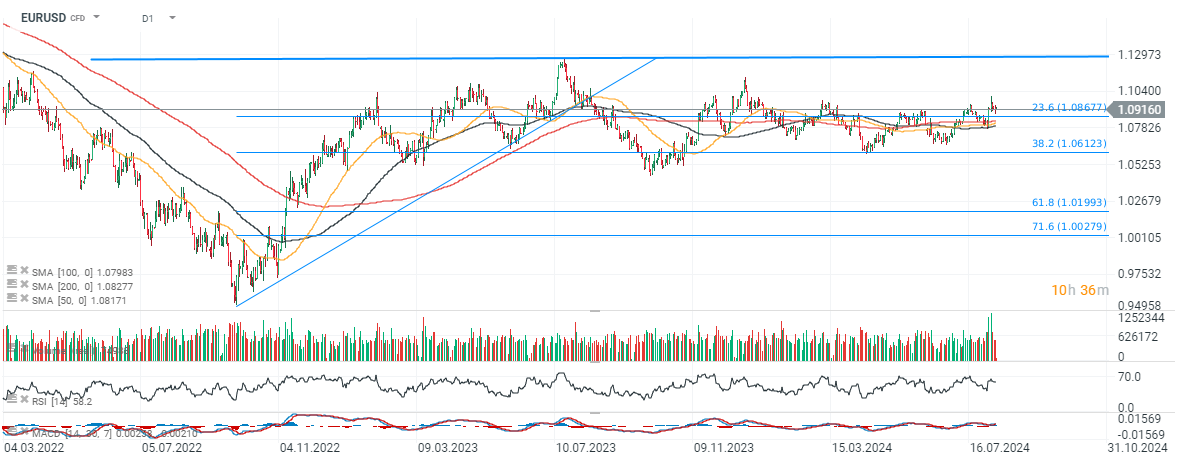

Source: xStation5

Source: xStation5

BREAKING: US December manufacturing PMI holds at 51.8; eases from 52.2 in November📌

BREAKING: S&P Manufacturing PMI data from the UK weaker than expected

Economic calendar: Markets await final US manufacturing PMI data🔎

BREAKING: Euro Zone Manufacturing PMI misses the estimate 🇪🇺 📉