EURUSD trades near parity levels ahead of expected 75 bp ECB rate hike

Monetary policy decision from the European Central Bank (1:15 pm BST) is a key event of the day. Bank is expected to deliver a 75 basis point rate hike, following a 50 basis point rate move in July. This would put the deposit rate at 0.75% - the highest level since October 2011. Inflation in the euro area exceeded 9% according to flash estimates for August, increasing pressure on the ECB to tighten policy quicker.

Such a big rate move from a usually dovish ECB may send an important message to the markets, even if it is almost 100% priced-in. EURUSD has been struggling as of late on the back of two reasons. Firstly, the common currency is underperforming amid a spike in energy costs that is threatening to push the euro area economy into recession. Secondly, pick-up in US yields is providing support for the US dollar. Having said that, a continuation of the ongoing drop in prices of energy commodities and potential drop in US yields, for example in case Fed slows tightening process, may be a chance for EUR.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appApart from that decision, press conference of ECB President Lagarde at 1:45 pm BST will also be in focus. Traders will look for hints on future rate moves and balance sheet reduction. EURUSD traders should also keep in mind that the pair may be more volatile at 2:00 pm BST during a speech from Fed Chair Powell.

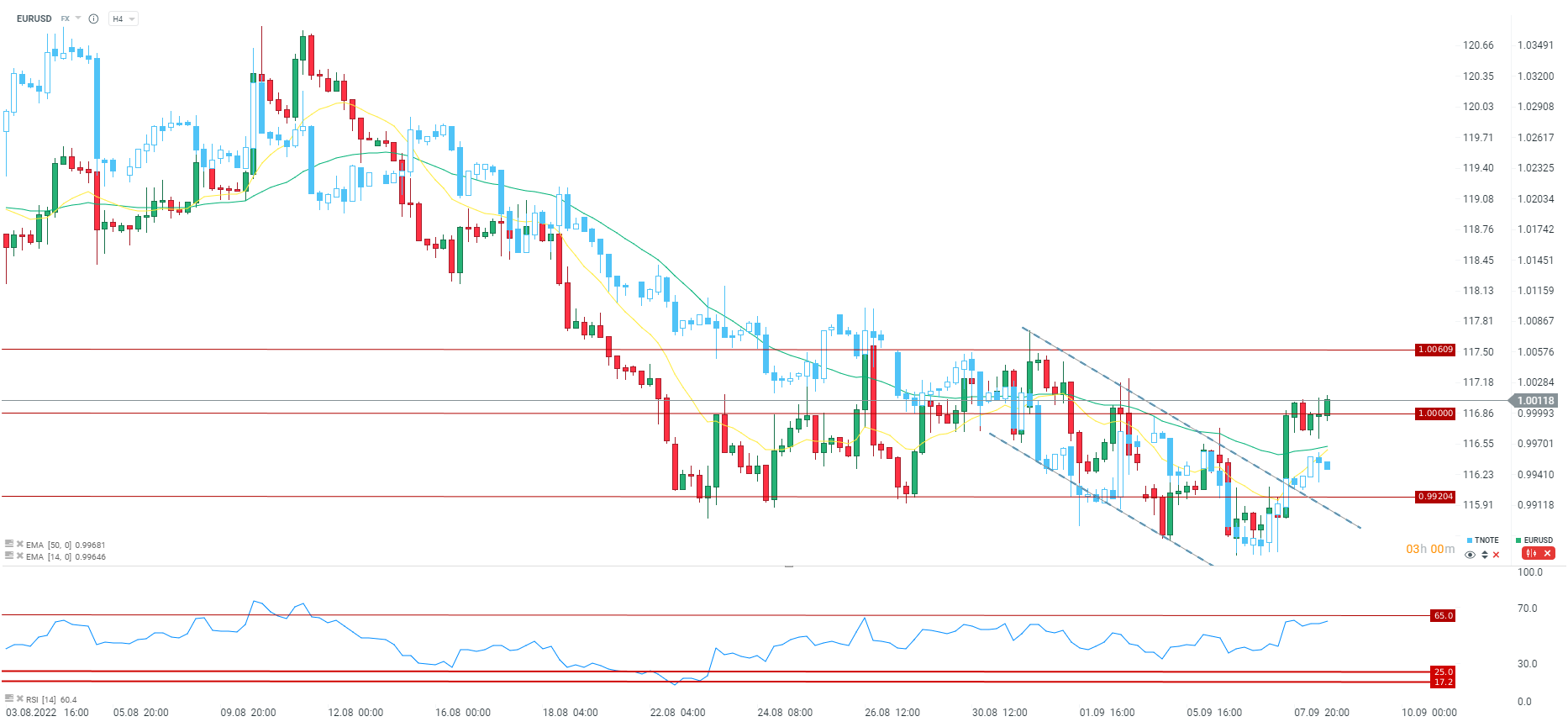

EURUSD is hovering around 1.00 handle today. The pair could benefit from a hawkish ECB guidance but the bank warned that it will make decision on meeting-by-meeting basis therefore any clear forward guidance may not be offered. If ECB fails to sound hawkish (or hikes by 50 bp) may see the pair resume recent slide. Source: xStation5

EURUSD is hovering around 1.00 handle today. The pair could benefit from a hawkish ECB guidance but the bank warned that it will make decision on meeting-by-meeting basis therefore any clear forward guidance may not be offered. If ECB fails to sound hawkish (or hikes by 50 bp) may see the pair resume recent slide. Source: xStation5