The dollar is clearly the weakest currency among the G10 today. The dollar index (USDIDX) is down 0.23%, while the EURUSD rate has gained 0.27%. The sell-off in the dollar is due to significantly weaker ISM reports for June released yesterday.

Market volatility is limited today, with Wall Street closed in observance of Independence Day in the United States. Despite this, the forex market is experiencing strong downward movements in the dollar, making it one of the weaker currencies today. The downward pressure is a result of yesterday's negative ISM data surprise. Although a month-to-month decline was expected, the actual June data showed an even deeper drop. The index fell to its lowest level in four years, with declines in all sub-indices, including employment, orders, and prices. Furthermore, ADP employment data also confirmed the downward trend, and investors are anticipating further weakening in tomorrow's NFP data.

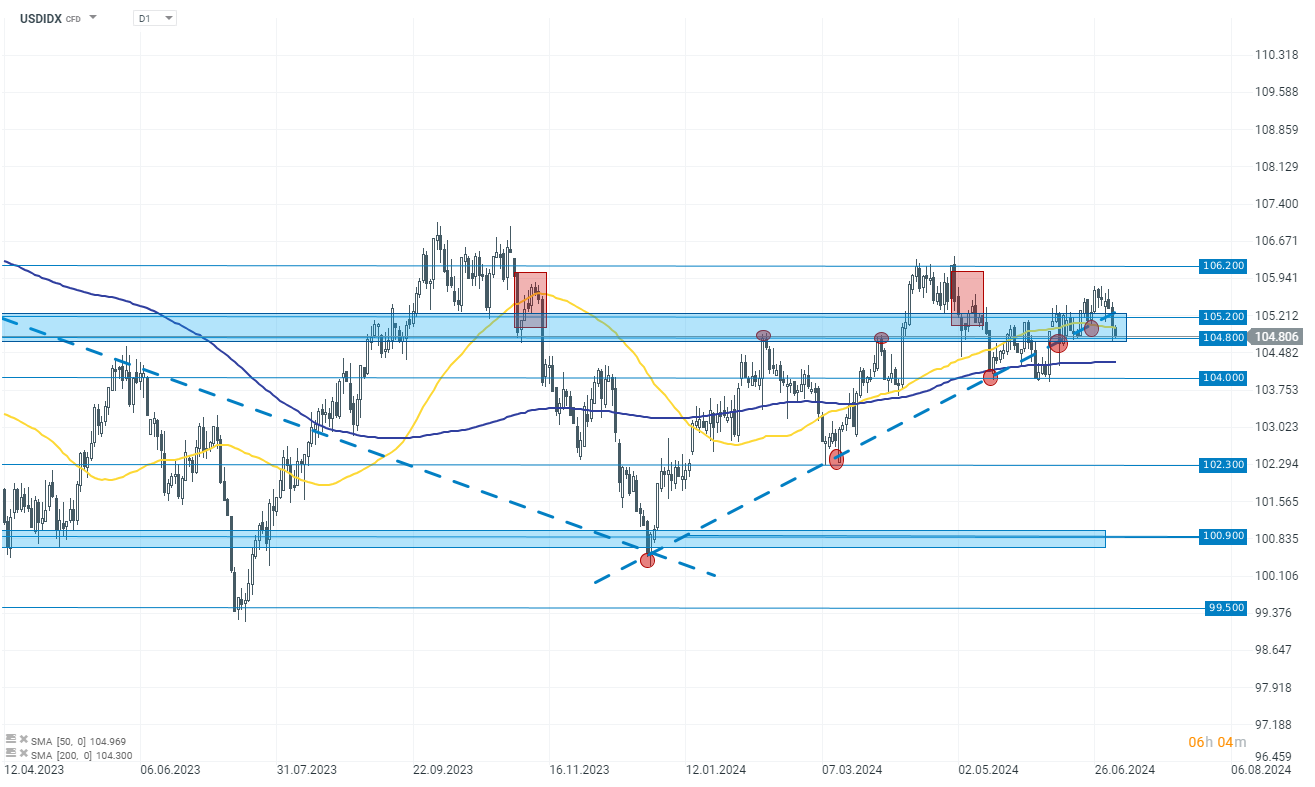

USDIDX (D1)

The dollar index is down 0.23% today, breaking below a key support zone (dashed upward trendline). Much depends on tomorrow's NFP employment report. If the data is equally weak, we can expect further dollar sell-offs due to concerns about a slowing US economy. Not long ago, we saw the opposite reaction, where markets reacted positively to weaker data, anticipating faster interest rate cuts. Currently, we see that investors' approach is slowly shifting. If the downward pressure on USDIDX persists, the next support zone is at the 104,000 level.

Source: xStation 5

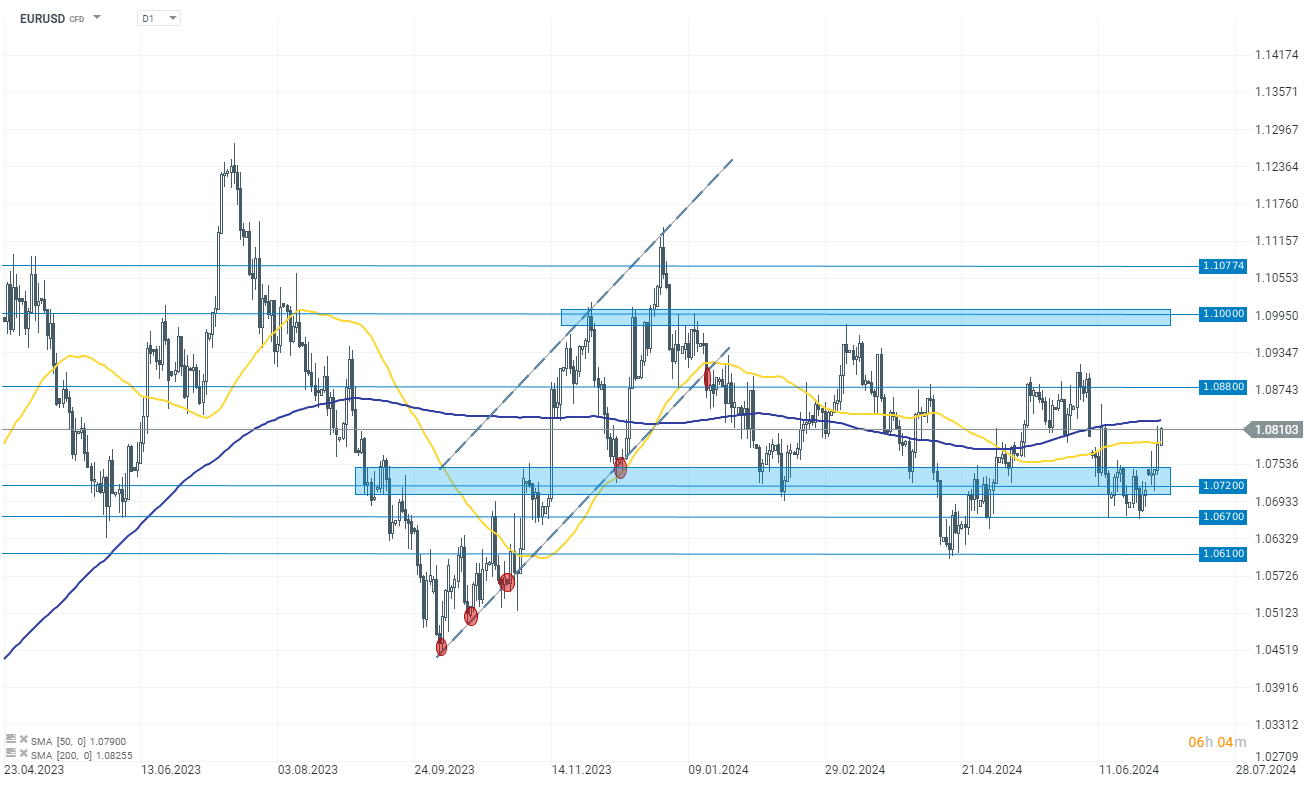

EURUSD (D1)

EURUSD is up 0.27% from the 1.0810 level, breaking out from a key support zone. The last two dynamic upward sessions indicate strong momentum. The next target for the current move could be the 1.0880 level. Conversely, the nearest support level is the recent consolidation zone around 1.0700.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)