Etsy (ETSY.US) shares jumped over 15.0% on Thursday after the online crafts marketplace posted solid quarterly results, saying its business remained strong in a volatile economic environment.

-

Company earned $ 0.58per share, which easily topped market projections of $ 0.37 per share.

-

Revenue increased 11.7% YoY to $ 594.47 million and also beat analysts’ estimates of $ 564.2 million.

-

For the current quarter, the company expects revenue in the region between $ 700 million and $ 780 million, and gross merchandise sales of $ 3.6 billion to $ 4 billion. StreetAccount analysts expected Q4 revenue of $ 743 million, and GMS of $ 3.9 billion.

-

Etsy also recorded operating deleverage since its EBITDA margin dropped by 5% to 28%. This equates to an EBITDA of $ 167.8 million.

-

"We are pleased that Etsy's business has remained strong in a volatile environment and we believe our sustained performance is a testament to Etsy's unique position in e-commerce where, in a world of mass commodities supplied by companies obsessed with speed and scale, Etsy is the antidote, "said CEO Josh Silverman.

-

Etsy repurchased $ 151 million of common stock in the quarter.

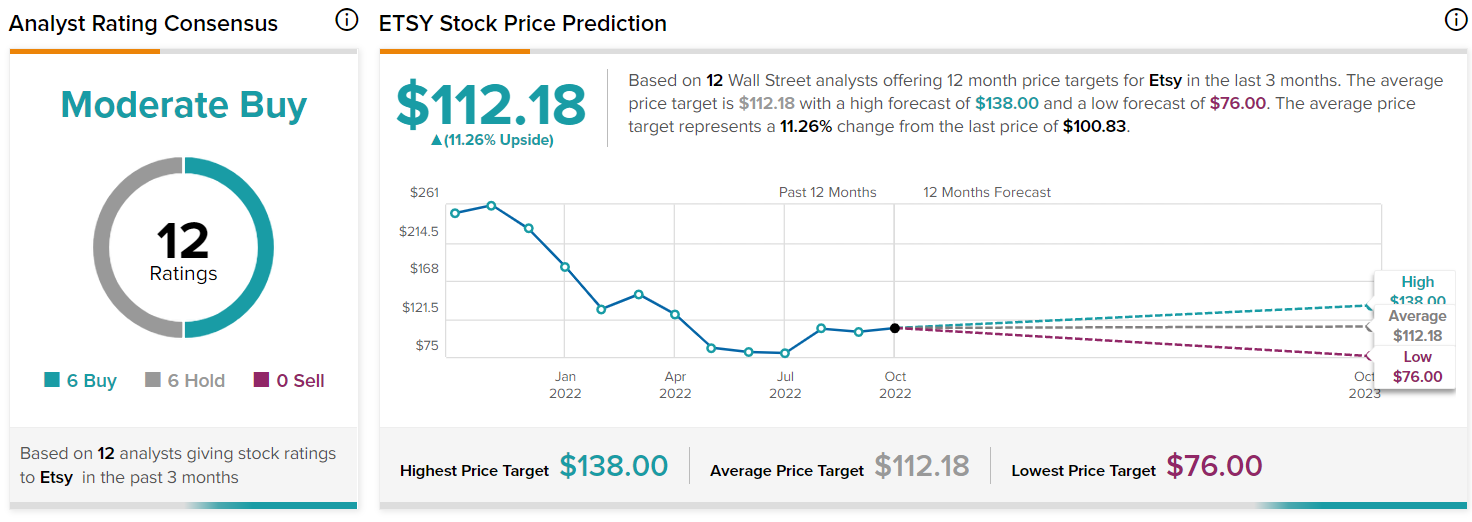

Company has a moderate buy consensus based on 12 analysts ratings - 6 buys, 6 holds, 0 sells, with an average price target at $112.18, which implies 11.60% upward potential from current levels. Source: Tipranks.com

Company has a moderate buy consensus based on 12 analysts ratings - 6 buys, 6 holds, 0 sells, with an average price target at $112.18, which implies 11.60% upward potential from current levels. Source: Tipranks.com

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

Etsy (ETSY.US) stock bounced off the key support zone at $89.15, which coincides with 78.6% Fibonacci retracement of the upward wave launched in March 2020 and lower limit of the descending channel. Better than expected quarterly figures gave more fuel for the bulls and if current sentiment prevails, upward move may accelerate towards the resistance zone around $113.45. Source: xStation5