-

This morning's topic is China, in particular the uncertainty surrounding developer Country Garden and the decline in new loans in July.

-

Chinese banks extended 345.9 billion yuan worth of loans in July, thereby posting an 89% drop from June and sinking to the lowest level since late 2009, People's Bank of China data showed on Friday

-

The incoming data and information triggered a sell-off in APAC markets, which is now also spilling over into other markets.

European futures indicate that indices on the Old Continent will start today's session lower. The Euro Stoxx 50 is losing nearly 0.4% before the opening. Overall, the start of the European session brings a retreat from risk-linked instruments. In the FX market, the Japanese yen and the U.S. dollar are currently posting the biggest gains. WTI crude oil is losing nearly 1.2% and is trading in the region of $85.7 per barrel.

The economic calendar for today's session is almost empty, with the only reading worth noting being the CPI report from Poland, which will be announced at 09:00 am BST.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appCPI inflation for July (y/y) - forecast: 10,8%. Earlier: 11.5% y/y.

CPI inflation for July (m/m) - previously: -0.2% m/m.

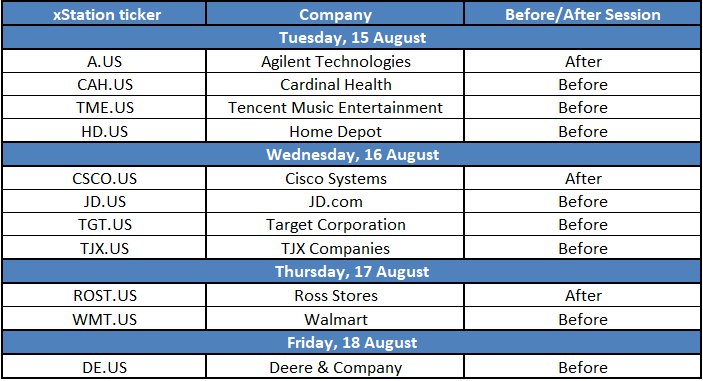

Companies publishing earnings this week. Source: XTB