One of the large companies in the dry commodity freight sector (raw materials including steel, coal and wheat) Eagle Bulk Shipping (EGLE.US) reported financial results above forecasts, surprisingly reporting still relatively strong revenue and earnings per share despite a slowdown in the freight sector and below-average rates. The company specializes in operating medium-sized vessels.

Revenues: $101.4 million vs. $72.8 million forecasts

Earnings per share: $1.21 vs. $0.44 forecasts

Net profit: $18 million

- The company pointed out that the decline in freight rates lasting from 2022 is surprisingly large even given the overall economic uncertainty.

- The opening of China's economy surprises negatively but still positively impacts the dry bulk carrier sector, with hopes for further improvement in the seasonally better second part of the year

- The company is operating at a relatively low w debt relative to industry competitors. The company intends to use 30% of earnings to pay dividends ($0.56 per share).

- In Q2, it repurchased 28% of its strategic stake in the company from the OakTree fund for cash (3.8 million shares)

- 95% of the company's fleet (about 90 vessels) is equipped with scrubbers to reduce operating costs

- The company expects freight rates to return to the vicinity of average, in the medium term, and expects an upturn in the current and next quarter of the year.

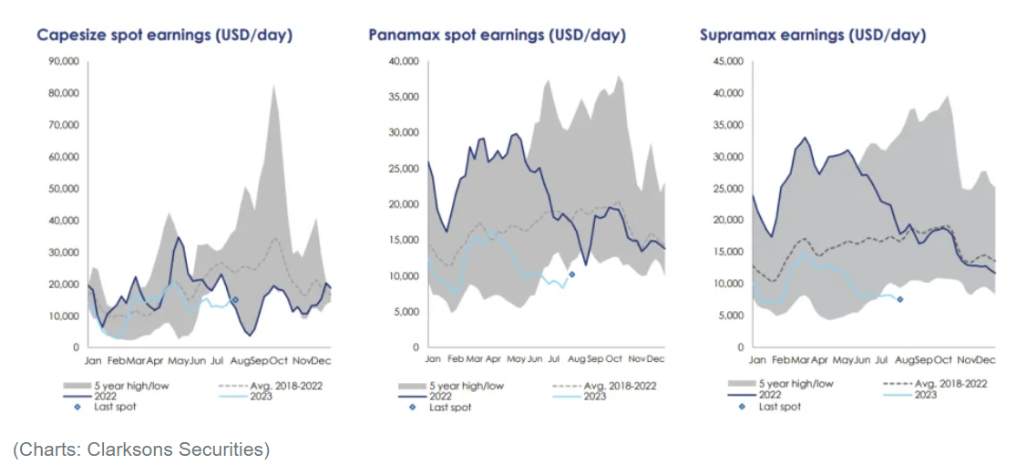

Seasonally, freight rates for all three types of container ships (3 different sizes) are well below average). Source: Clarkson Securities

Eagle Bulk's shares are holding support set by previous price reactions near $40 - this coincides with the 61.8 Fibonacci retracement of the upward wave from the spring of 2020. The price is below the SMA200 (red line) - a rise above it may herald a possible longer rebound. Source: xStation5

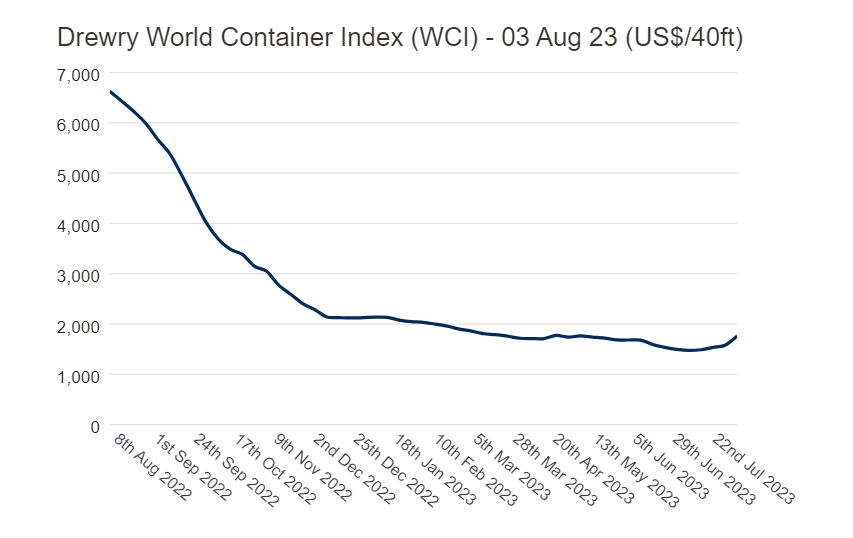

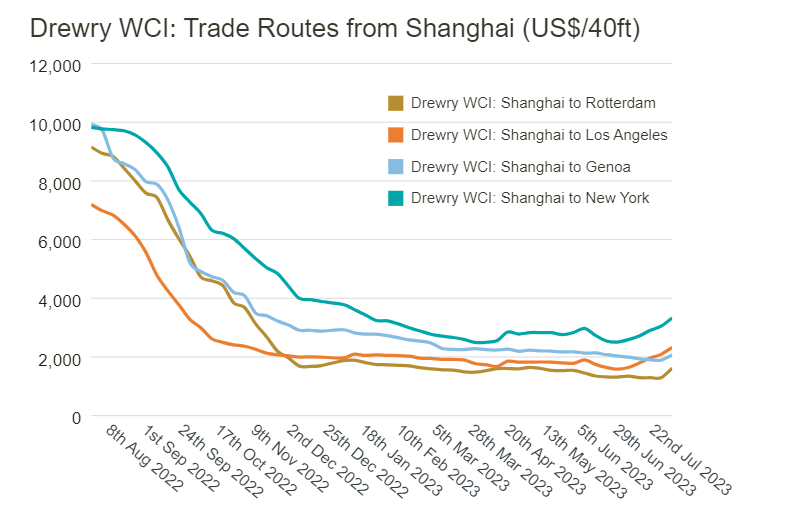

Container freight rates according to Drewry data are gradually increasing which potentially reflects the relatively still strong demand in the economy and the opening of China (although this is running well below expectations).

Source: Drewry

However, the Baltic Dry index tracking average dry freight prices on the world's 20 largest trade routes is still trading around 1,100 points - well below the March-May levels but still more than 100% above the March 2023 500 points.

Source: CNBC

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡