- The first session after the holiday break starts in the green

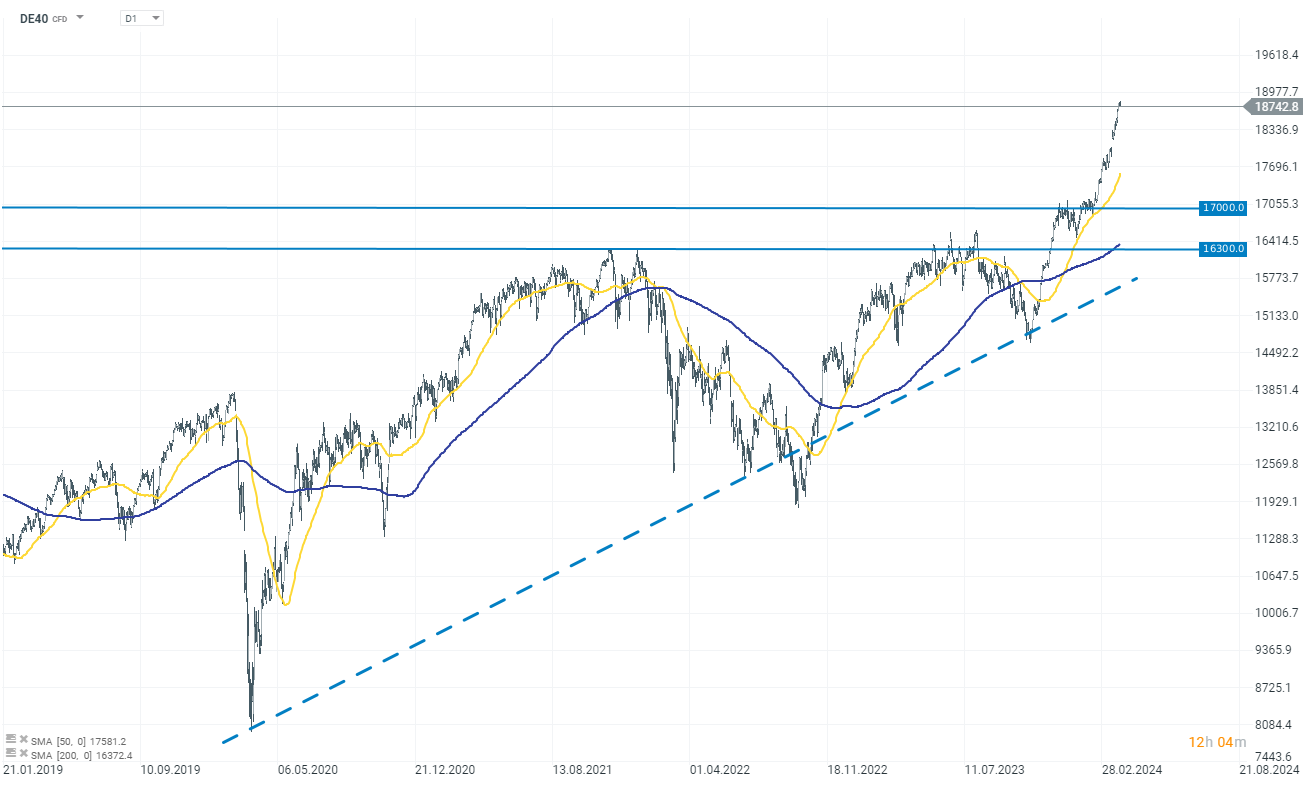

- However, the DAX loses 0.05% to 18,770 points

- The Euro loses slightly in the first part of the day

- Weak PMI data for the German manufacturing sector

- Regional inflation indicates lower CPI readings from Germany

The first day after the long weekend starts positively in the European markets. In most EU countries, stock market indexes are registering gains. Only three countries, including Germany, Switzerland, and Spain, are experiencing declines in their main indexes. The rise in the stock market is supported by a weakening Euro. Investor sentiment is moderate following the publication of mixed PMI data from EU countries. In some countries, such as Italy, the UK, and Spain, we observe a continuation of the rebound in the manufacturing sector. On the other hand, in key economies for Europe, such as Germany and France, indexes are starting to lose again and remain well below the 50-point threshold. Nevertheless, PMI data for Europe is generally better than analysts' expectations.

Start investing today or test a free demo

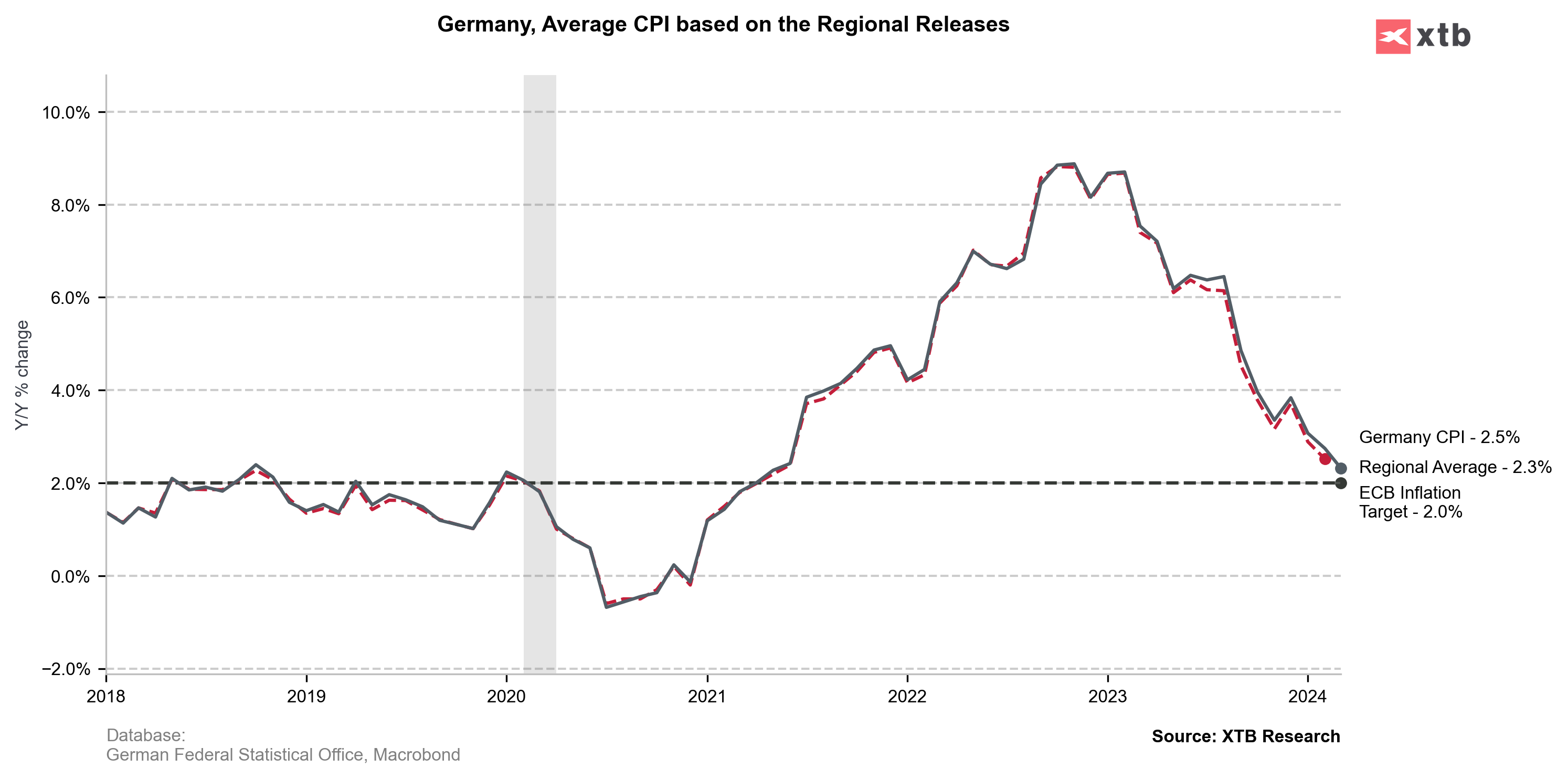

Open real account TRY DEMO Download mobile app Download mobile appToday, CPI data for Germany will also be published. Here, a further decline to a level of 2.2% y/y in March is expected, compared to 2.5% y/y in the previous month. In the first part of the day, we already learned about publications from individual regions in Germany, and here we also see confirmation of this decline. Therefore, the final publication of the CPI for Germany should not be a surprise to the markets, and all indications are that the report will show a decline in inflation dynamics to around 2.2-2.3% y/y.

DAX

Indexes in Europe are noting gains, yet the DAX loses 0.10% in the first part of the day. However, the quotations remain in the zone of record levels around 18,770 points.

Source: xStation 5

Company News

Henkel (HEN3.DE) gains 1.7% following Barclays' decision to raise its price target to €76 from €72, with the adjustment being influenced by expectations that first-quarter volumes will likely mirror those of the fourth quarter of 2023. Although the macro landscape remains challenging for adhesives, Barclays anticipates a potential inflection point for Henkel no earlier than 2025, particularly in its laundry and home care division, which is expected to be affected by portfolio optimization.

RWE (RWE.DE) declines 0.30% after BNP Paribas Exane analyst has downgraded RWE stock recommendation from "outperform" to "neutral." The price target for RWE has been set at 34.20 euros.

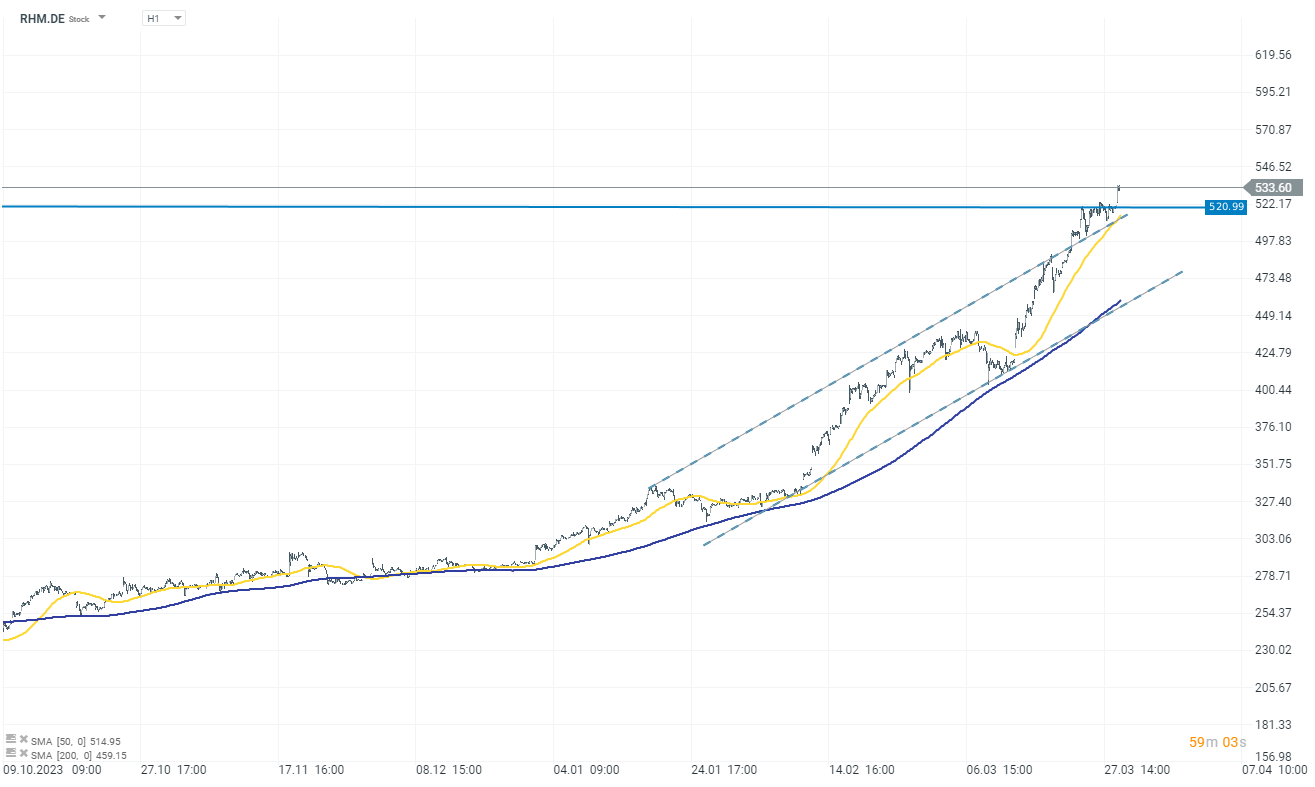

Rheinmetall (RHM.DE) has secured an order worth approximately €135 million from KNDS Germany to supply components for 22 self-propelled howitzers PzH2000. According to an emailed statement, the first of these artillery systems is scheduled to be delivered to the Bundeswehr in the summer of 2025.