- Most indices in Europe open lower

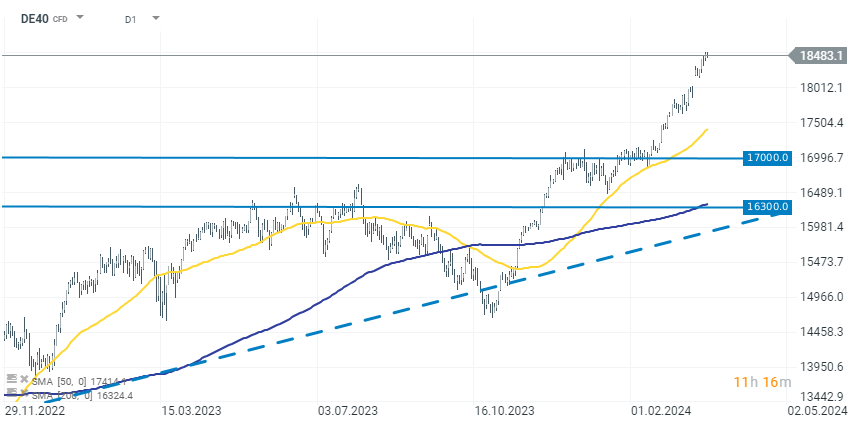

- DAX is trading 0.20% lower at the level of 18470 points

- The Euro is not recording significant changes in the first part of the day

European indices are having a weaker session in the first part of the day. Nearly all contracts are losing, except for the Italian index ITA40 (+0.30%) and the Austrian AUT20 (+0.10%). The German index DAX is also recording a drop of 0.20% to the level of 18470 points, but these are still high levels close to record highs around 18550 points.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appSource: xStation 5

Company news

Direct Line (DLG.UK) experienced a significant drop, falling as much as 13.0% on Monday after the announcement that Ageas, a Belgian insurer, would not be making a bid to acquire the company. This decline followed a surge last month when Direct Line initially rejected a takeover bid from Ageas. The decision by Ageas came after their unsuccessful attempts to engage with Direct Line's board, leading them to express regret over not being able to collaborate towards a recommended offer.

Source: xStation 5

Hensoldt (HAG.DE), a company in the Aerospace & Defense industry in Germany, has seen its shares surge as much as 10.50%, making it the top gainer in the German stock market. This gain comes despite mixed financial results for the fiscal year. The company reported an 8.2% increase in revenue, reaching €1.85 billion, but experienced a 31% decline in net income to €54.0 million. The profit margin also fell to 2.9%, down from 4.6%, mainly due to increased expenses. Earnings per share (EPS) decreased to €0.51 from €0.74. Despite these challenges, the company's revenue is projected to grow by an average of 15% per annum over the next three years, closely aligning with the 16% growth forecast for the Aerospace & Defense industry in Germany.

Swedish real estate group SBB Norden (SBBB.SE) gains almost 10% after the company announced a significant debt buyback plan, offering to repurchase its debt at a 60% discount to reduce its substantial multi-billion debt burden. The company will spend €162.7 million to buy back €407.7 million worth of debt, aiming to trim its substantial debts of about 62 billion Swedish crowns ($5.9 billion). This move is in response to the pressures of high debt levels, rising interest rates, and a weakening economy impacting many European property companies, particularly in Sweden.

Kingfisher (KGF.US), a major home improvement retailer and owner of brands like B&Q and Screwfix, has issued a profit warning for the year ending January 2025, forecasting earnings below expectations. This announcement adds pressure on CEO Thierry Garnier to speed up the company's turnaround efforts, despite already having made significant cost cuts. The company cited concerns about the market outlook for 2024, attributing it to a delay between housing and home improvement demand.