Summary:

-

Another Japanese company urges for progress on Brexit talks

-

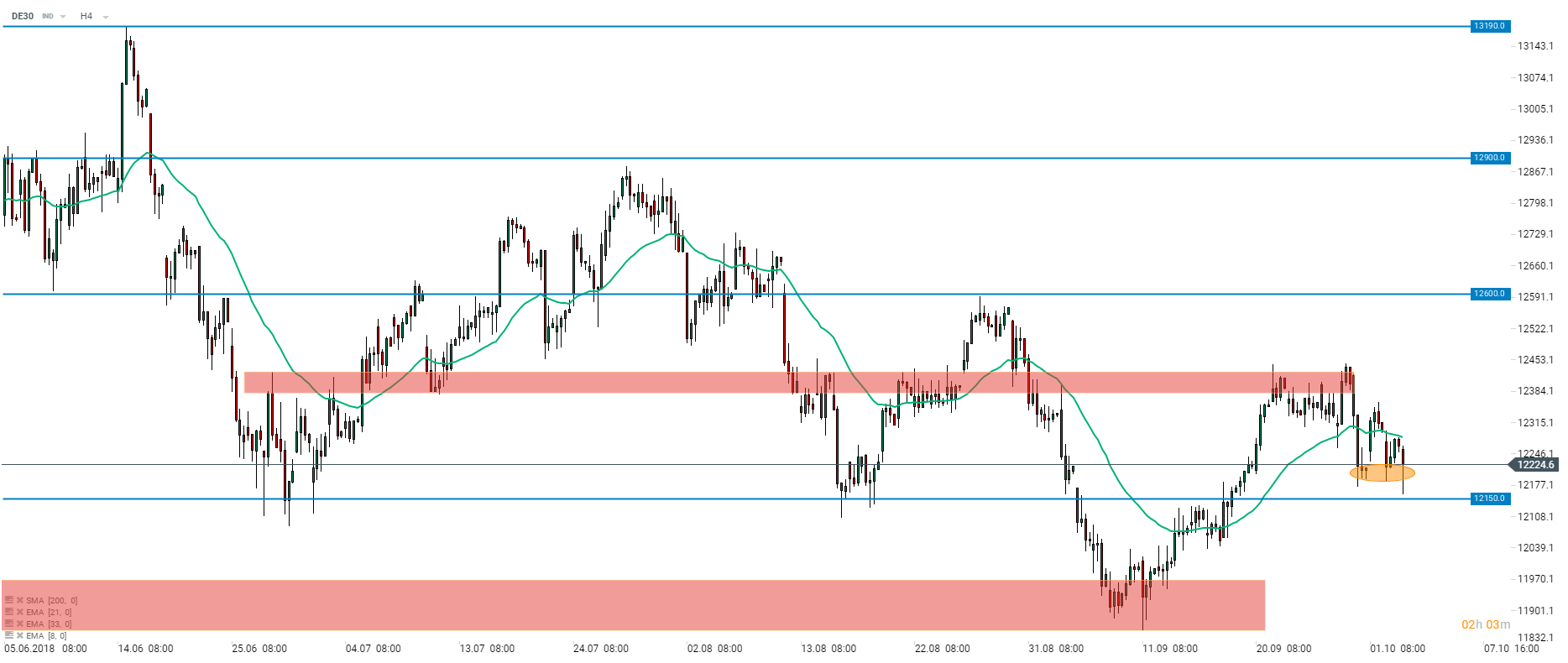

DAX (DE30 on xStation5) plunged toward the support level at 12150 pts in the morning

-

Wirecard (WDI.DE) CEO sees stock price quadruple in the coming years

The US equities moved higher yesterday being boosted by strong data readings. However, the Asian trading was equivocal. Stocks in Japan moved lower with Nikkei (JAP225) declining 0.61%. On the other hand, the Australian S&P/ASX 200 (AUS200) added 0.49% thanks to weaker AUD.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appA mixed opening was seen in Europe on Thursday. Equities in Germany, United Kingdom and France opened lower while stocks in Spain accounted upside price gap. Italian shares launched today’s trading flat. Russian equities opened with the biggest downside price gap. Media and personal goods companies could be found among European underperformers in the first minutes of Thursday’s trade while banks and insurers opened with the biggest upward price gap.

DE30 (DAX futures underlying) extended the latest downward move at the beginning of today’s session. The German benchmark plunged in the morning to just a notch above the support level at 12150 pts handle. The index recouped part of the losses to trade in the area around 12200 pts handle at press time (orange circle on the chart above). Do notice that this area saw some price action in the past few days therefore it may be relevant level to watch in the short term. Source: xStation5

DE30 (DAX futures underlying) extended the latest downward move at the beginning of today’s session. The German benchmark plunged in the morning to just a notch above the support level at 12150 pts handle. The index recouped part of the losses to trade in the area around 12200 pts handle at press time (orange circle on the chart above). Do notice that this area saw some price action in the past few days therefore it may be relevant level to watch in the short term. Source: xStation5

Earlier this week we wrote about concerns of the Japanese companies over uncertainties surrounding Brexit. Another large company from Japan expressed similar concerns today and this time it was Nissan. The Japanese carmaker urged British and European lawmakers to reach a deal on the future trade relationship saying that it has major investments in the UK and needs clarity on what to expect in the future. Nissan said that in case a so-called hard Brexit will occur a sudden change from the current trade rules to WTO rules will have serious impact on the British automotive industry. Carmakers are companies worried over the no-deal Brexit as border stops will cause significant delays at various stages of the supply chains and therefore disturb output and add costs.

While the Italian government’s decision to lower the budget deficit from 2020 was welcomed by the markets with a relief one should not forget that proposed numbers during the next two years are still high. European Commissioner Pierre Moscovici said that efforts to lower budget deficit are a good signal but Italy is still at risk of breaking the European rules on the structural deficit in the next year. However, this were just a hints and Moscovici said that he will stop short of making more judgements until the Italian budget plan is officially present in the later part of the month.

Major European stock indices after the first hour of trade:

-

DAX30 (DE30): -0.34%

-

FTSE 100 (UK100): -0.52%

-

CAC40 (FRA40): -0.65%

-

IBEX (SPA35): -0.27%

-

FTSE MIB (ITA40): -0.37%

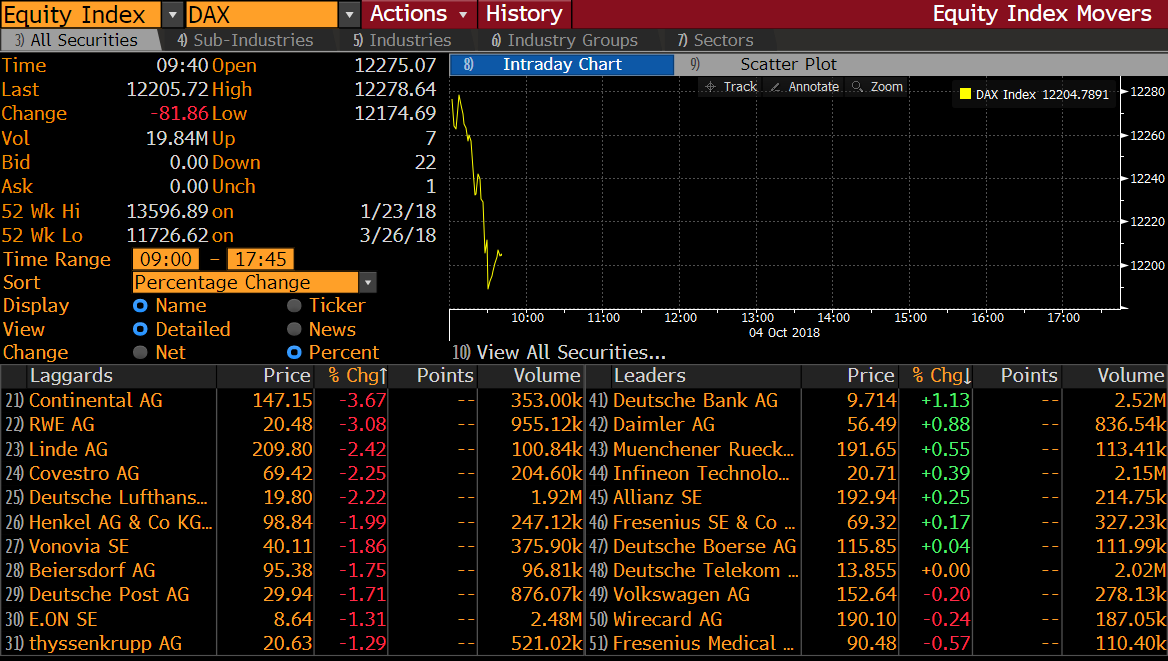

Deutsche Bank (DBK.DE) outperforms DAX peers after announcing hiring of the consultant firm to help the Bank with US stress tests. Source: Bloomberg

Deutsche Bank (DBK.DE) outperforms DAX peers after announcing hiring of the consultant firm to help the Bank with US stress tests. Source: Bloomberg

Company News

Interesting remarks came from the Wirecard (WDI.DE) CEO, Markus Braun, during an interview with Handelsblatt. The executive said that the company has a potential to boost its market valuation to €100 billion in the coming years. Braun sees opportunity in a global trend of shifting away from cash towards mobile and digital payments. Asked about high valuation in comparison to earnings (P/E at around 75) he said that despite this he does not expect share price to crash. Notice that bringing Wirecard’s market cap to €100 billion would mean quadrupling stock price.

Deutsche Bank (DBK.DE) is one of the best performing DAX stocks today. Financial Times reported that the Bank hired Oliver Wyman, a management consulting company, to help it with the US stress tests. Namely, the consulting firm will help the Bank tackle problems in the capital-planning practices as well as in the risk management. Deutsche Bank has struggled for a long time to do well in the stress tests of its US subsidiary and an effort to change it was viewed as a positive sign by investors. Recall that strengthening of the US branch is one of the goals of the new CEO, Christian Sewing.