-

European indices trade lower on Friday

-

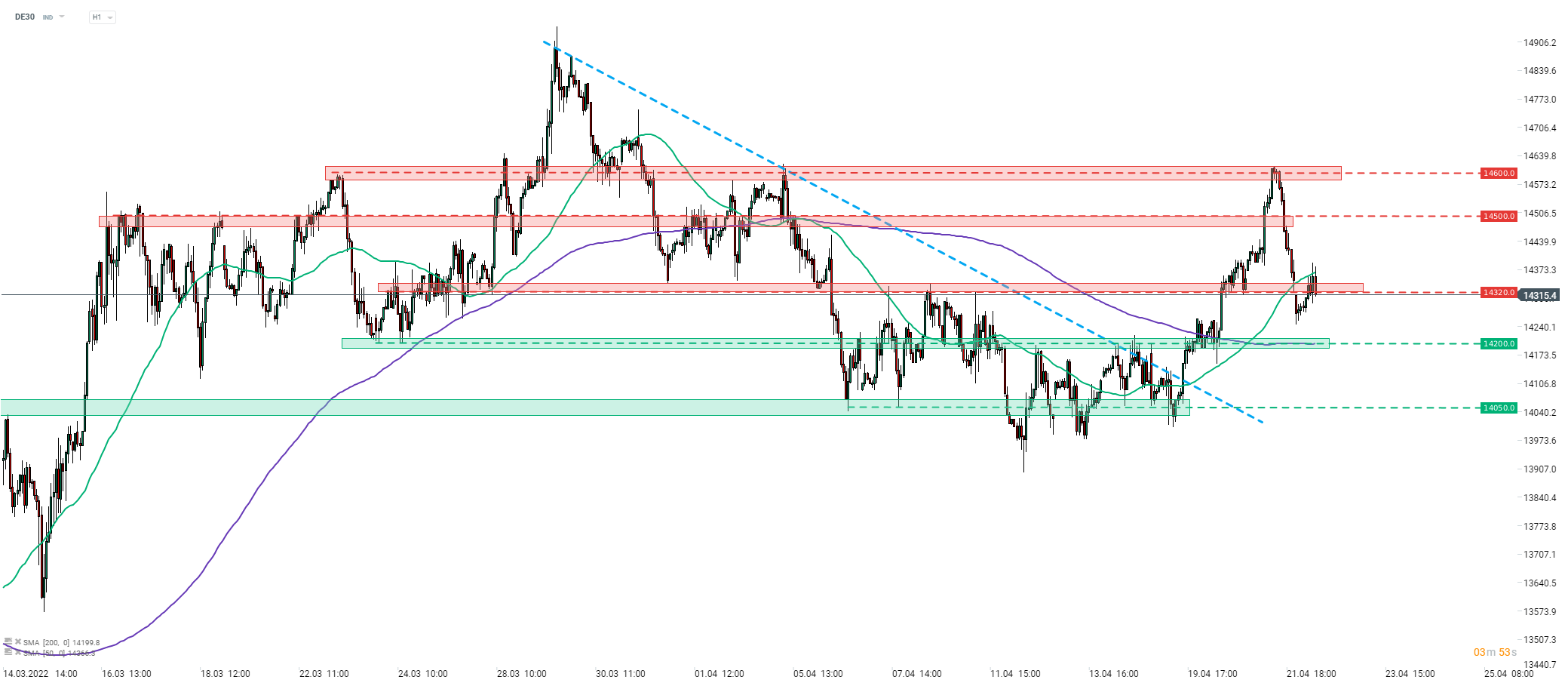

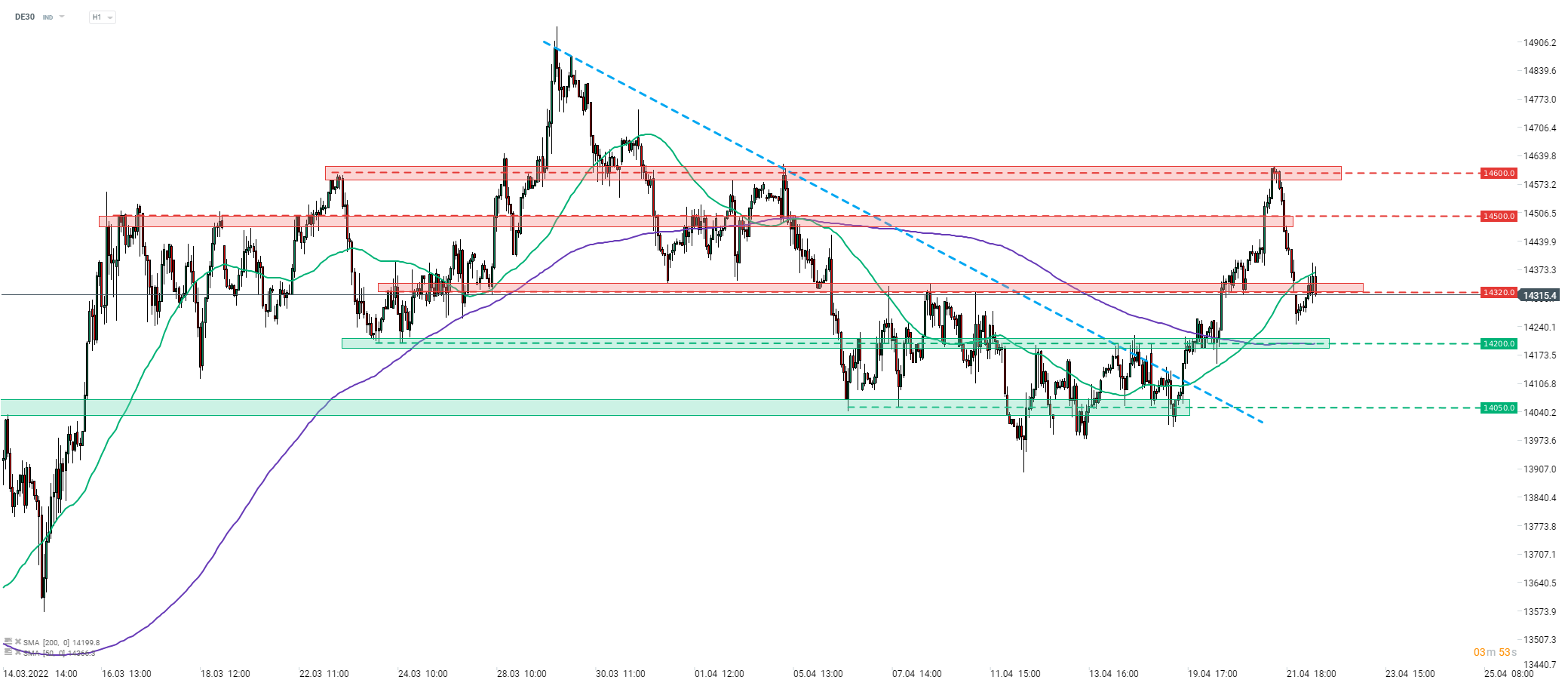

DE30 tries to climb back above 14,320 pts

-

SAP drops after Q1 earnings release

European stock market indices are trading lower on the final trading day of the week. Majority of blue chips indices from Western trade more than 1% below yesterday's closing levels. Major indices from Germany, France, Italy and Poland are top underperformers as each is trading around 1.5% lower at press time. On the other hand, Swiss SMI index (SUI20) can be seen as an outperformer as it manages to hold flat on the day.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appDE30 tested 14,600 pts resistance zone yesterday but failed to break above. As we have hinted in DE30 analysis yesterday, a pullback to the 14,320 pts followed a failed attempt of breaking above 14,600 pts. Index even managed to drop below this zone but declines were halted in the 14,250 pts area. An attempt to break back above the 14,320 pts zone was made this morning but, so far, it failed to bear fruit. Note that the advance this morning was limited by the 50-hour moving average (green line) that runs just slightly above 14,320 pts zone. In case bulls fail to push the price back above 14,320 pts, attention may shift towards two near-term supports - 14,200 and 14,050 pts.

Company News

SAP (SAP.DE) reported Q1 2022 results today. Company reported quarterly sales at €7.1 billion, above the €6.9 billion expected by analysts. Solid sales growth was driven by a 25% jump in cloud sales, to €2.82 billion (exp. €2.75 billion). SAP said that its cloud backlog increased 23% to €9.7 billion and that it still expects full-year cloud sales to reach €11.55-11.85 billion. EPS dropped from €0.88 in Q1 2021 to €0.63 in Q1 2022. After-tax profit was 41% YoY lower at €632 million.

Salzgitter (SZG.DE) decided to boost full-year guidance following the release of preliminary Q1 results. Salzgitter said that sales in Q1 reached €3.4 billion (+62% YoY) while pre-tax profit was €465 million, up from €117.3 million in Q1 2020. Company now expects full-year 2022 pretax profit to reach €750-900 million, up from previous forecast of €600-750 million.

Airbus (AIR.DE) reached a pay deal with over 3,000 workers of its wing plants in the United Kingdom. As a result, workers groups dropped plans to launch a strike. Airbus offered an 8.6% pay rise.

Analysts' actions

-

HeidelbergCement (HEI.DE) was downgraded to "hold" at Societe Generale. Price target set at €51.00

SAP (SAP.DE) is trading lower today following the release of its Q1 earnings report. After a lower opening of the session, stock continued to move lower until it tested recent lows in the €95 area. Declines were halted there and stock recovered some ground but continues to trade below yesterday's close. Key levels to watch now are the aforementioned €95 area (support) and 61.8% retracement of recent upward impulse in €105 area (resistance). Source: xStation5