-

European markets drop

-

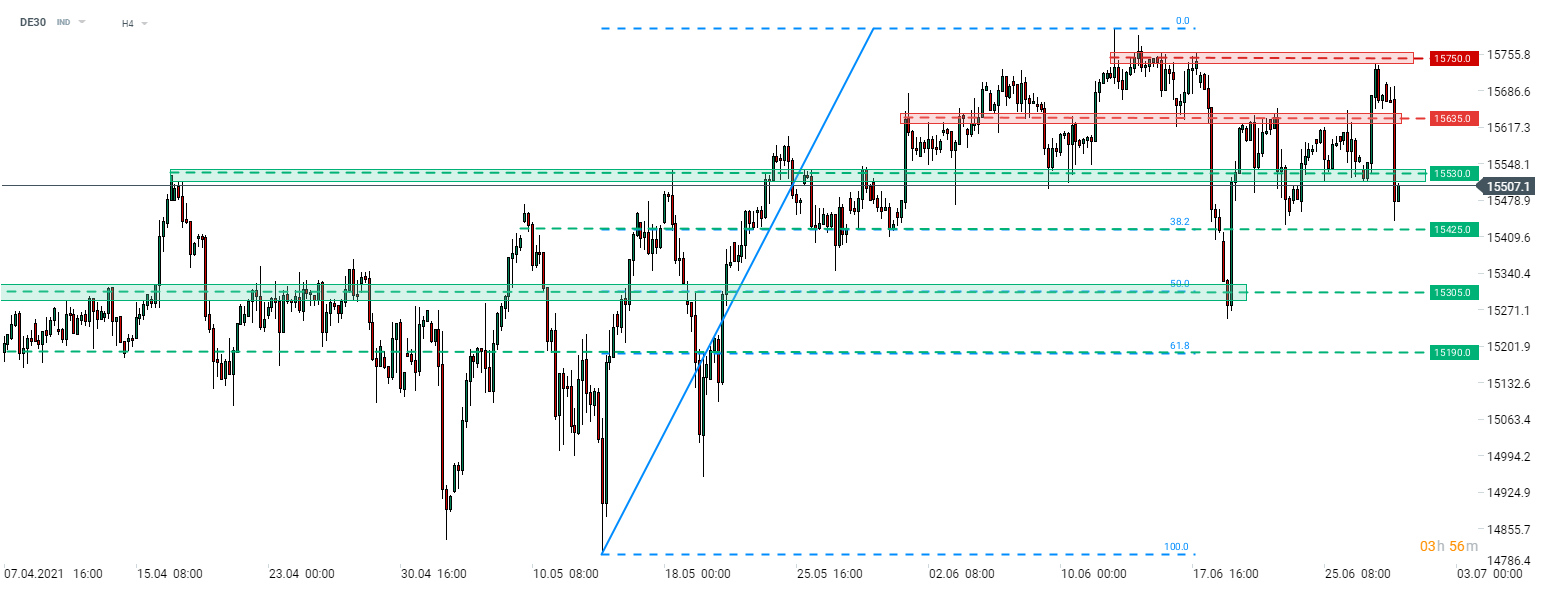

DE30 pulls back from ATH area

-

Deutsche Bank may lose license for IPOs in Hong Kong

European stock markets opened little change today but a strong downward move arrived at the beginning of cash trading. Majority of indices from Europe trade lower on the day with German DAX (DE30), French CAC40 (FRA40), Spanish IBEX (SPA35) and Italian FTSE MIB (ITA40) dropping more than 1%. Equities from the eastern part of the Old Continent perform slightly better but also trade lower on the day. ADP employment report at 1:15 pm BST is a key macro release of the day.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appDE30 managed to break above the upper limit of a recent trading range yesterday and tested an all-time high area. However, moods deteriorated today and the index experienced a steep downward move after the launch of the European cash session. Yesterday's gains were erased and DE30 dropped below the lower limit of the trading range at 15,530 pts.Two levels to watch in near-term are support at 38.2% retracement (15,425 pts) and resistance at 15,530 pts. Volatility may pick-up near 1:15 pm BST as ADP employment data report will be released. Should today's trading finish near current levels, a doji candlestick would surface on the monthly chart and a bearish engulfing pattern would surface on a daily chart.

Company News

According to a Reuters report, Deutsche Bank (DBK.DE) may lose the ability to perform IPO-related services in Hong Kong. Due to a staff's error, Deutsche Bank failed to renew its license and it is set to expire today.

The Supreme Court in Ohio, United States allowed state's authorities to move forward with a lawsuit against Volkswagen (VOW1.DE) for the so-called 'Dieselgate' scandal. In other news it was reported that Volskwagen has been sued alongside Audi in a consumer data breach case that exposed data of 3.3 million consumers.

RWE (RWE.DE) was awarded 77 megawatts at Polish renewable energy auction. Company won a contract for a 48-megawatt onshore wind farm and 29-megawatt solar projects. New assets are expected to become operational in 2022 and 2023.

BASF (BAS.DE) announced that it will build a battery recycling plant in Germany. Investment will help reduce the carbon footprint of a nearby cathode active materials plant and help optimise technology. Site is expected to become operational in 2023.

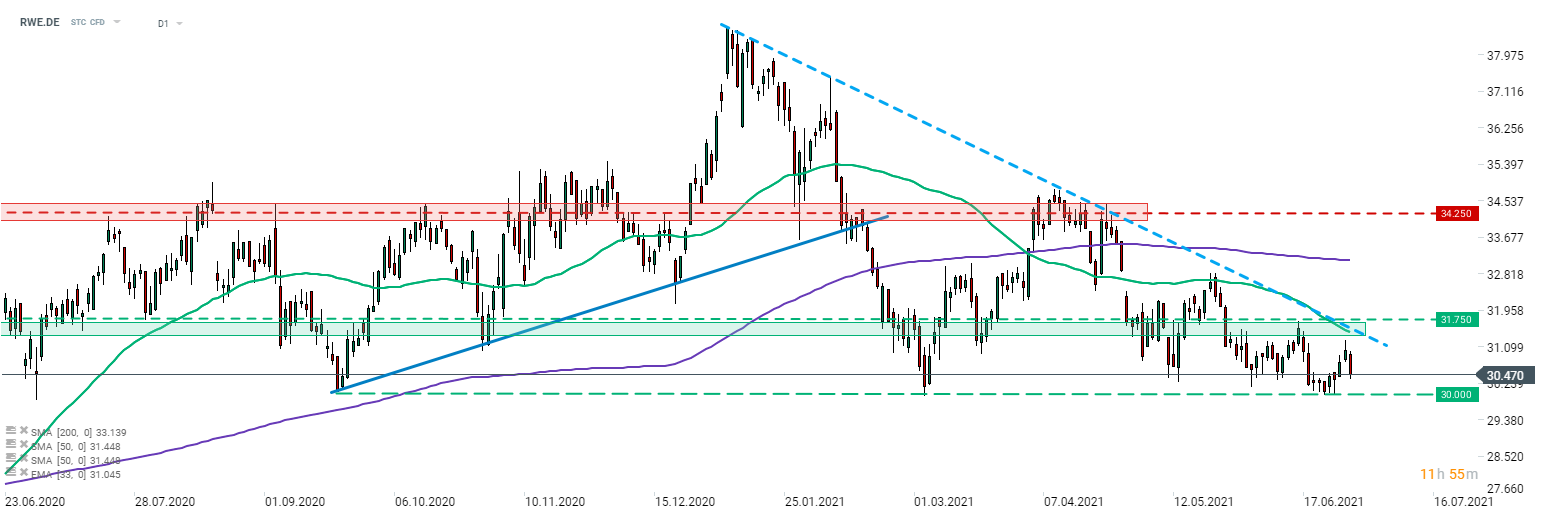

RWE (RWE.DE) is trading lower today amid broad risk-off moods seen across the Old Continent. Stock moves lower after painting a new lower high during the ongoing downtrend. Near-term support zone to watch can be found ranging around €30.00 mark. This is also the lower limit of a descending triangle pattern so break below could herald a bigger drop. Source: xStation5

RWE (RWE.DE) is trading lower today amid broad risk-off moods seen across the Old Continent. Stock moves lower after painting a new lower high during the ongoing downtrend. Near-term support zone to watch can be found ranging around €30.00 mark. This is also the lower limit of a descending triangle pattern so break below could herald a bigger drop. Source: xStation5