-

Stocks in Europe drop as concerns over spread of coronavirus mount

-

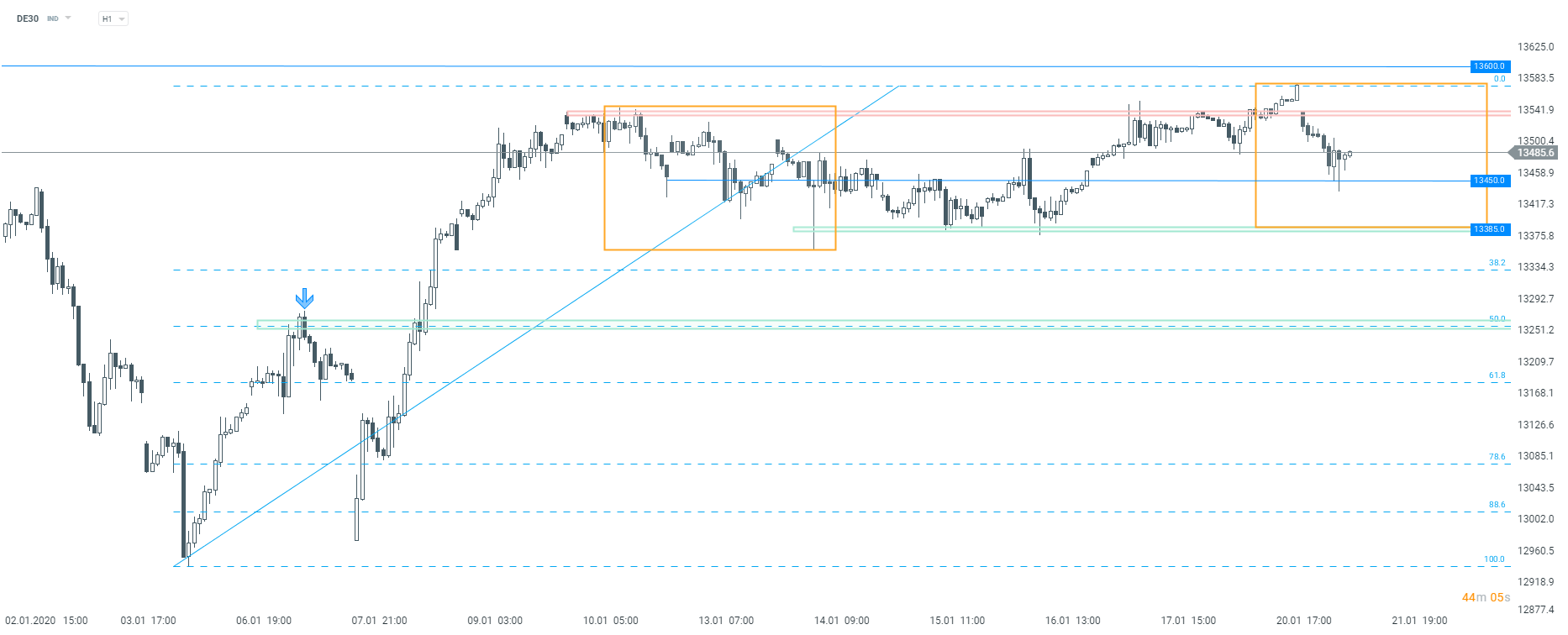

DE30 pulls back after reaching fresh two-year high

-

Commerzbank (CBK.DE) and Deutsche Bank (DBK.DE) drop after lacklustre earnings release from UBS (UBSG.CH)

Stocks in Europe launched today’s trading lower echoing poor performance of Asian equities. Risk-off moods can be ascribed to fears of coronavirus in China spreading. Poor earnings report from UBS also exerts pressure on the banking sector. UK and French stocks are top laggards in the western part of the continent while Russian equities lead losses in the eastern part.

ZEW index shows optimism rising in Germany

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appRelease of the ZEW index for January was the sole major print from Germany scheduled for today. The index came in much higher than expected as expectations sub-index jumped from 10.7 pts to 27 pts (expected 15 pts). This was the highest reading since mid-2015! Current situation sub-gauge moved from -19.9 pts to -9.5 pts (expected: -13.5 pts). ZEW expectations index is said to be leading the euro area economy by around 12 months but correlation is not perfect.

Source: xStation5

Source: xStation5

DAX (DE30) painted a fresh two-year high yesterday and made the second highest close in history. However, the index is moving lower today as risk-off moods dominate global financial markets. The German index tested 13450 pts handle shortly after the cash session opening but managed to recover partially. Support at 13450 pts is a near-term level to watch with 13375 pts serving as the final hurdle for the bears and a lower limit of the trading range. Taking a look at the index from a broader perspective, DE30 keeps pulling back after each test of the resistance zone marked by ATH from early-2018. However, the uptrend structure is preserved as the index keeps painting higher highs and lows. Two major events for the German index this week are ECB decision (Thursday) and flash PMI release (Friday).

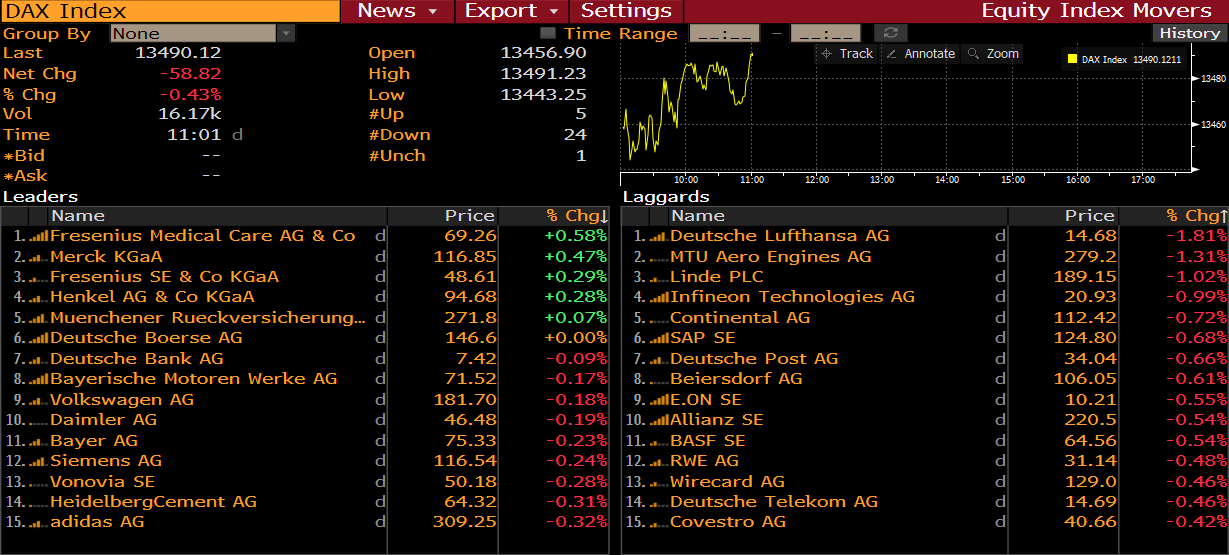

DAX members at 10:01 am GMT. Source: Bloomberg

DAX members at 10:01 am GMT. Source: Bloomberg

European banks are on watch today following lacklustre earnings release from UBS Group (UBSG.CH). The Swiss bank missed profitability and cost targets it has set during a revamp over a year ago as the wealth management unit continued to struggle amid capital outflows. The release sets a gloomy outlook for earnings of other European banks and exerts pressure on the sector. Commerzbank (CBK.DE) and Deutsche Bank (DBK.DE) trade lower today.

Hugo Boss (BOSS.DE) released preliminary results for Q4 2019. The German luxury fashion merchandiser reported sales of €825 million (exp. €802.3 million). The company noted that sales momentum in Europe picked up in Q4 2019 while Asia-Pacifc region continues to enjoy strong performance (spare for Hong Kong). Full-year report will be released on March 5.

German cabin crew union UFO is said to have abandoned plans to strike at Lufthansa (LHA.DE).

Analyst actions

-

Fresenius Medical (FME.DE) raised to “buy” at Jefferies. Price target set at €80

-

Covestro (1COV.DE) cut to “sell” at Bankhaus Lampe. Price target set at €36

-

Lufthansa (LHA.DE) cut to “sell” at Bankhaus Metzler. Price target set at €12.50

Commerzbank (CBK.DE) moves lower today as poor earnings from UBS exert pressure on European banking sector. The stock is testing the key support zone ranging around the psychological €5.00 barrier. A break below it would pave the way for a retest of a record low (€6.45 area). Source: xStation5

Commerzbank (CBK.DE) moves lower today as poor earnings from UBS exert pressure on European banking sector. The stock is testing the key support zone ranging around the psychological €5.00 barrier. A break below it would pave the way for a retest of a record low (€6.45 area). Source: xStation5