-

European indices trade lower

-

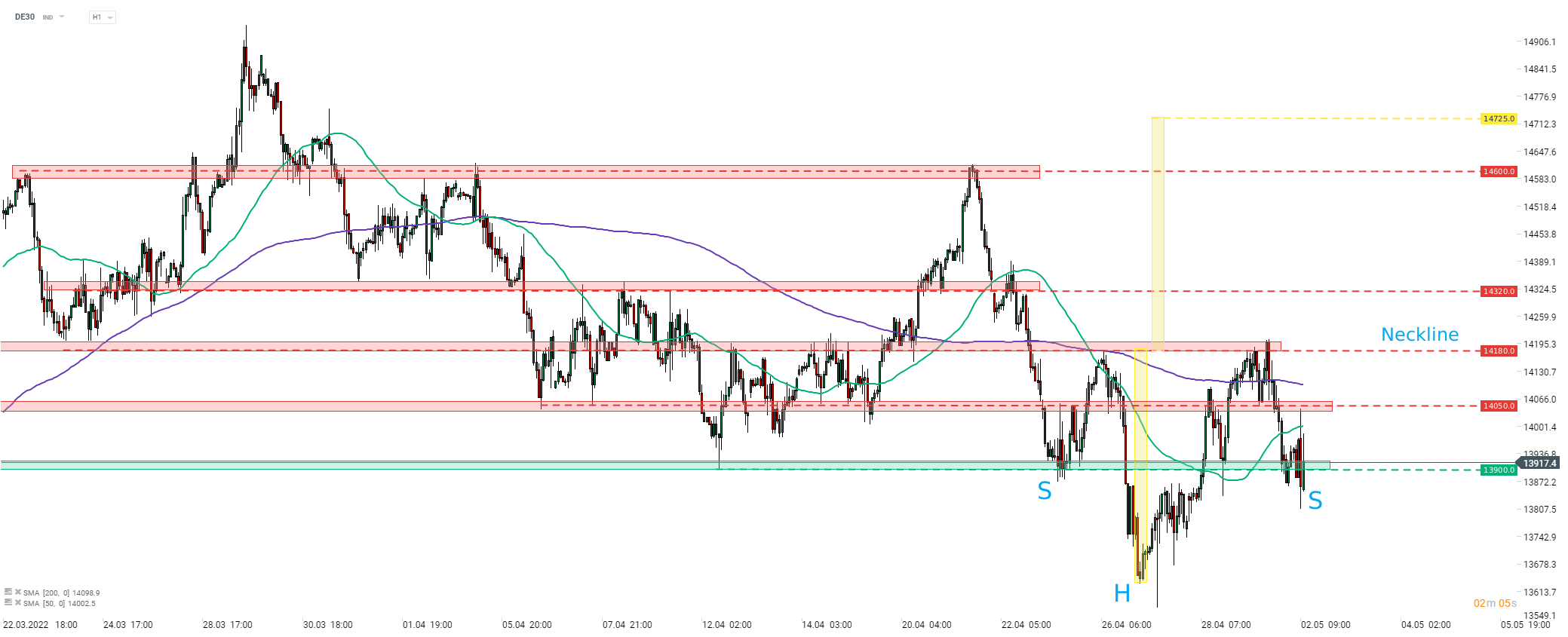

DE30 tries to rebound from 13,900 pts area

-

Adler Group plunges over 40% as auditor refuses to provide opinion

European stock market indices are taking a hit during the first trading session of a new month. Declines deepened following a lower opening of the European cash session and now almost all blue chips indices from the Old Continent trade over 1% lower on the day. Dutch AEX (NED25) is one of top laggards, dropping 2.3% at press time. Spanish IBEX (SPA35) and German DAX (DE30) are outperforms dropping "only" 1.2-1.4%. Release of final manufacturing PMI data earlier in the day did not have an impact on equity markets.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appTechnical situation on DE30 is little changed compared to Friday. An inverse head and shoulders pattern is still in play. Index currently tries to rebound from the 13,900 pts area, where the right shoulder of the pattern was painted. Neckline of the pattern, which is also a key resistance to watch in case rebound extends, can be found in the 14,180 pts area. Textbook range of an upside breakout from the pattern points at a possible 3.8% upside and a move above 14,700 pts.

Company News

Adler Group (ADJ.DE) plunged over 40% today. Company published delayed annual results on Saturday that showed a €1.18 billion loss. Loss was driven by a €1.08 billion goodwill write-down. However, what sent shares into freefall was a comment from company's auditor KPMG. KPMG said that it cannot provide an audit opinion as Adler withheld information on some deals. Majority of Adler's board members (all of whom held positions last year) offered to resign.

According to a Reuters report, TUI (TUI.DE) received 1.3 million holiday bookings in April. Reuters reported information citing an internal TUI memo. In the document, TUI CEO Fritz Jousssen said that bookings are being made on shorter notice and are of higher quality, what has a positive impact on the company's margins.

According to a West Australian report, Qantas Airways plans to place the largest order in its history with Airbus (AIR.DE). The Australian carrier is expected to order over 150 aircraft from Airbus. Report says that Qantas placed orders for 52 aircraft and has option for 106 more to be delivered over the next 10 years. If all options are exercised, deal value would reach almost $25 billion.

Analysts' actions

-

Henkel (HEN3.DE) downgraded to "hold" at Deutsche Bank. Price target set at €75.00

Share price of Adler Group (ADJ.DE) plunged more than 40% today after KPMG said it was unable to provide an audit opinion. Stock reached a textbook range of a downside breakout from a recent trading range today near €3.90. Declines were halted for now and stock returned above €4.00 per share. Nevertheless, it is still down 43% on the day and 62% lower year-to-date. Source: xStation5