-

Stocks in Europe trade lower

-

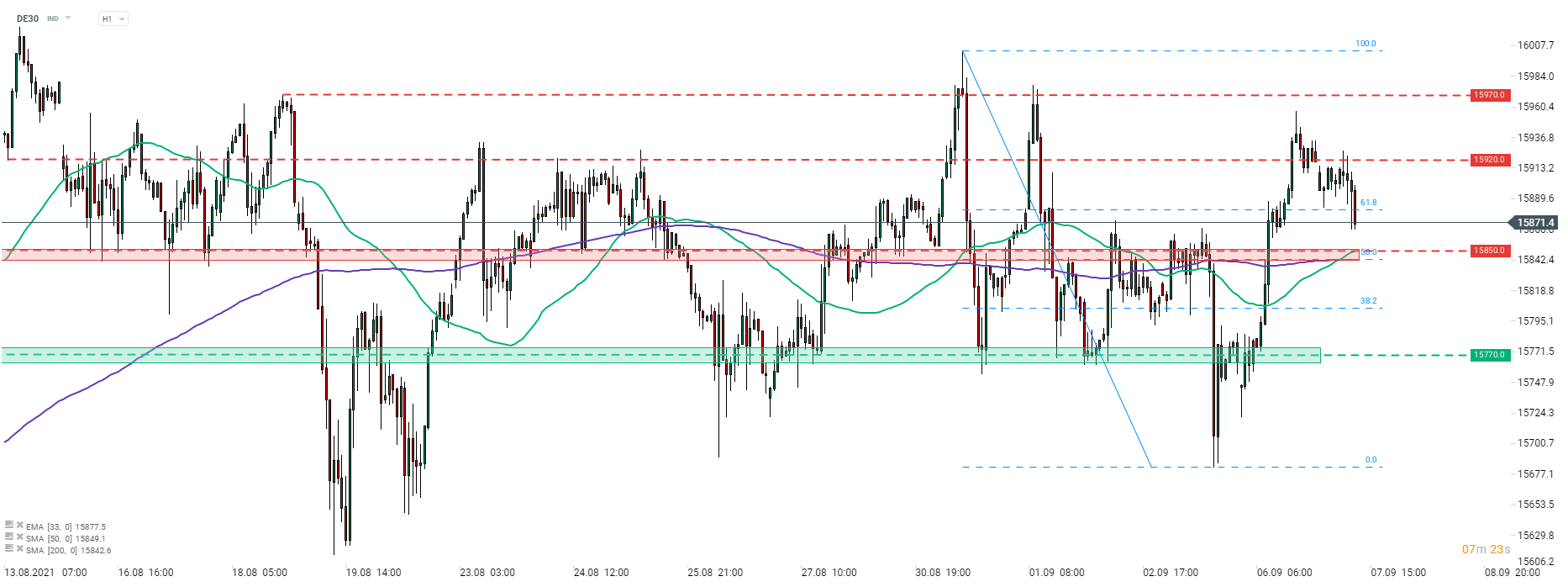

DE30 drops below 15,900 and tests 61.8% retracement

-

Deutsche Telekom agreed to sales T-Mobile Netherlands

Majority of the European stock market indices traded slightly lower during the first half of the European session on Tuesday. Indices from the Old Continent erase part of yesterday's gains. Utilities, media companies and chemical stocks are the worst performing sectors in Europe today while consumer products companies and retailers outperform.

German ZEW indices for September were released 10:00 am BST and turned out to be a disappointment with both current situation and expectations indices missing estimates. Current conditions index was expected to jump from 29.3 to 34.0 but instead increased to only 31.9. Expectations index was expected to show a big drop from 40.4 to 30.0. However, release showed an even bigger drop with the index dropping to 26.5 - the lowest reading since March 2020. Disappointing release pushed indices from Europe to new daily lows.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Source: xStation5

Source: xStation5

DE30 rallied yesterday and reached a daily high slightly below the 15,960 pts mark. However, moods deteriorated later on and the index pulled back from the area. Pullback is being continued today with DE30, as well as other major indices from Europe, trading lower. German index is attempting to break below the 61.8% retracement of last week's correction at press time (15,880 pts area). Note that this level has been already tested earlier today and bears were unable to deliver a more decisive break below. In case buyers defend the area, a recovery and move towards 15,920 pts mark, that served as in today's morning trade, may be on the cards. On the other hand, dipping below the aforementioned retracement would pave the way for a test of the 15,850 pts price zone marked with the 50- and 200-hour moving averages as well as 50% retracement.

Company News

Deutsche Telekom (DTE.DE) has reached an agreement to sell a Dutch unit of T-Mobile for €5.1 billion. Two funds - Warburg Pincus and Apax Partners - will buy a stake in T-Mobile Netherlands from Deutsche Telekom and its partner Tele2. Tele2 holds a 25% stake in the unit.

Olivier Blume, CEO of Porsche Automobil Holding (PAH3.DE), said that the company is enjoying a very high demand for its all-electric Taycan model. Blume said that Porsche planned to produce 20,000 Taycan units this year and as much have been sold by the company in the first half of the year alone. As a result of strong demand, wait times for the all-electric Taycan are now stretching up to six months, up from a normal wait time of around four months.

German regulators launched an investigation into Structured Alpha Funds managed by Allianz (ALV.DE). Structure Alpha Funds incurred massive losses during the coronavirus pandemic and a number of lawsuits against it have been launched in the US. Now Structured Alpha Funds also face a probe in Germany. German authorities will look into whether Allianz executives from outside the Funds unit had an impact on the decision-making process in the Funds.

Deutsche Telekom (DTE.DE) launched today's trading with a big bullish gap following news of sale of Dutch unit of T-Mobile. However, bulls were unable to hold onto these gains and the stock began to trim today's advance. Price pulled back to the upward trendline that acts as the first near-term support. In case stock continues to move lower and breaks below the trendline, market's attention will shift to the lower limit of the Overbalance structure at €17.41 (23.6% retracement can be found in the same area). Source: xStation5

Deutsche Telekom (DTE.DE) launched today's trading with a big bullish gap following news of sale of Dutch unit of T-Mobile. However, bulls were unable to hold onto these gains and the stock began to trim today's advance. Price pulled back to the upward trendline that acts as the first near-term support. In case stock continues to move lower and breaks below the trendline, market's attention will shift to the lower limit of the Overbalance structure at €17.41 (23.6% retracement can be found in the same area). Source: xStation5