-

European markets trade lower on Thursday

-

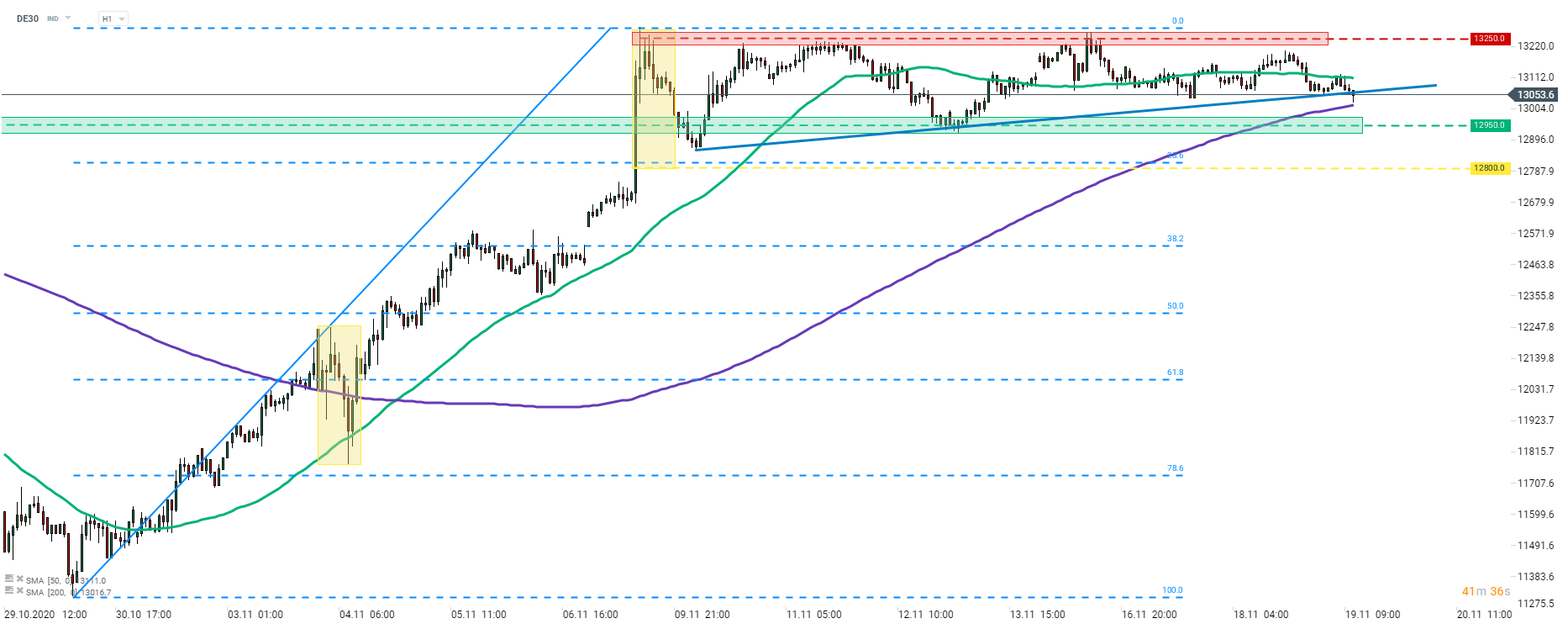

DE30 tests lower limit of short-term trading range

-

Thyssenkrupp (TKA.DE) will cut additional 11 thousand jobs

European stock markets are trading lower on Thursday, following a poor session on Wall Street yesterday and mixed trading in Asia today. Blue chips indices from Germany, France, Spain, UK and Netherlands are all trading over 1% lower. Worsening pandemic situation in countries like the United States and returning restrictions are the main drivers behind the drop. However, European indices may also reflect poor outlook for the EU budget and recovery fund that has been vetoed by Poland and Hungary.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appDE30 jumped towards the resistance zone at 13,250 pts yesterday but failed to touch it. Subsequent downward move has brought the German index back to the lower limit of a recent short-term trading range at 13,070 pts. Moreover, an upward trendline can be found in the same area therefore if we see a break below this hurdle, downward move may accelerate. In such a scenario, 200-hour moving average at 13,000 pts could become the first target for sellers (purple line). Key support can be found at around 12,800 pts, where 23.6% retracement and the lower limit of the Overbalance structure can be found.

Company News

Thyssenkrupp (TKA.DE) released an earnings report for fiscal-2020 (Q4 2019 - Q3 2020). German steel company generated full-year sales of €28.9 billion, 31.2% YoY lower and much lower than expected €30.8 billion. Company reported a net loss of €5.5 billion. Thyssenkrupp said that there is no room for dividend payout in the current environment. Moreover, the company announced that it will have to cut 11 thousand jobs, or around 10% of its total workforce.

Analyst actions

-

Munich Re (MUV2.DE) downgraded to "hold" at Societe Generale. Price target set at €250

-

Vonovia (VNA.DE) upgraded to "buy" at Jefferies. Price target set at €66

-

Delivery Hero (DHER.DE) rated "buy" at DZ Bank. Price target set at €110

-

Siemens (SIE.DE) downgraded to "hold" at Societe Generale. Price target set at €115

DAX members at 10:02 am GMT. Source: Bloomberg

DAX members at 10:02 am GMT. Source: Bloomberg