-

European indices erase morning gains

-

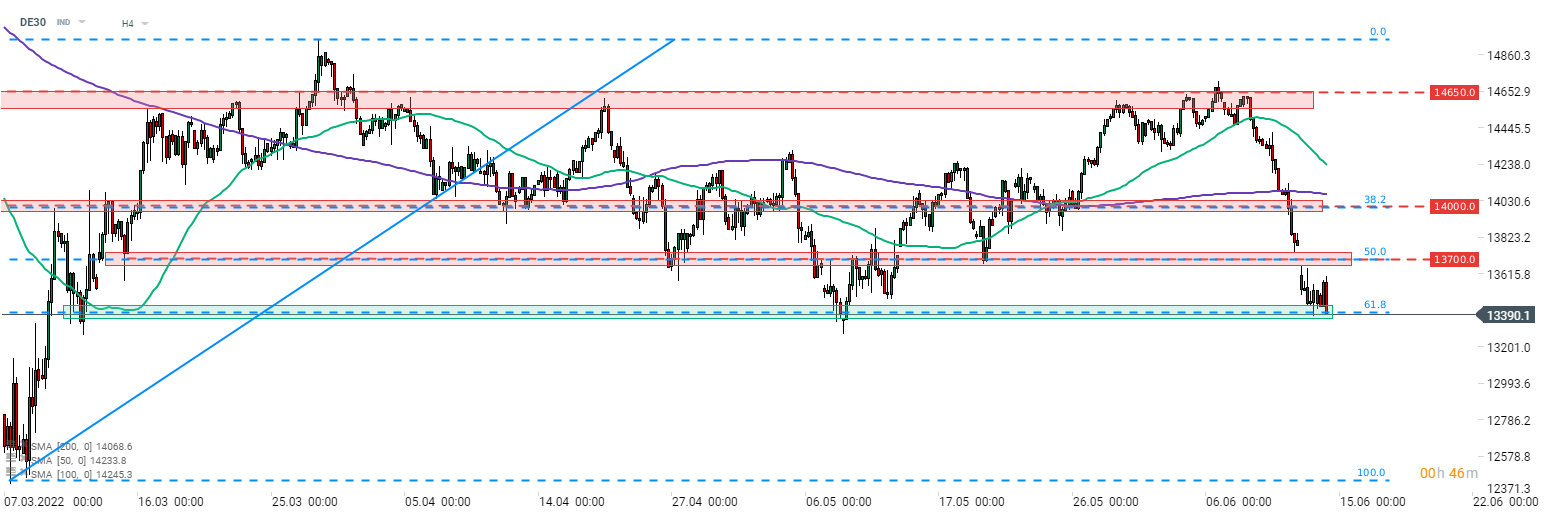

DE30 erases gains and retests 13,400 pts support

-

Brenntag and Wacker Chemie expect higher full-year earnings

A sell-off on stock markets was halted and European indices launched today's trading slightly higher. However, that optimism did not last long as those gains were quickly erased and now major indices from Western Europe trade slightly lower on the day.

German ZEW indices were released at 10:00 am BST. Current situation index improved from -36.5 to -27.6 pts, while the market expects -31.0. However, expectations subindex missed expectations as it came in at -28.0 (exp. -27.5). Overall, the reading is rather neutral and didn't contribute much to the ongoing pullback.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Source: xStation5

Source: xStation5

DE30 halted sell-off at 13,400 pts support zone marked with 61.8% retracement of the upward move launched in early-March. However, a recovery attempt launched overnight failed and gains made during the Asian session were steadily erased during European morning trade. The index is now trading lower on the day and is once again testing the aforementioned support at 61.8% retracement. A break below could pave the way for a bigger drop with early-March lows at 12,400 pts being a potential target.

Company News

Deutsche Post (DPW.DE) will increase prices for small parcel shipments in an attempt to pass increased costs onto customers. Company's delivery unit said that increase reflects higher airfares, delivery and labor costs. Price for up to 2 kilogram packages will increase 10%, coming into effect on July 1, 2022.

Brenntag (BNR.DE) boosted the 2022 earnings forecast, citing a positive trend in the second quarter of the year. Company now expects EBITDA to reach €1.75-1.85 billion, up from previous forecast of €1.45-1.55 billion. Brenntag said that apart from earnings trends, the upgraded forecast also takes into account improvements in efficiency as well as impact of already closed acquisitions.

Wacker Chemie (WCH.DE) said that it now expects Q2 EBITDA to be around €600 million, above €500 expected by the market. Company also said that it expects full-year earnings to be higher than in previous outlook but precise forecasts will be provided in a half-year report at the end of July.

Analysts' actions

-

Hannover Re (HNR.DE) upgraded to "buy" at HSBC. Price target set at €173.00

-

Adidas (ADS.DE) downgraded to "hold" at HSBC. Price target set at €200.00

Brenntag (BNR.DE) launched today's trading with a bullish price gap as the stock reacted to a forecast upgrade. However, price once again struggles with the 50-session moving average (green line), which halted advance yesterday. Stock faces a pack of near-term resistance levels ahead - moving average, trendline and €74.20 resistance zone - and a break above those would be needed to invalidate downtrend structure. Source: xStation5