-

European stock markets trade lower

-

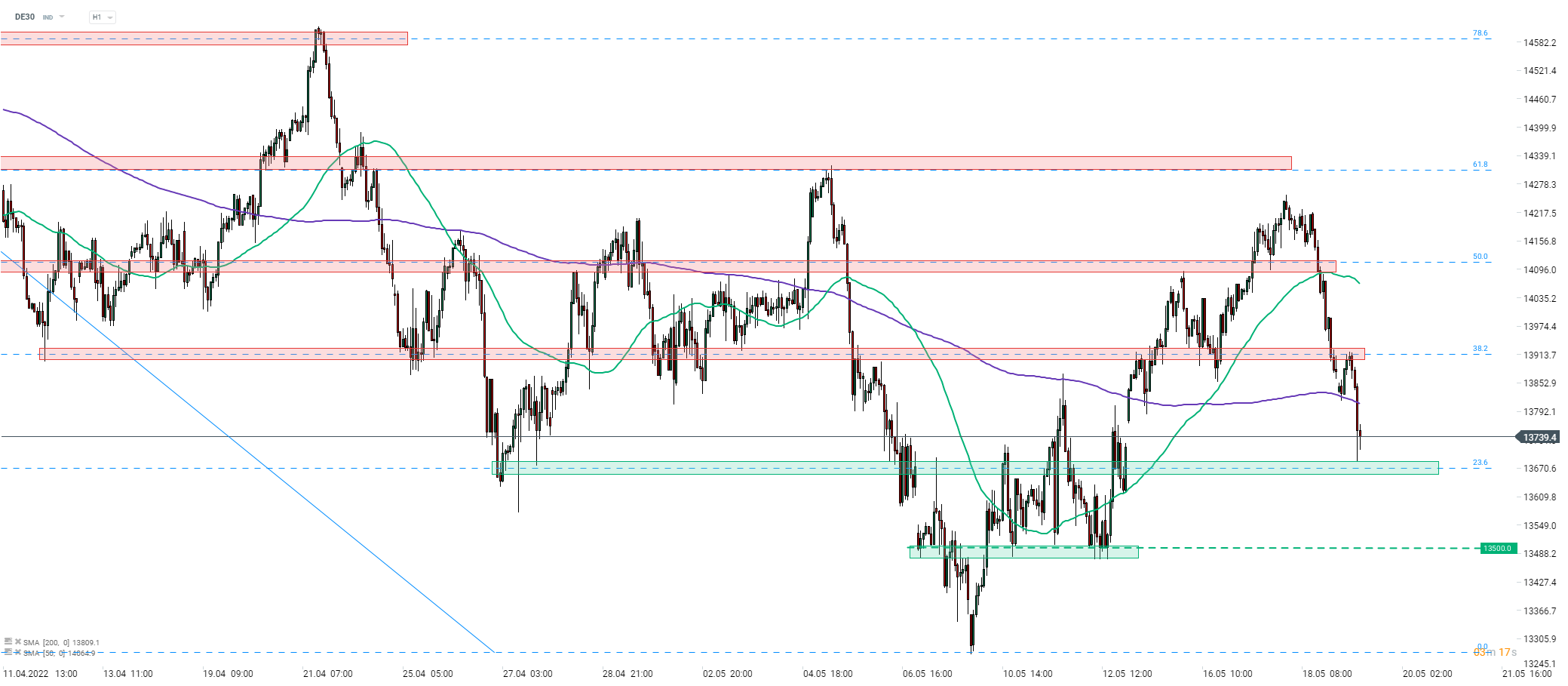

DE30 paints daily low near 13,700 pts

-

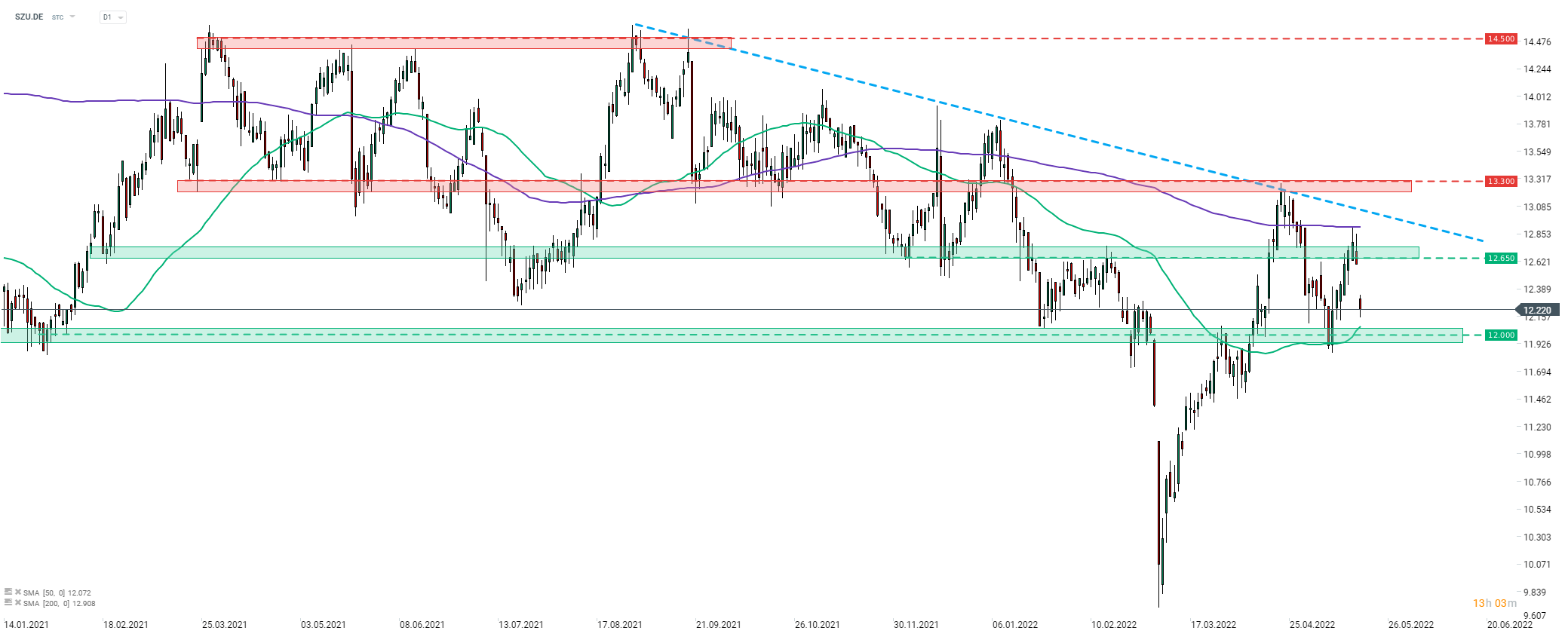

Suedzucker maintains fiscal-2023 profit forecast

European stock markets indices are trading lower on Thursday. Weaker earnings from major US retailers as well as sales warning from Cisco set the stage for a downbeat session in Asia and Europe. Majority of blue chips indices from the Old Continent trade over 1% lower today with UK FTSE 100 (UK100) being one of top laggards (-2%). ECB minutes will be released at 12:30 pm BST and will show whether European Central Bank is a dovish as Lagarde painted it during a press conference.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appDE30 snapped a recovery rally yesterday, plunging below some key support. The index dropped below the price zone marked with 50% retracement of the April correction and the downward move accelerated afterwards. Index also plunged below zone marked with 38.2% retracement and briefly halted downward move at 200-hour moving average (purple line). However, an attempt to launch a recovery move failed when bulls failed to break back below the 38.2% retracement. Another wave of selling can be observed today with the index reaching a daily low slightly above 13,700 pts, an area marked with 23.6% retracement. A drop below this hurdle would pave the way for a pullback towards 13,500 pts. Traders should keep on guard near 12:30 pm BST as ECB minutes will be released and may provide some hints on the moods among European policymakers.

Company News

According to a Reuters report, the European antitrust watchdog is set to grant unconditional approval for Volkswagen (VOW1.DE) to acquire Europcar, clearing the final hurdle for the €2.9 billion acquisition. Official confirmation of approval is expected on May 25, 2022.

Suedzucker (SZU.DE) reported results for fiscal-2022 (February 2021 - February 2022). Suedzucker reported a 13.8% YoY jump in revenue, to €7.6 billion (exp. €7.32 billion). Operating profit was 47.5% YoY higher at €332 million (exp. €332 million). EBITDA was 15.2% YoY higher at €692 million. Company maintained forecasts for the current fiscal year and still expects operating profit in fiscal-2023 to reach €300-400 million and EBITDA to reach €660-760 million.

Analysts' actions

-

Commerzbank (CBK.DE) upgraded to "buy" at UBS. Price target set at €8.60

Suedzucker (SZU.DE) is making a 3% dive today. Company released a solid earnings report for fiscal-2022 but overall risk-off moods seem to be offsetting this. Stock is pulling back after a failed attempt of breaking above 200-session moving average (purple line) earlier this week. A near-term support zone to watch in case pullback deepens can be found around 2% below current market price in the €12.00 area, that is additionally strengthened by the 50-session moving average (green line). Source: xStation5