Summary:

-

Green opening in Europe, optimism in China disappeared at the end of trading

-

European manufacturing PMIs disappoint in October

-

Deutsche Bank (DBK.DE) drops on the lowest third quarter revenue since 2010

European stock markets have started today’s trading on a stronger footing in the wake of subsequent stimulatory steps taken by the China’s authorities to help the faltering stock market recover as the country grapples with some adverse effects stemming from the trade war with the United States. However, gains across Chinese indices disappeared at the end of the trading day. As a consequence, while the Shanghai Composite closed 0.3% (it was growing more than 1% during the session) the Hang Seng (CHNComp) is trading already 0.4% shortly before the close.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

The European manufacturing sector continues faltering in October sending flashing lights. Source: Macrobond, XTB Research

Although stocks in Europe moved up at the opening there are growing concerns that the ongoing bull market is coming to an end, and the tomorrow’s ECB meeting could be another possible risk event. Let us recall that the European Central Bank is on course to wind down its bond buying programme at the end of this year and this fact has been already discounted. Even as the stock market is not the point where the ECB is looking at when it sets monetary policy (at least not directly) downbeat moods could make the central bank more uncertain to tweak its policy toward a more hawkish tilt. While a postponement of the end of the QE programme does not seem to be a real option (it would push the euro substantially down), the bank could alter its view regarding the economic outlook. In the prior meeting the bank wrote in its statement that risks to this outlook were “broadly balanced” underlining threats coming from global trade frictions.

The faltering manufacturing sector could be another factor to be more bearish for the ECB on Thursday. French index in October fell to 51.2 from 52.5 while German one declined to 52.3 from 53.7 - both turned out to be well below expectations. What’s more, in case of Germany we also got a disappointing number for the services sector as PMI dropped to 53.6 from 55.9. The two bleak readings from Germany resulted in a clear slide of the composite PMI to 52.7 from 55 previously. In a nutshell, today’s PMI prints from France and Germany (especially in the latter) seem to be consistent with the slowing economy and a thesis of passing the peak in the current business cycle earlier this year. In this point one needs to add that the latest data regarding labour costs indicated that these costs increased in almost all categories suggesting that the European economy could be entering a stage when economic growth slows and price growth picks up - not the best mixture for monetary policy to say the least.

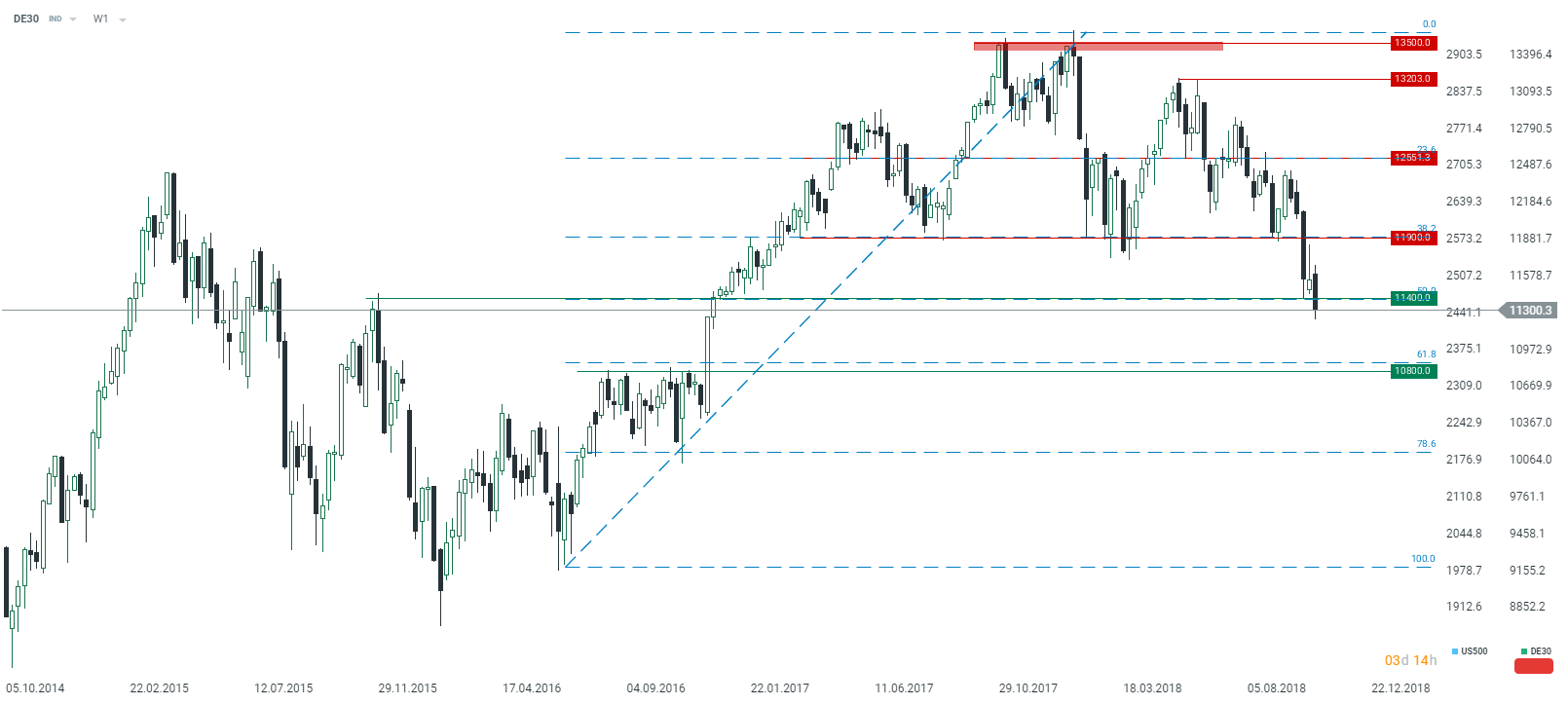

The German DE30 is trading clearly below its critical technical level this morning following the gloomy PMIs. From a technical viewpoint this week’s close is going to be outstandingly important as it may set moods for upcoming weeks. In our view the breakdown of the 50% retracement of the rally from mid-2016 could be the symbolic end of the bull market. Source: xStation5

The German DE30 is trading clearly below its critical technical level this morning following the gloomy PMIs. From a technical viewpoint this week’s close is going to be outstandingly important as it may set moods for upcoming weeks. In our view the breakdown of the 50% retracement of the rally from mid-2016 could be the symbolic end of the bull market. Source: xStation5

After the first hour of trading the German index is rising 0.3%, stocks in France (FRA40) are going up 0.7% while the EuroStoxx50 (EU50) is moving up 0.6%. The British FTSE100 (UK100) is rising 0.55% and the FTSE MIB (ITA40) is climbing 0.3%. Nevertheless do notice that the SP500 futures are falling 0.6% at the time of writing implying a red start of trading there.

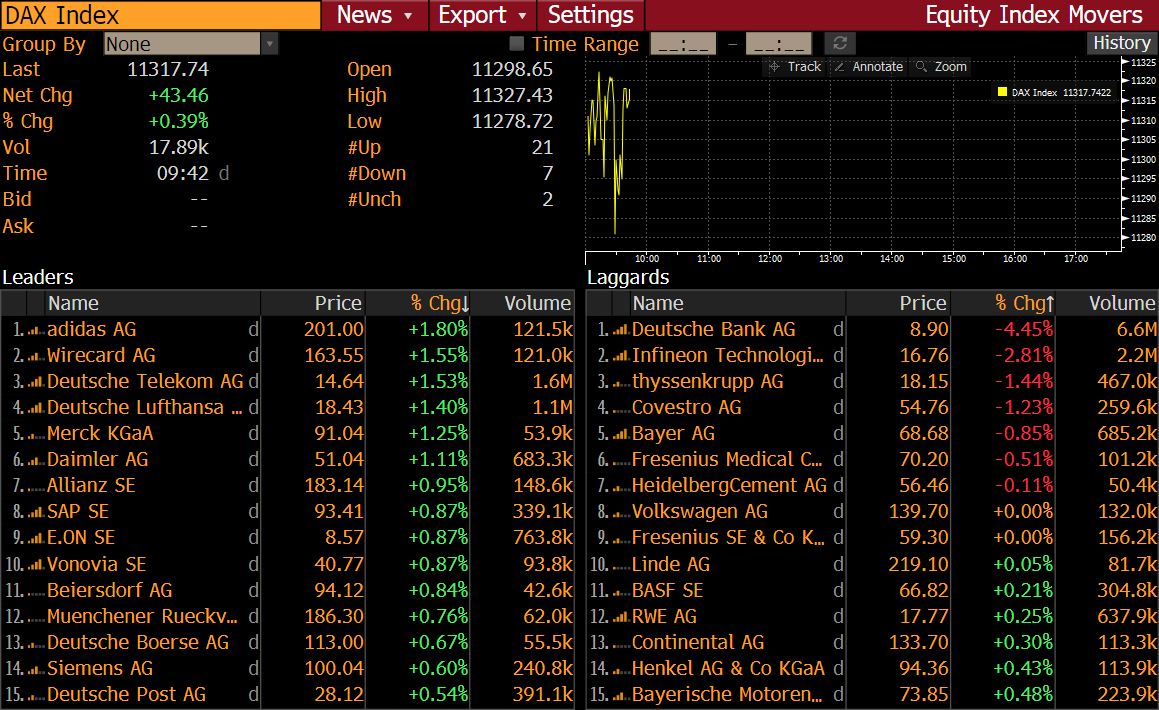

Deutsche Bank (DBK.DE) is by far the largest loser within the DE30. Source: xStation5

Deutsche Bank (DBK.DE) is by far the largest loser within the DE30. Source: xStation5

Looking into the German DAX one needs to focus on Deutsche Bank. The company released weakish earnings for the third quarter with revenue hitting the lowest level since 2010 (in third quarters only). The German lender also reported weaker than expected revenue in trading equities and fixed income while net income exceeded expected value of 160 million EUR and came in at 211 million EUR.

In turn, Daimler (DAI.DE) is rising slightly more than 1% following two positive reports. Firstly, the company informed that it will hold a 50% stake (the remaining stake will be held by Geely) in the joint venture headquartered in eastern city of Hangzhou. The venture will offer car sharing services in some Chinese cities. The statement also said that Geely’s electric cars will join the fleet in the future. Secondly, Daimler was upgraded to buy from neutral by the Bank of America ML. The company will release its earnings on October 25.