-

European markets try to recover from yesterday's declines

-

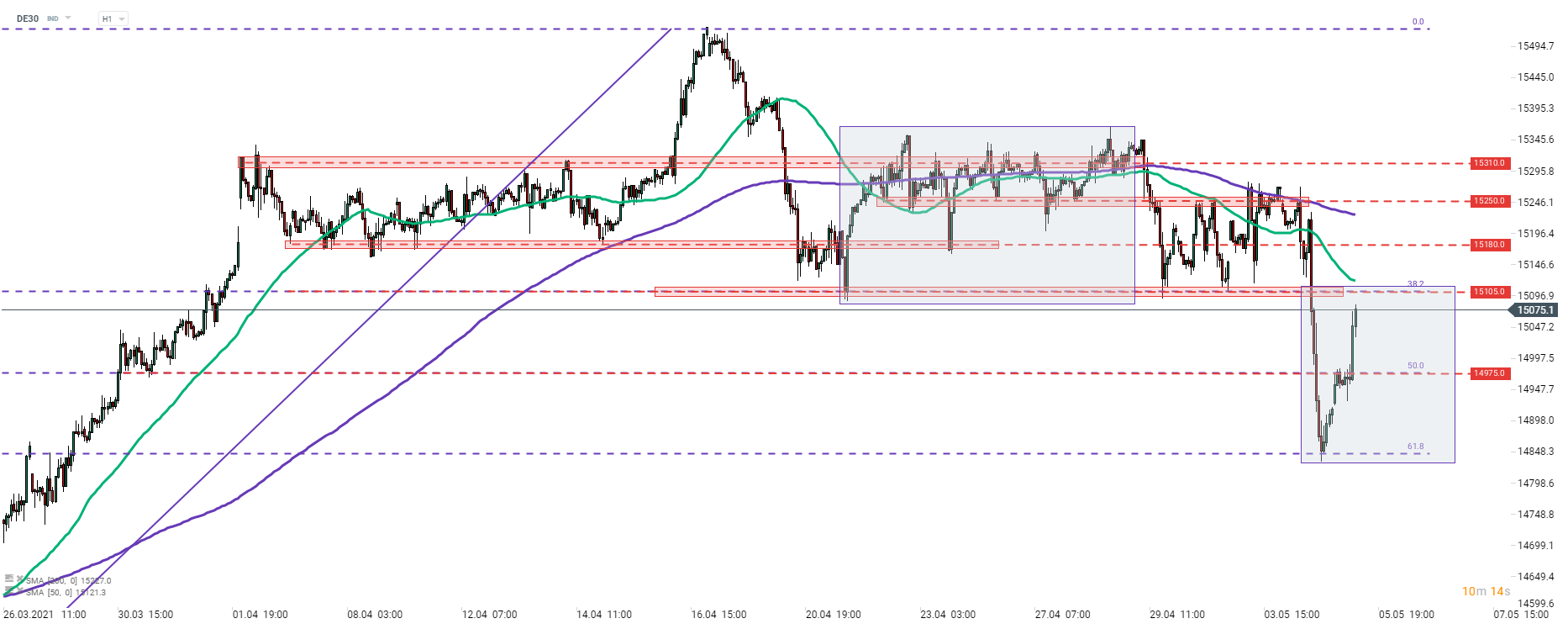

DE30 climbs back above 15,000 pts

-

Daimler and Delivery Hero drop after shareholders announce stake sales

European stock markets are trading higher on Wednesday in an attempt of recovering from yesterday's losses. German DAX (DE30), UK FTSE 100 (UK100), Italian FTSE MIB (ITA40), Spanish IBEX (SPA35) and Polish WIG20 (W20) all gain 1% or more today. Gains can be spotted all across the Old Continent.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appDE30 plunged yesterday on the back of hawkish comments from US Treasury Secretary Janet Yellen. German index dropped to the lowest level since late-March 2021. Yesterday's daily low was reached near the 61.8% retracement of the upward move started on March 25, 2021. Strong upward move was launched later on as Yellen backtracked on her interest rate comments. The near-term resistance level to watch on DE30 can be found at 15,105 pts. This area is marked with previous price reactions, 38.2% retracement, 50-hour moving average as well as the upper limit of a local market geometry. Breaking back above it could put the index on track toward recent all-time highs.

Company News

Deutsche Post (DPW.DE) decided to boost full-year EBIT forecast following release of solid Q1 earnings. Company expects full-year EBIT at €6.7 billion, up from a previous forecast of €5.6 billion. Q1 revenue reached €18.86 billion, up 22% compared to Q1 2020. Q1 EBIT reached €1.91 billion and was higher than expected €1.87 billion. Express segment has been the biggest driver of EBIT. Q1 2021 free cash flow reached €1.183 billion, compared to a free cash burn of €409 million in Q1 2020.

Delivery Hero (DHER.DE) drops after a group of company's shareholders unveiled a plan to sell 9.8 million shares, or a 3.9% stake. Stake could be worth as much as €1.2 billion.

Daimler (DAI.DE) trades lower today after Japanese Nissan Motor said that it will sell its stake in the company. The move comes after French carmaker Renault also decided to sell stake in Daimler. Nissan owns around 1.5% of Daimler and aims to sell it via accelerated bookbuilding offer. Bookrunner said that shares are expected to price at €69.85.

Hugo Boss (BOSS.DE) reported a 10% YoY decline in Q1 sales, to €497 million. EBIT improved from negative €14 million in Q1 2020 to a positive €1 million in Q1 2021. Company reported a net loss of €8 million, compared to a net loss of €18 million in Q1 2020. Hugo Boss expects global operations to improve significantly in 2021, compared to a pandemic hit 2020. Nevertheless, the company said that it is unable to provide precise guidance for the year.

Hugo Boss (BOSS.DE) is trading higher following the release of Q1 2021 earnings report. Stock jumped to a fresh post-pandemic high. The near-term resistance zone to watch, should the upward move continue, can be found at around €41.60. The upper limit of the upward channel as well as 78.6% retracement of the 2020 pandemic drop can be found in the area. Source: xStation5

Hugo Boss (BOSS.DE) is trading higher following the release of Q1 2021 earnings report. Stock jumped to a fresh post-pandemic high. The near-term resistance zone to watch, should the upward move continue, can be found at around €41.60. The upper limit of the upward channel as well as 78.6% retracement of the 2020 pandemic drop can be found in the area. Source: xStation5