-

Stocks in Europe plunge

-

DE30 reaches lowest level since early-August

-

Deutsche Bank CEO optimistic about 2021 dividend

Stocks in Europe plunged at the start of today's trading. Major blue chips indices from the Old Continent trade over 1% lower. German DAX (DE30) is one of the worst performing indices, trading almost 1.5% lower at press time. While sell-off has eased, European benchmarks continue to trade near daily lows. Economic calendar today is almost empty and there are no releases that could trigger bigger moves on stock markets (impact of BoC decision is likely to be limited to CAD market).

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appAfter a few days of range trading, DE30 managed to deliver a more decisive break below the support zone at 15,800 pts, marked with the 23.6% retracement of the upward move launched in mid-July 2021. However, sell-off did not stop there and the index continued to move lower and eventually broke below the support marked with 38.2% retracement. As a result, DE30 reached the lowest level since early-August. The next major support zone to watch ranges between 50% retracement (15,530 pts) and 15,500 pts mark. Index managed to recover slightly off the daily lows and in case it manages to finish the day above the aforementioned 38.2% retracement, bulls may be offered some hope.

Company News

Siemens Energy (ENR.DE) is the worst performing DAX stock today, dropping over 5%. Shares trade lower amid general risk-off moods but the stocks is additionally pressured by downgrade it has received at JPMorgan. JPMorgan cut recommendation for the stock from "neutral" and price target was lowered from €30 to €29. JPMorgan has also cut recommendation for Siemens Gamesa, a Spanish renewable energy unit in which Siemens Energy holds 67% stake.

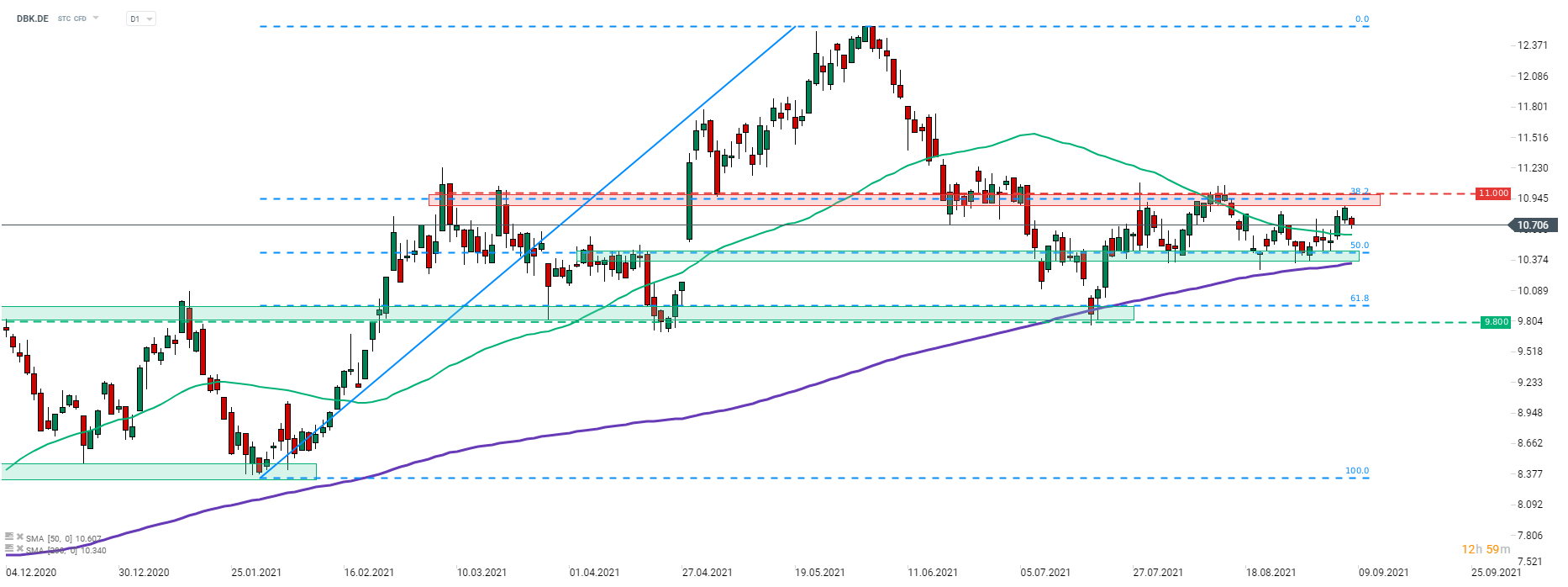

Christian Sewing, CEO of Deutsche Bank (DBK.DE), said that he is optimistic that the German bank will hit 2022 targets. Sewing also said that he is optimistic about the 2021 dividend. Apart from that, Sewing used his speech at the Handelsblatt conference to once again blame EU authorities for limiting cross-border consolidation of the European banking sector and in turn limiting the ability of European lenders to grow and challenge US banks.

Airbus (AIR.DE) announced that its gross orders received in August reached 102 jets, the highest since January 2020. European planemaker said that it had 3 cancellations during the month and delivered 40 jets. Airbus' year-to-date sales after August stand at 132 jets.

Deutsche Bank (DBK.DE) continues to trade in a range defined by 38.2% and 50% retracement of the upward impulse launched at the beginning of a year. Stock is pulling back from the upper limit of the range today amid broad risk-off moods. Near-term support is defined by the 50% retracement - the lower limit of the range at around €10.40. Source: xStation5

Deutsche Bank (DBK.DE) continues to trade in a range defined by 38.2% and 50% retracement of the upward impulse launched at the beginning of a year. Stock is pulling back from the upper limit of the range today amid broad risk-off moods. Near-term support is defined by the 50% retracement - the lower limit of the range at around €10.40. Source: xStation5