Darden Restaurants (DRI.US) stock erased premarket gains and is currently trading nearly 2.0% lower despite the company posted upbeat figures for the fourth quarter as sales improved, mainly thanks to the return of its fine-dining business.

- The owner of Olive Garden and other restaurant chains earned $2.24 a share, topping analysts’ estimates of $2.21 a share. Revenue of $2.6 billion also came in above Wall Street estimates of $2.54 billion.

- For the current fiscal year, the company expects diluted net earnings per share in the region of $7.40 to $8, compared to the consensus EPS estimate of $8.15, however sales growth in same-restaurant may fall from 11.7% to 6%.

- Darden issued a revenue outlook of $10.20 billion-$10.40 billion, compared to market projections of $10.22 billion.

- Company increased its quarterly dividend by 10% and authorized a new $1 billion share repurchase program.

- “By adhering to our strategy, and pricing below inflation, we ended the year with significantly better margins than pre-COVID,” said Darden CFO Raj Vennam.

- Several analysts believe that company sales may increase in the future, however margins may take a huge hit due to surging inflation and slowing customer demand.

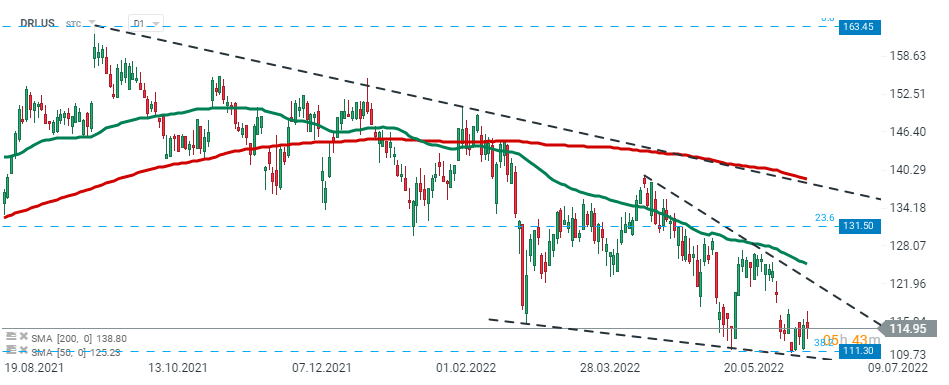

Darden Restaurants (DRI.US) stock has been trading in a downtrend in recent months, however price found support around $111.30 level which coincides with lower limit of the triangle structure and 38.2% Fibonacci retracement of the upward wave launched in March 2020. As long as price sits above this level, another upward impulse may be launched. Source: xStation5