- European indices took a hit on Wednesday, with the German DAX and CAC40 closing 1.11% and 0.81% lower, respectively, snapping a 3-day winning streak.

- UK inflation rate jumped to a fresh 40-year high of 9.1% in May, mainly due to surging energy and food prices, while flash estimates pointed to pandemic-low Euro Area consumer confidence for June.

- Wall Street indices erased early losses and are trading higher during a volatile session. The Dow Jones gained 0.10%, while the S&P 500 rose nearly 0.4%, while Nasdaq jumped over 0.5%.

- Fed Chair Powell said that a recession in the US is “certainly a possibility” during his testimony to Congress. He reaffirmed the central bank is committed to raising rates expeditiously to bring down inflation, and warned inflation could continue surprising to the upside. This is a more hawkish narrative compared to the previous meeting.

- EUR and CHF are the best performing major currencies while AUD and NZD lag the most; The dollar index fell as much as 0.5% to below 104.

- The Czech National Bank raised interest rates by 125 bp, while analysts' expected 100 bp increase. The rate is now 7.0%, which may be a determinant of what to expect in Poland due to the comparable inflation levels.

- Gold could be among assets that may be targeted in a possible next round of European Union sanctions on Russia, a draft document showed. Nevertheless, bullion prices remains stable around $1838.00, while silver fell below $21.50.

- Oil price fell nearly 7.0% early in the session due to the recession concerns and US administration plans to suspend gas tax for three months. Nevertheless buyers managed to reduce some of the losses and WTI currently trades around $105.70, while Brent is testing $111.00 level.

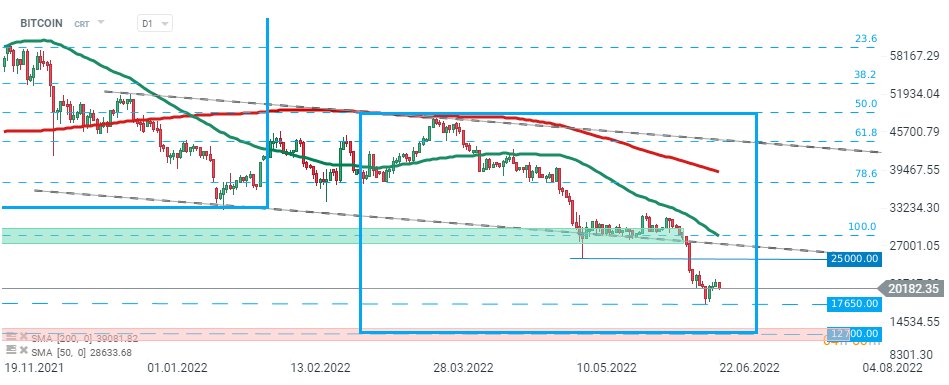

- Downbeat moods prevail on the crypto market, where Bitcoin pulls back towards psychological support at $20,000, while Ethereum broke below $1100 level.

Bitcoin - sellers once again become more active and if current sentiment prevails another downward impulse towards recent lows at $17650 may be launched. Source: xStation5

Bitcoin - sellers once again become more active and if current sentiment prevails another downward impulse towards recent lows at $17650 may be launched. Source: xStation5