- Mixed moods in Europe

- Wall Street hit new records

- Antipodeans currencies under pressure

- Ethereum reaches new ATH

European indices finished today's session in mixed moods, as the FTSE 100 fell 0.2% from recent highs, while the DAX rose 0.8% to a 6-week high. Mining companies took the biggest hit, weighed down by falling commodity prices, namely iron ore, coal, and copper. On the earnings front, BP, Standard Chartered, and Ferrari posted upbeat quarterly figures, while Adecco missed on expectations. Oil and gas giant BP stock declined more than 4.0% despite solid quarterly results.

US indices climbed to record highs on Tuesday, getting a boost from a string of encouraging earnings reports. Pfizer, Estée Lauder, DuPont, KKR & Co and Under Armour posted better than expected quarterly results. Avis Budget Group's stock skyrocketed over 145% before paring back some of those gains, after the car rental company reported blockbuster third-quarter earnings yesterday and revealed plans of building its EV fleet. On the other hand, Tesla shares fell over 3% after Elon Musk said the company has not signed a contract with Hertz yet and after news that the carmaker will recall 11,700 vehicles. So far, 55.8% of S&P 500 companies have reported quarterly financial results, with 82% beating earnings estimates, according to FactSet. Meanwhile, the Fed's 2-day monetary policy meeting started today and the central bank is expected to announce a reduction in its bond purchases tomorrow while focus will also be on commentary about interest rates and how sustained the recent surge in inflation is.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appIn the forex, the JPY is the strongest of the majors while the AUD is the weakest after the RBA decided to left interest rates and the QE program unchanged and dropped the yield control program. The USD is just behind the JPY as traders position ahead of the FOMC decision tomorrow.

WTI crude fell 0.50% and is trading around $83.60 a barrel, while Brent dropped 0.70% and is trading around $84.50 a barrel as investors await US inventory levels and the OPEC+ meeting next Thursday. API data later in the day is expected to show US crude inventories rose by 1.567 million barrels last week, the sixth consecutive week of gains. Elsewhere, gold price fell 0.30% to $1786 level while silver fell over 2.3% and is trading around $23.40 amid stronger dollar. The yield on the benchmark 10-year Treasury note rose to 1.54%.

Bitcoin jumped nearly 5% and is currently trading around $ 63,500. If current sentiment prevails, an upward move may accelerate towards records at $ 67,000. Ethereum has climbed to a new all-time high today and is currently trading at $ 4,500. BTC's domination begins to decline in favor of other cryptocurrencies, which could herald the beginning of the altcoin season. Currently, the global crypto market is valued at $ 2.73 trillion.

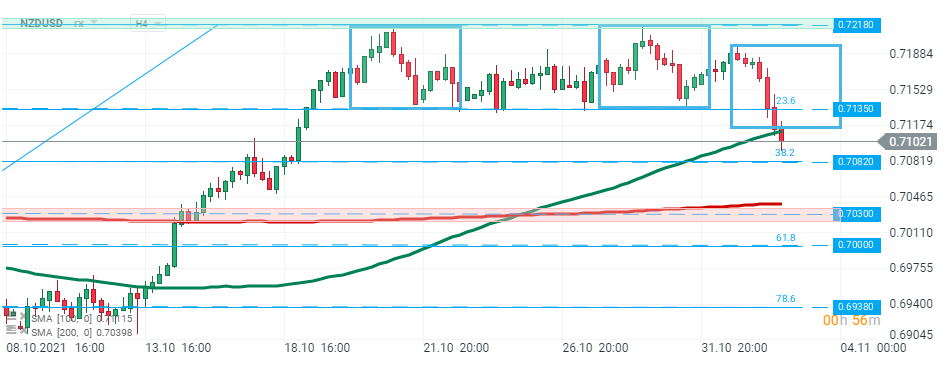

NZDUSD pair has been moving sideways recently, however during today's session buyers managed to break below the lower limit of the consolidation zone at 0.7135 which coincides with 23.6 Fibonacci retracement of the last upward wave. Later in the session the pair broke below the lower limit of the 1:1 structure and 50 SMA (green line) and is currently approaching major support at 0.7082 which is strengthened by 38.2% retracement. Source: xStation5

NZDUSD pair has been moving sideways recently, however during today's session buyers managed to break below the lower limit of the consolidation zone at 0.7135 which coincides with 23.6 Fibonacci retracement of the last upward wave. Later in the session the pair broke below the lower limit of the 1:1 structure and 50 SMA (green line) and is currently approaching major support at 0.7082 which is strengthened by 38.2% retracement. Source: xStation5