- US500 and US30 both hit new ATH's

- European equities close mostly higher

- NATGAS price soar

- Bitcoin soars after Musk revealed his crypto investments

European indices finished today's session mostly higher, with German DAX at a one-month high of 15,600 pts. Market sentiment was lifted thanks to solid Q3 earnings, namely better-than-expected pre-tax profits and a share buyback announcement from HSBC. Meanwhile, the Aerospace sector took a hit as an unexpected wave of Covid cases in China weighed on the traveling industry. On the data front, the German Ifo Institute business climate index dropped slightly to 97.7 in October, amid broad pessimism across economic sectors.

Upbeat moods prevail in the US, where S&P 500 and Dow Jones both hit fresh ATH's while Nasdaq jumped to its highest level since mid-September as investors remain optimistic ahead of the quarterly results from major tech companies. Tesla provided the biggest boost to the S&P 500 and the Nasdaq, after car rental firm Hertz placed an order for 100,000 Tesla cars, while Morgan Stanley raised its price target on the stock. As a result, electric maker stock rose nearly 10% and hit a new all-time high. Meanwhile PayPal stock added 4.1% after the payments company scrapped its plans to buy the digital pinboard site Pinterest Inc for as much as $45 billion. Of the 117 S&P 500 companies that have reported so far, 84% beat market forecasts, according to Refinitiv. Big tech companies are due to report quarterly results this week, including Facebook (today after markets close), Alphabet, Amazon, Apple and Microsoft. A third of the Dow companies also is set to release quarterly results this week, including Caterpillar, Coca-Cola, Boeing and McDonald's.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appWTI crude erased early gains and is trading below $83.80 a barrel, while Brent added 0.50% and is trading around $85.15. Saudi Arabia's Energy Minister said during the weekend OPEC+ alliance should maintain its cautious approach to managing global crude supplies, a view backed by both Nigeria and Azerbaijan. Russia's oil minister said he wants OPEC+ to stick to its deal to raise output by 400k/bpd at the November meeting. Meanwhile, US energy companies reduced oil and natural gas rigs for the first time in seven weeks, according to Baker Hughes in a report released on Friday. The price of natural gas rose almost 10% today as the latest weather forecasts suggest lower temperatures in the coming weeks in the US. Investors do not seem to pay much attention to the recent EIA report, which showed an increase in natural gas stocks. Elsewhere, gold jumped above $1800 level and silver is trading around $24.50 as mounting pressures of high inflation and a soft dollar outweighed concerns over rising yields. Also recently, Powell acknowledged that inflation is well above the target and may run into next year, prompting markets to hedge with the yellow metal.

Bitcoin is starting to recover from the last correction. The price of the main cryptocurrency bounced off the support at $60,000 and is currently testing $ 63,000 level following Elon Musk's statement regarding his investments in the crypto market. Ethereum (ETH) is currently trading at $ 4,200 and is approaching its ATH at $ 4,400.

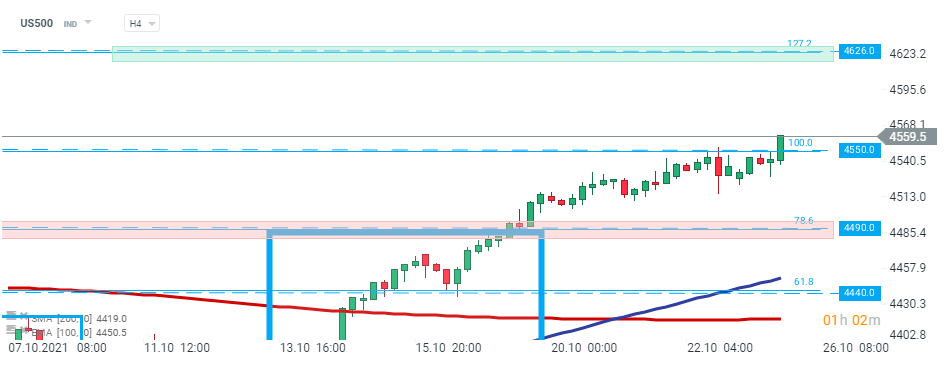

US500 managed to erase early losses and jumped to new record at 4559.0 pts. If buyers will manage to uphold current momentum, then upward move may accelerate towards next resistance at 4626.0 pts which coincides with 127.2% Fibonacci external retracement of the last downward correction. Source: xStation5

US500 managed to erase early losses and jumped to new record at 4559.0 pts. If buyers will manage to uphold current momentum, then upward move may accelerate towards next resistance at 4626.0 pts which coincides with 127.2% Fibonacci external retracement of the last downward correction. Source: xStation5