- European stocks finished higher

- Wall Street rises after Powell testimony

- Surging oil and commodity prices

European indices finished today's session higher, partially erasing some of the recent losses, led by energy and mining stocks amid soaring oil and commodities prices in the wake of war between Ukraine and Russia. Moods improved slightly after Interfax informed that a ceasefire is to be discussed during the next round of talks between both sides. Due to the escalation of military actions which results in many deaths and injuries Russian oligarch Abramovich announced he will sell Chelsea soccer club and set up a foundation that will use all net proceeds from the transaction to “benefit all victims of the war in Ukraine.” Meanwhile, elevated inflation levels in the Eurozone and low levels of unemployment in Germany strengthened the case for a rate hike by the ECB.

Major Wall Street indices also moved higher after Fed Chair Powell said the US economy no longer needs such an accommodative policy stance, signaling higher interest rates in March. Powell opts for a 25 bp increase but noted that the Fed could move more aggressively if inflation does not abate as expected. Still, he pointed out that the outbreak of war in Ukraine brought a significant degree of uncertainty for monetary policy. Meanwhile, the Biden administration is open to imposing sanctions on Russia's oil and gas industry but going after its exports at the moment could help the Kremlin due to high oil prices and ongoing supply disruptions (nevertheless as a sign of protest against Putin's actions traders and investors are still moving away from Russian oil and gas). Additionally White House announced further sanctions targeting the defense sectors of Russia and Belarus.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appPrices of many industrial metals rose sharply due to well-deserved sanctions imposed on Russia by the Western countries. Nickel and aluminum rose 3.60% and 4.60% respectively during today's session. Oil prices rose over 7%, with WTI crude futures surged past $112 per barrel, the highest since 2013. Gold pulled back to $1923 level while silver fell at one point nearly 2%, however buyers managed to erase most losses. Major cryptocurrencies pulled back from major resistance zones. Bitcoin bulls failed to break above $45,000 and Ethereum struggles with psychological resistance at $3000.

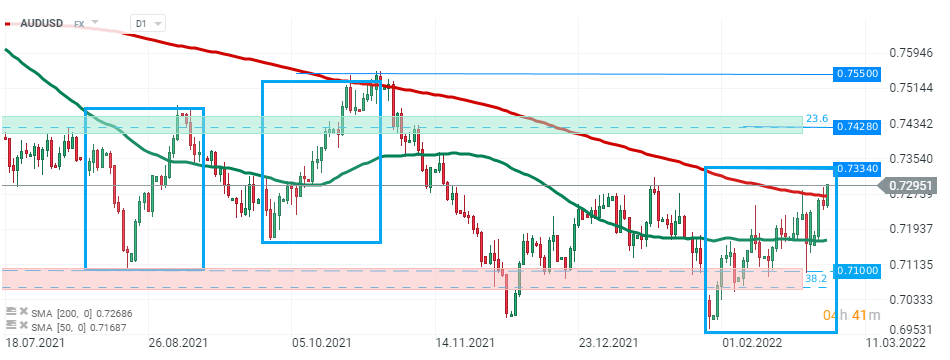

AUDUSD pair broke above 200 SMA (red line) as stronger-than-expected Q4 economic growth lifted sentiment. Aussie is also supported by rising commodity prices given Australia’s status as a net energy exporter and a producer of basic materials. Pair is currently heading towards local resistance at 0.7334 marked with the upper limit of the 1:1 structure. Source: xStation5

AUDUSD pair broke above 200 SMA (red line) as stronger-than-expected Q4 economic growth lifted sentiment. Aussie is also supported by rising commodity prices given Australia’s status as a net energy exporter and a producer of basic materials. Pair is currently heading towards local resistance at 0.7334 marked with the upper limit of the 1:1 structure. Source: xStation5