Cryptocurrencies, including Bitcoin, trade higher over the week and those gains extended into Monday's trading. Bitcoin was testing $65,000 area earlier today but failed to break above and pulled back below $64,000 mark. Meanwhile, crypto-linked stocks continue to trade higher as Bitcoin still remains above pre-weekend levels.

Taking a look at BITCOIN chart at H4 interval, we can see that price tested $65,000 resistance zone, marked with previous price reactions and 200-period moving average (purple line). Price pulled back below $64,000 mark and is now approaching $63,000. The first major support zone to watch should the pullback deepen can be found in the $61,500 area.

Bitcoin at H4 interval. Source: xStation5

Bitcoin at H4 interval. Source: xStation5

In spite of a pullback on Bitcoin, US crypto-linked stocks hold onto their gains from the opening of today's session and even extend them to new daily highs. Among stocks making big moves one can find Marathon Digital (MARA.US), CleanSpark (CLSK.US), Cipher Mining (CIFR.US), MicroStrategy (MSTR.US) or Hut 8 Mining (HUT.US).

Marathon Digital (MARA.US) rallies over 13% and tests $20 resistance zone, marked with 50-session moving average. Source: xStation5

Marathon Digital (MARA.US) rallies over 13% and tests $20 resistance zone, marked with 50-session moving average. Source: xStation5

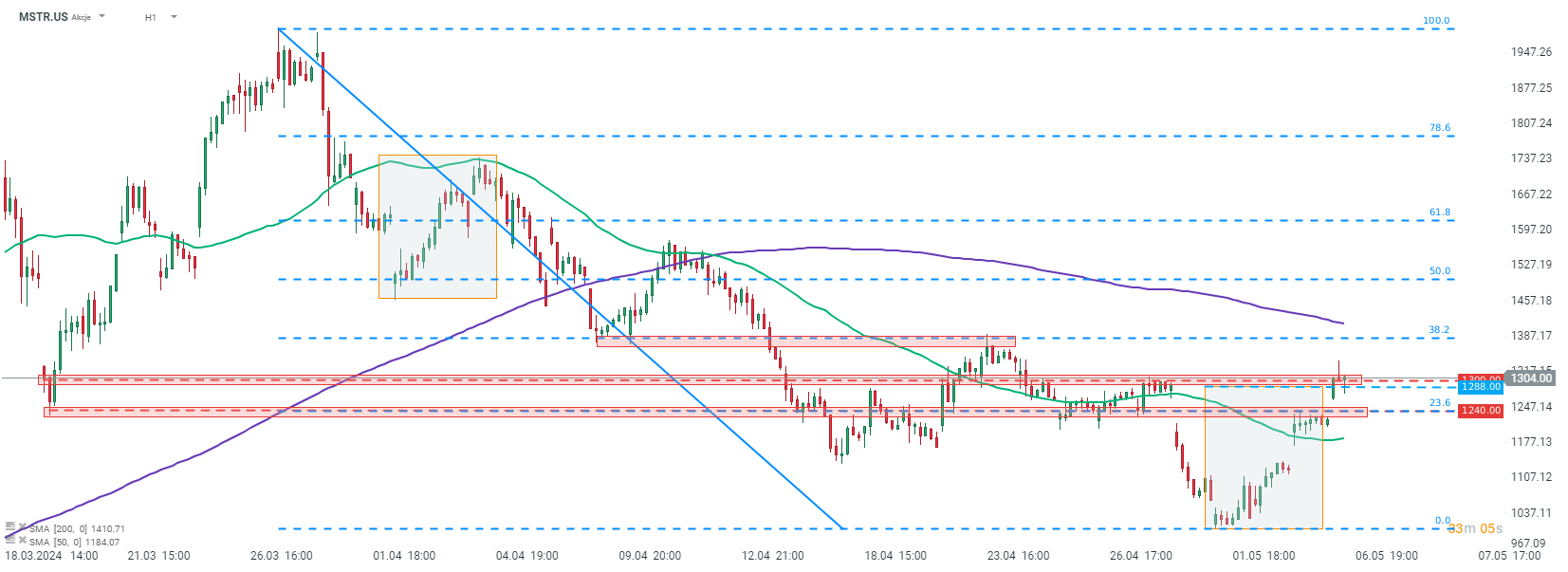

MicroStrategy (MSTR.US) broke above the $1,240 resistance zone and the upper limit of a local market geometry. Stock gains almost 7% and is testing $1,300 resistance zone. Source: xStation5

MicroStrategy (MSTR.US) broke above the $1,240 resistance zone and the upper limit of a local market geometry. Stock gains almost 7% and is testing $1,300 resistance zone. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?