- Bitcoin is trading under $18,000

- MassMutual - purchased $100 million in Bitcoin

- Grayscale- largest cryptocurrency trust fund purchased around 131,254 ETH

This week was negative overall for altcoins of all sizes. Major cryptocurrencies broke out of last week's consolidation zones and began to decline. The bearish sentiment prevails today following Bitcoin’s recent slide below $18,000. Altcoins across the board dived in tandem with BTC. The capitalization of all digital assets in circulation decreased to 520.8 billion, while an average daily trading volume is registered at $118.7 billion. Bitcoin's market dominance increased to 62.9%. Despite the most recent sell-off interest in the cryptocurrency market from institutional investors appears to be increasing. After several significant investments by Square Inc and other companies like Stone Ridge, MicroStrategy is the latest one to join the trend. Company is offering $550 million in convertible notes with net proceeds to buy Bitcoin. In a press release on Wednesday, the company announced that the notes will be unsecured senior obligations of MicroStrategy and will have an interest rate of 0.75% per annum. Meanwhile JPMorgan Chase & Co, which used to have very negative views of Bitcoin, has recently stated that gold will be suffering because of Bitcoin as money is being shifted towards the digital asset. Also DBS Bank of Singapore, which is known for its negative approach to cryptocurrencies, announced he launch of a digital asset exchange featuring Bitcoin, Ethereum, Bitcoin Cash, and XRP and several fiat currencies including SGD, USD, HKD, and JPY.

MassMutual invests $100 million in Bitcoin

MassMutual multinational insurance company which has more than $235 billion in its assets has purchased $100 million in Bitcoin for its general investment fund. Investment represents 0.04% of its general investment account and is set to provide the insurance company with a "measured yet meaningful exposure to a growing economic aspect of our increasingly digital world." MassMutual, which has been established in 1851, also acquired a $5 million minority equity stake in NYDIG, a subsidiary of Stone Ridge that provides cryptocurrency services to institutions, according to a statement. NYDIG, which already keeps more than $2.3 billion in crypto assets for clients, will provide custody services for MassMutual’s Bitcoins.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Bitcoin price found some support at the lower limit of the descending parallel channel and the 200 SMA (red line). If the current sentiment prevails, the downward move could be extended to the $16,800 handle or even $16,000. Source: xStation5

Bitcoin price found some support at the lower limit of the descending parallel channel and the 200 SMA (red line). If the current sentiment prevails, the downward move could be extended to the $16,800 handle or even $16,000. Source: xStation5

Grayscale Trust Fund has bought over 130,000 ETH

The largest cryptocurrency trust fund, Grayscale, has recently purchased around 131,254 Ethereum pushing its total to $1.66 billion at current prices. "While the Bitcoin system was the first stop for most investors before this year, a growing number of people are paying attention to Ethereum in its own right in 2020", Michael Sonnenshein, managing director at Grayscale Investments LLC, said in an interview with Bloomberg. Sonnenshein noticed that a new group of investors emerged this year for whom Ethereum is the most important cryptocurrency and often the only one.

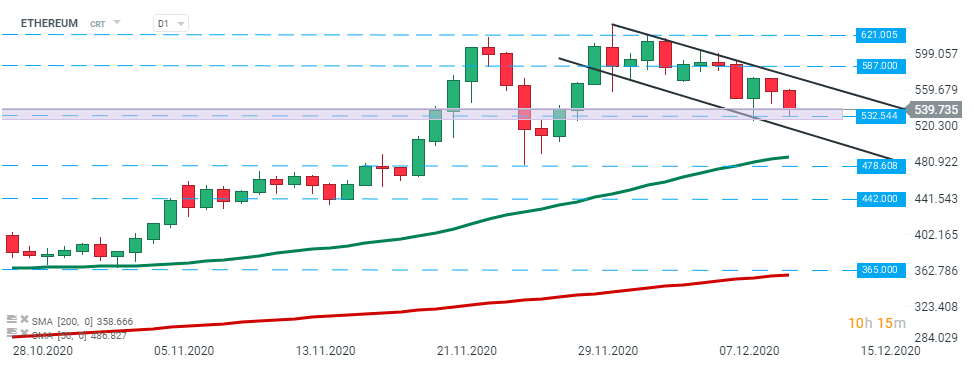

Ethereum has been trading in a downward trend recently. Sellers are trying to break below the lower limit of the descending parallel channel and local support at $532.54 and direction of a future move will depend on reaction to this hurdle. If buyers manage to halt declines here, upward impulse towards $587.00 level could be launched. However, one should remember that in the short term trend remains downward and break below support at $532.54 could see declines deepen. Next support lies at $478.60. Source: xStation5

Ethereum has been trading in a downward trend recently. Sellers are trying to break below the lower limit of the descending parallel channel and local support at $532.54 and direction of a future move will depend on reaction to this hurdle. If buyers manage to halt declines here, upward impulse towards $587.00 level could be launched. However, one should remember that in the short term trend remains downward and break below support at $532.54 could see declines deepen. Next support lies at $478.60. Source: xStation5