The sentiment of the cryptocurrency market remains mixed, with Bitcoin once again halting dips below $26,000. The still quite strong dollar index is putting some pressure on risky assets, demand for cryptocurrencies is tight. Volatility - thing which was characterictis of crypto markets is lower again. Lower volumes and volatility impact may lead to another high price-range Bitcoin move.

- JP Morgan indicated that the downward pressure on the cryptocurrency market is starting to weaken and there is less and less room left for declines although some analysts are raising concerns about the 'bearish' chart on the W1 interval (Bitcoin price below the SMA200). Analysts have highlighted the significant drop in CME Bitcoin futures - the recent sell-off has again 'cleared the market'

- Ethereum still below the two key SMA averages, although 1inch Protocol invested $10 million in reserves to buy 6,088 ETH yesterday - the large purchase, however, did not build significant upward pressure

- Pantera Capital points out that Bitcoin's current cycle is no different from previous ones, the declines caused by the collapse of the FTX exchange in the fall were likely the bottom of the sell-off. Also, the timing in which they took place relative to the halving planned for spring 2024 meshes with previous sell-offs in Bitcoin cycles. Analysts believe that Bitcoin's price will settle around $150,000 by the summer of 2025

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appBITCOIN is trading near the key $26,000 level set by previous price reactions. In addition, we can see that the RSI during last week's 'crash' fell to around 10 points where the last time we saw this indicator was in February (when the price fell below $20,000). Bitcoin has been holding the $25,900 - $26,200 level almost continuously for the past week - several times the bulls have stopped the sellers.So it looks like Bitcoin is forming another 'base' environment for further breakout from an environment of low volatility. In the shorter term, the SMA100 (black line), which runs around $27,200, remains relevant. It is worth noting, however, that unlike in February, the RSI has not risen as vigorously, and although it is 52 points, the price is still close to oversold levels. Source: xStation5 Analyzing ETHEREUM on the H1 interval, it shows nary a hint of weakness and is trading just below the SMA100 and SMA200 - potentially, a breakout above both of them could give fuel to the bulls and embolden buyers to test $1,760. Source: xStation5

Analyzing ETHEREUM on the H1 interval, it shows nary a hint of weakness and is trading just below the SMA100 and SMA200 - potentially, a breakout above both of them could give fuel to the bulls and embolden buyers to test $1,760. Source: xStation5

Bitcoin's halving cycles to date (with each cycle, Bitcoin's mining reward halves). Source: Pantera Capital

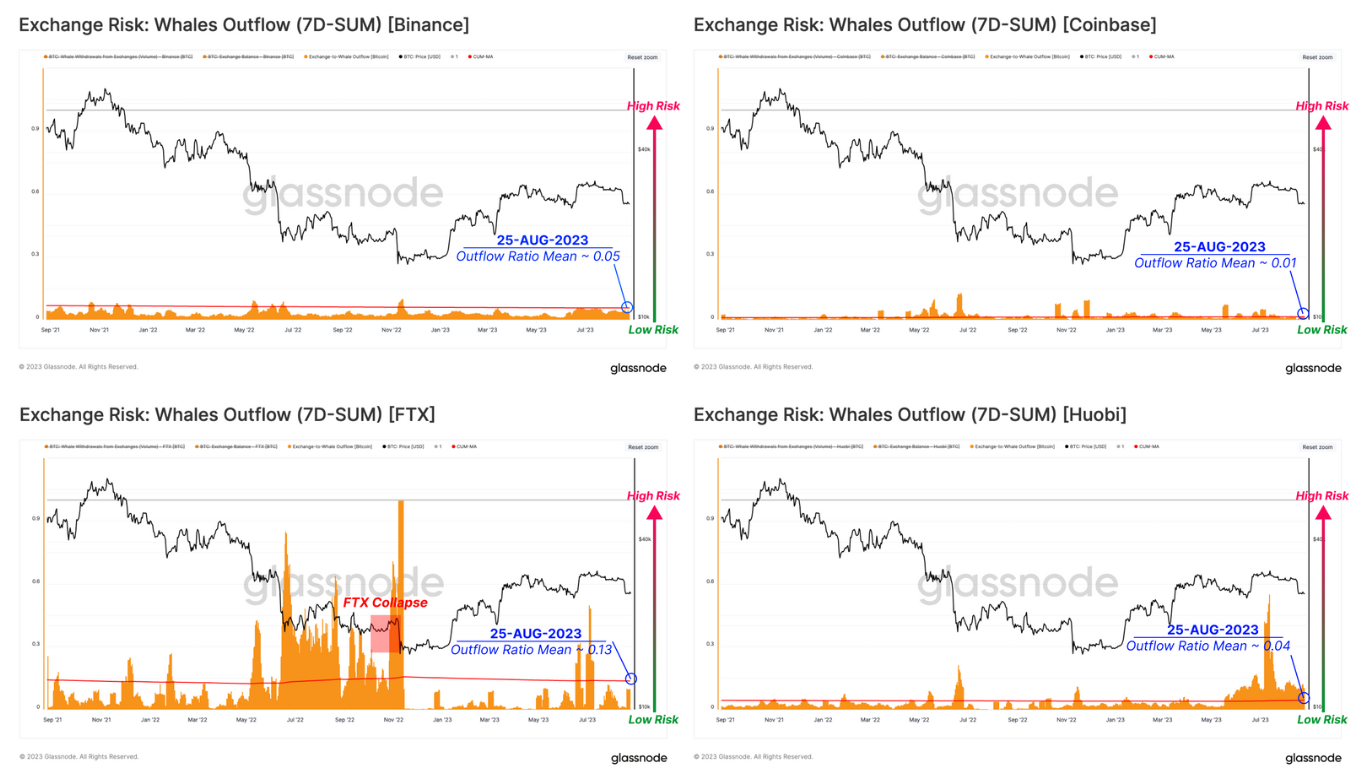

The on-chain indicator above measures how much BTC held by whale addresses has left the major crypto exchanges (which could ptirm extreme sentiment). The red horizontal line shows the average whale withdrawal rate (as total withdrawals from exchanges). Coinbase and Binance still show record low withdrawal rates over the past two years, with a long-term average of less than 5%. So we can see that the largest 'whale' investors storing BTC on exchanges are still showing a relatively small dose of optimism and are ready to realize gains/losses. Source: Glassnode The overall dominance of BTC movements (inflows/outflows to exchanges) is now near its highest levels ever, at 54%. The share of BTC flows belonging to whales between exchanges has reached a new high near 18% and continues to rise. Source: Glassnode

The overall dominance of BTC movements (inflows/outflows to exchanges) is now near its highest levels ever, at 54%. The share of BTC flows belonging to whales between exchanges has reached a new high near 18% and continues to rise. Source: Glassnode