Cryptocurrencies are back in consolidation, and last week's temporary euphoria caused by a US court decision that criticized the SEC's 'unwarranted' postponement of the approval of the Grayscale spot ETF proved unsustainable. Sellers returned to the market quickly, and on Thursday/Friday, another downward wave took place last week. Although JP Morgan expects that the SEC will eventually allow Bitcoin-based ETFs, demand at current price levels remains weak.

Crypto 'at the mercy of the dollar' ?

If risk aversion in the markets in the autumn deepens (likely strengthening the dollar), the cryptocurrency market will remain muted, and unless a more serious banking crisis is on the horizon, it is difficult to find significant catalysts for increased demand for Bitcoin. It is worth noting, however, that seasonally speaking, September is a rather weak month for equities, with a decidedly better last quarter of the year.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appIf we look at the dollar index (contracts on USDIDX), we see that while Bitcoin broke out of the bottom of the medium-term uptrend started back in 2022, the dollar did the exact opposite. The dollar index broke out above the downtrend line.

Source: xStation5

Bitcoin ETF rumors become less important?

- The crypto market situation now appears to be related to risk aversion in global markets - weaker sentiment dominated the second half of the year

- The SEC has until mid-October to respond to the court's decision. It can comply and allow the Grayscale Bitcoin ETF, appeal or request a retrial

- Berenberg Fund analysts believe that a sizable problem in the ETF's approval process is the role of cryptocurrency exchange Coinbase (COIN.US), which appears on almost every institution's application as a provider of so-called oversight sharing services

- The exchange itself is in litigation with the SEC so it currently remains unlikely that the U.S. regulator will approve its participation in the 'ETF business' as a credible institution

- In light of the above information, it seems that the war for 'crypto ETFs' will last longer, and the market is beginning to see this topic (even in an optimistic scenario) as rather too distant to influence prices today

- With Bitcoin weaker, demand for other cryptocurrencies will remain even weaker, with liquidity drying up. A higher risk-free rate (higher interest rates) has sucked some of the energy out of the extremely risky assets that were so eagerly reached for in times of negative and near 0 interest rates.

Bitcoin D1 chart

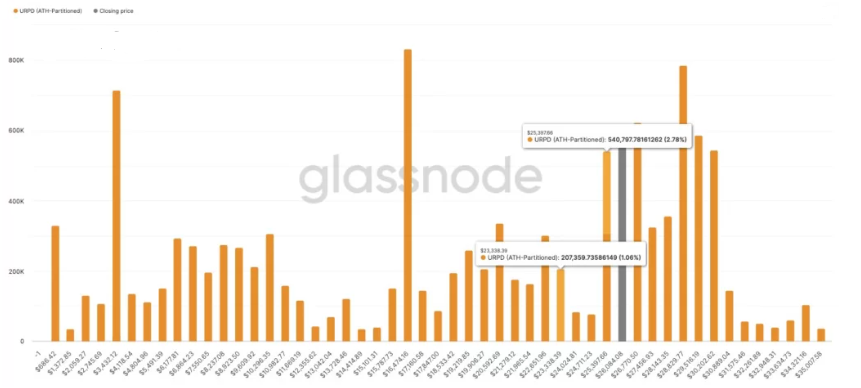

Looking at the chart of BITCOIN on the D1 interval, we can see that the price remains within an important price range - around $26,000. These are levels set by previous price reactions, including local peaks from the summer of 2022, the price peak from February, the lower range of the consolidation from May, the bottom of the sell-off from June and the range of the sideways movement after the cascading sell-off from mid-August. Looking at the significant Fibonacci retracements of the upward wave from April 2023 (the banking crisis, after the increases then returned to the narrative of Bitcoin as a 'safe haven' asset). We can see that the price between the 38.2 retracement ($27,000) and the 61.8 retracement ($24,000). All three key averages of the SMA200, 100 and 50 are above the price today, and momentum temporarily favors sellers. For the moment, a test of the area around $24,000 seems a more likely scenario. Source: xStation5 Relatively few bitcoin trades were made at prices in the $26,000 to $24,000 range. A kind of gap of interest among traders/traders indicates that support at the lower levels, 61.8 Fibo retracement, seems more natural. Source: Glassnode

Relatively few bitcoin trades were made at prices in the $26,000 to $24,000 range. A kind of gap of interest among traders/traders indicates that support at the lower levels, 61.8 Fibo retracement, seems more natural. Source: Glassnode