Strengthening dollar and yields are putting pressure on Bitcoin, ahead of tomorrow's US data: CPI inflation, the Fed decision and the Powell conference. Contracts for the dollar index (USDIDX) are trading up more than 0.2% today, another session in a row, and yields on 10-year U.S. Treasury bonds are back above 4.45%, although they were trading at 4.26% last week. Some cryptocurrencies are losing considerably more today than Bitcoin, which is slipping less than 5%. Ethereum is trading down nearly 6% and has retreated below $3500; Intercomp and Sushi are losing nearly 10%, and declines on Uniswap exceed 12%.

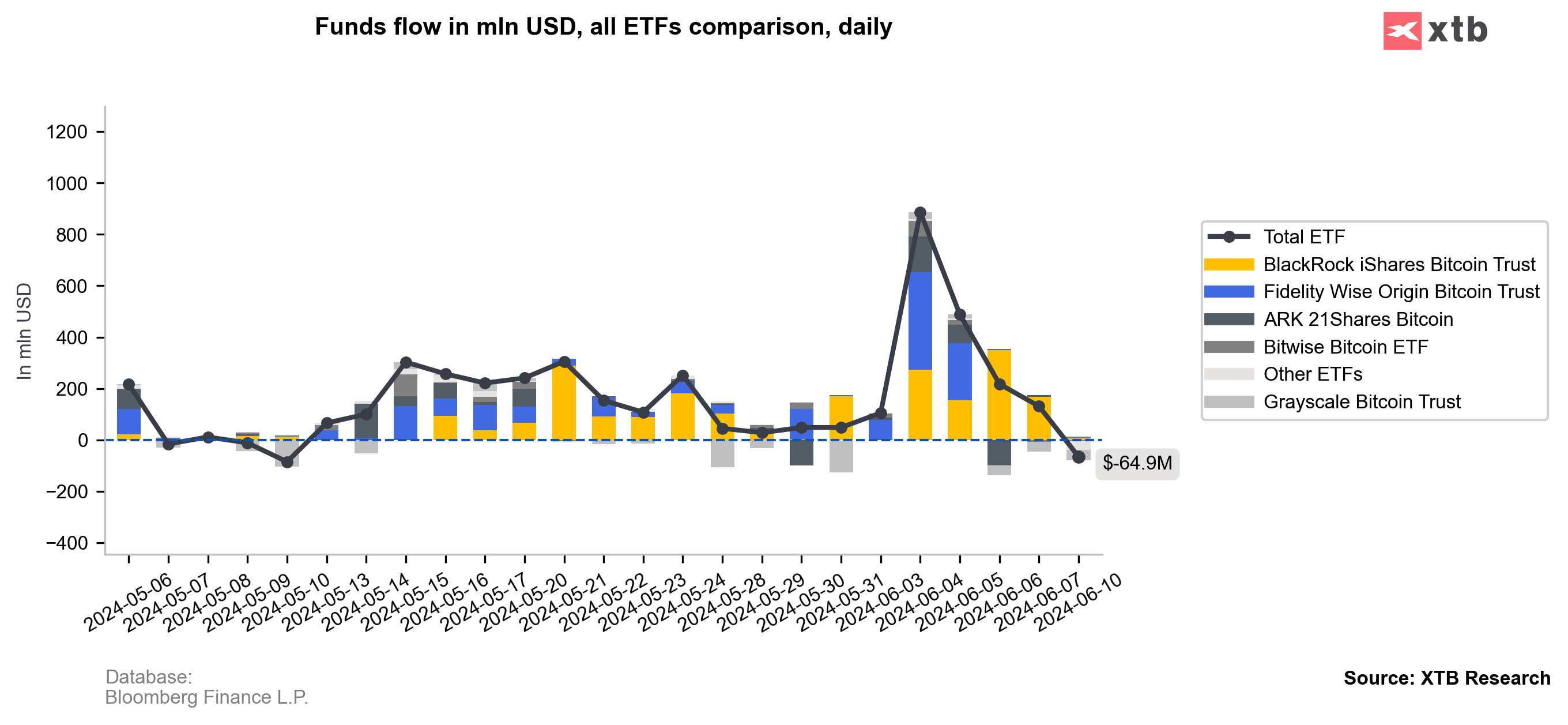

Yesterday, ETFs recorded small net outflows of $64.9 million after 19 days of buying. Source: Bloomberg Finance L.P.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appBITCOIN (D1 interval)

Bitcoin is trading down nearly 5% today, and key short-term support can be found at $65,300, where we see the 50-session moving average and the 23.6 Fibonacci retracement of the January 2024 upward wave. Source: xStation5

Source: xStation5

UNISWAP (H1)

News of the acquisition of Crypto Game: The Game turned out to be only a short-term, speculative catalyst for increases on Uniswap. Today, those increases have been completely erased, and the token is testing the area below $9, last seen in the second half of May. The market reacted with a sell-off at the level of the exponential 200-session moving average (EMA200,red line). Source: xStation5

Source: xStation5