Today's inflation data in the USA exceeded expectations, triggering a necessary market correction. The data showed an average consumer price increase of 3.1% year-over-year and, excluding energy and food prices, a 3.9% year-over-year increase. Although these actual figures were 0.2 percentage points higher than the consensus, it's not as bad a report as it seems at first glance. A detailed analysis of inflation based on the latest data is invited.

Headline and core inflation

The market reacted immediately to the data. The US500 fell below 5000 points, and the US100 below 18000 points, spurred by inflation figures significantly exceeding expectations. It's important to note that the consensus on Monday before the publication indicated slightly higher data at 3.0% and 3.8%, respectively, but then dropped by 0.1 percentage points for each measure to 2.9% year-over-year and 3.7% year-over-year. Compared to the previous month's report, we see a further decline in CPI inflation from 3.4% in December, while core inflation remains at the same level.

Strong US economy drives inflation?

The main contribution to inflation was again the rental housing sector, part of service inflation. However, high prices are supported by a heated market. The US economy is in excellent condition, as confirmed by the latest GDP readings. Recent PMI data also indicate a rebound in business sentiment and improving prospects. Pressure on price increases is also added by high ISM readings for prices and employment.

Services weighing on inflation?

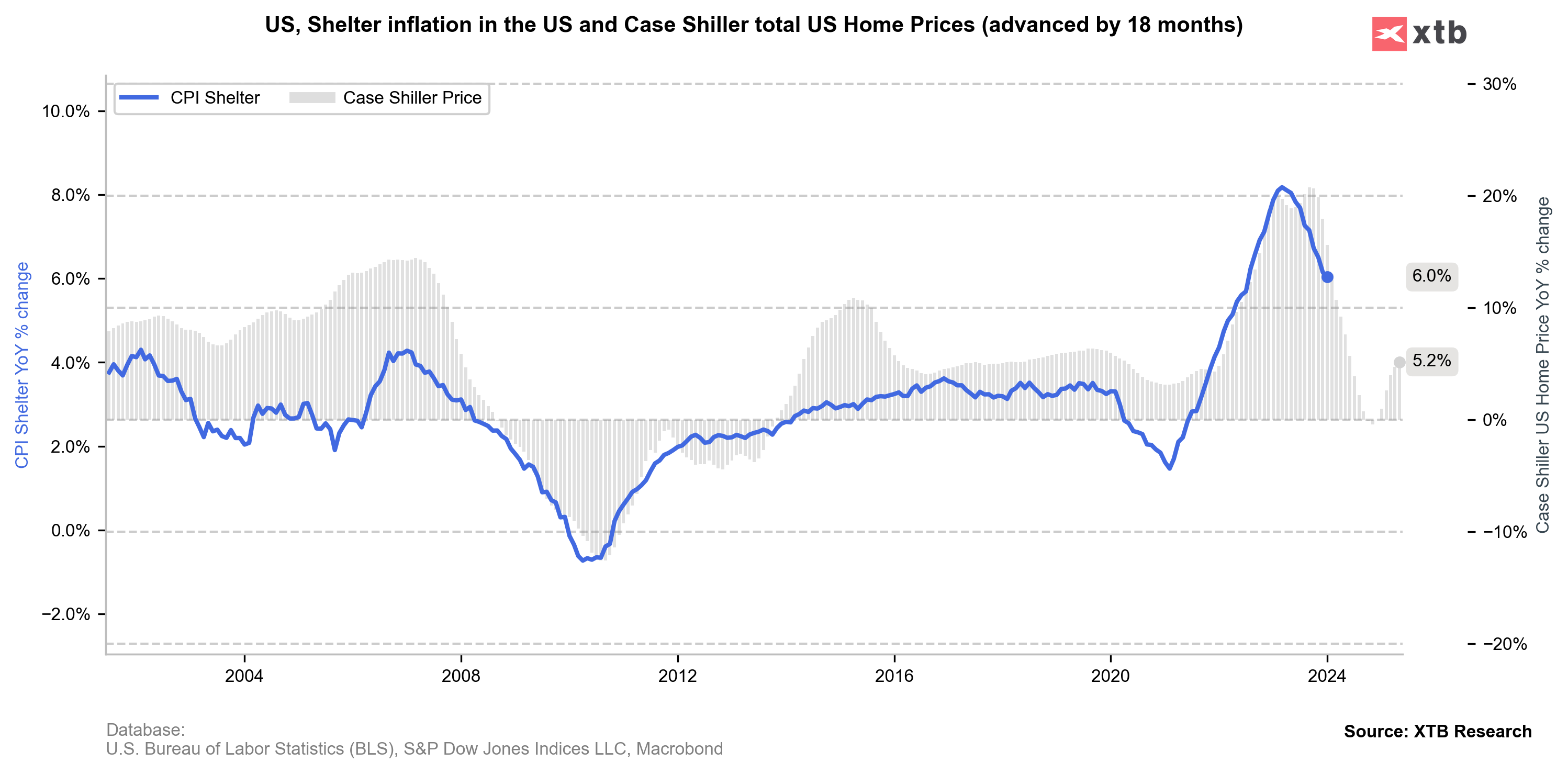

Persistent inflation in the services sector is an argument for the Federal Reserve to maintain interest rates for a longer period. Currently, rental housing prices weigh the most in the inflation basket.

However, looking at the correlation of the Shiller housing price index, we can assume that a downward trend for the rental market is inevitable. Unfortunately, we will have to wait a bit longer for this decline.

The positive news is that significant improvements are seen in other sectors, and the situation has practically returned to normal.

What do the Data Mean for the Fed?

At its last meeting, the Fed indicated that it wants to be sure about inflation before it starts lowering interest rates. The current data strongly argues for maintaining rates for longer, as reflected in current market expectations. After the publication, the dollar strengthened significantly, and bond yields also rose. Directly after the publication, expectations related to the first Fed rate cuts fell to just under 100 basis points in 2024, compared to 125 basis points before the report. Consequently, the first interest rate cut has been moved from June to July, and a potential May cut is now practically excluded. For a market overheated by recent rises, this is an ideal catalyst for at least a short-term correction. On the other hand, we are still waiting for a report from Nvidia, which could again stimulate high investor expectations and drive further rises in BigTech companies.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report