Oil

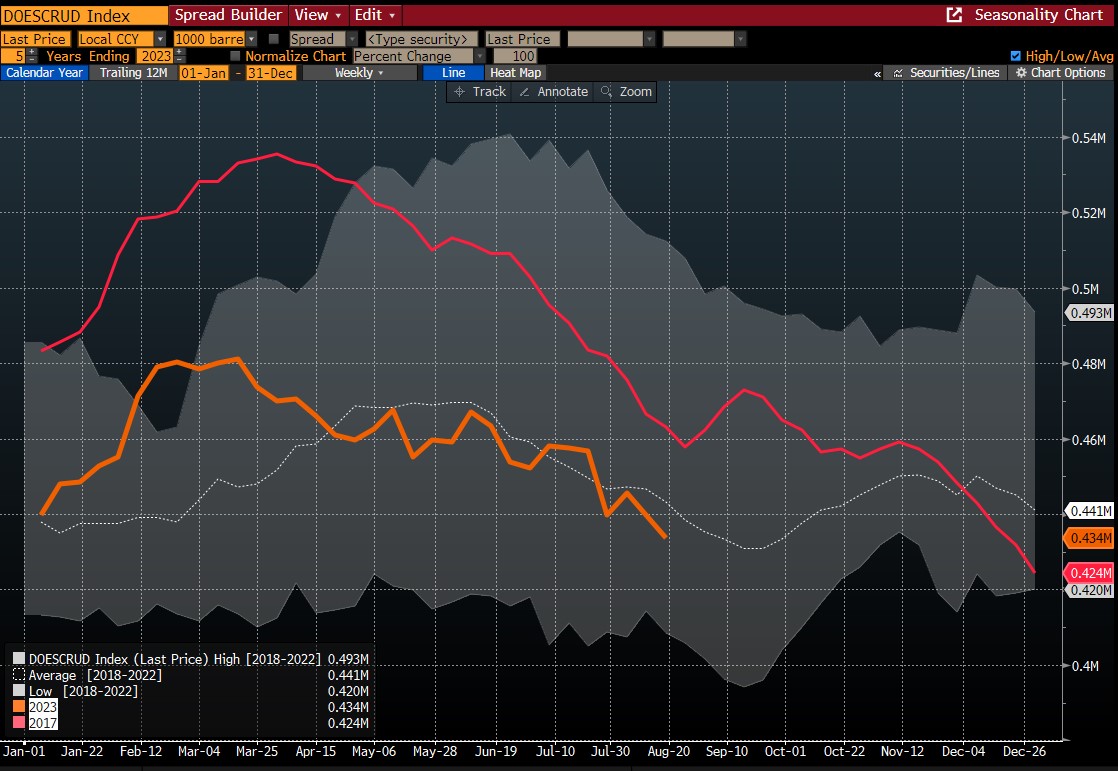

- Crude oil reserves have been declining since the beginning of March and they are now at around to 434 million barrels in the United States

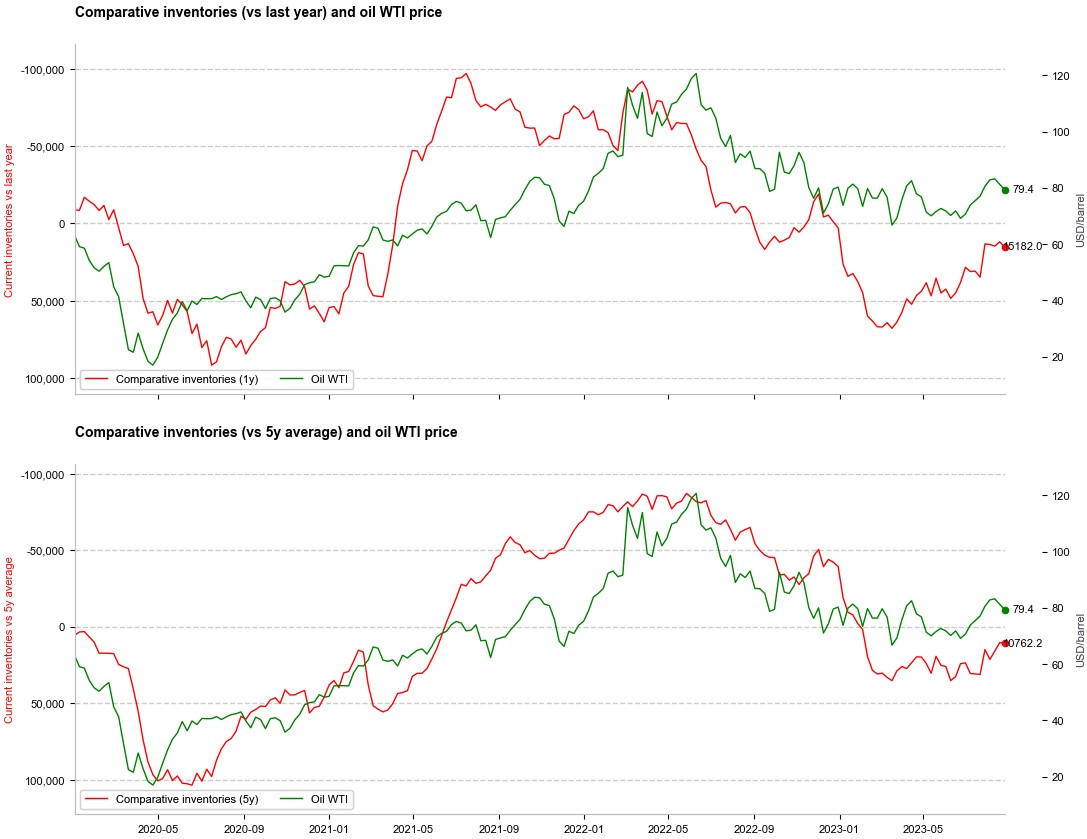

- Comparative reserves, which refer to current reserves compared to levels from last year and the 5-year average, are also decreasing, indicating that excessive oversupply is no longer present

- It is estimated that by the end of this year, the oil market deficit will average around 2 million barrels per day. Assuming that the United States accounts for about ¼ of this deficit, inventory levels could drop by 60 million barrels by the end of the year

- Equally important, this deficit cannot be filled with strategic reserves, which have been drained to their lowest levels since the 1980s over the past 2 years

- Further depletion of reserves should support higher crude oil prices than what is currently observed, and only a significant economic downturn in China could alter this situation

- The latest complete data on demand from China for May showed record-breaking consumption of crude oil and petroleum products in the country

- Of course, a hurdle for the bullish scenario would be a faster return of oil production from OPEC+ countries. At the moment, there's talk that Saudi Arabia will maintain an additional production cut of 1 million barrels per day into October

- In October, an OPEC+ meeting will take place to discuss the future of the production limitation agreement

- Saudi Arabia needs Brent crude oil prices to be around $80-85 USD per barrel to finance most of its budget plans

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appInventories are declining since March. This year's trend starts to resemble one from 2017 when inventory levels were dropping until the end of the year due to OPEC output cuts. Source: Bloomberg Finance LP

Comparative inventories are declining, especially in relation to last year's levels, signaling that prices should at least remain at current elevated levels. Source: Bloomberg Finance LP, XTB

50-session moving average broke above the 200-session moving average. In theory, this is a bullish signal that may hint at looming bullish trend reversal. On the other hand, it often took 1-2 months after such a signal surface for trend to reverse. Key near-term resistance level can be found at $82 per barrel, followed by $85 per barrel. Source: xStation5

Natural Gas

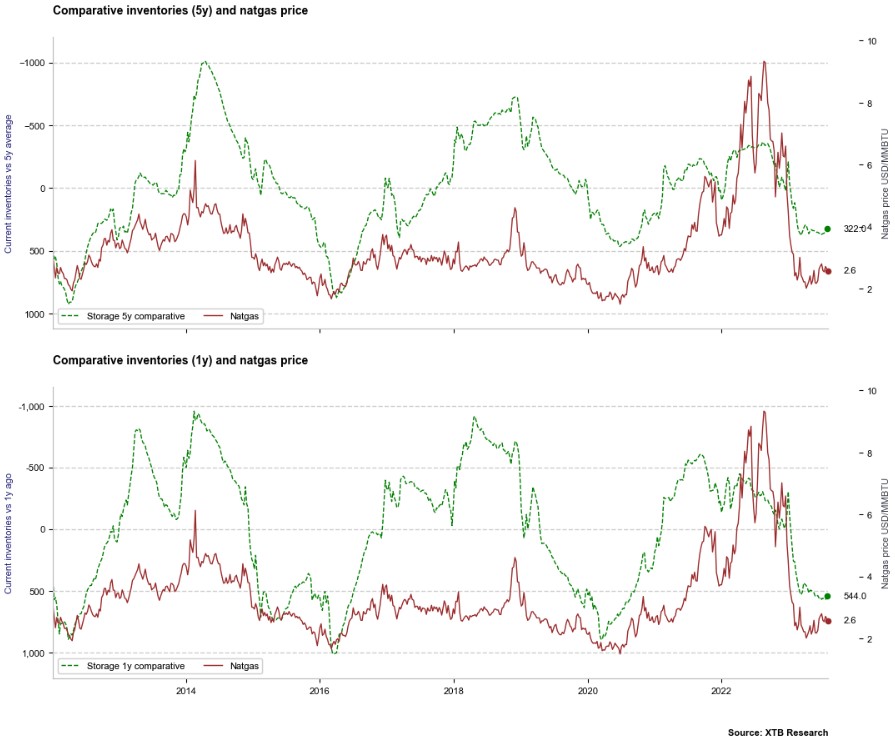

- The latest increase in gas reserves in the USA amounted to just 18 billion cubic feet (bcf), which was the lowest growth for this period in at least 30 years!

- We are witnessing a slight decrease in comparative reserves. However, it's worth noting that the oversupply compared to last year or the 5-year average has been persisting relatively long compared to other potential turning points

- The futures curve indicates that the next roll-over will bring a significant price increase, implying a rise in short-term demand. If this aligns with a further minor increase in reserves, an attempt to reach the range of $3.5-$4.0 USD cannot be ruled out during the early autumn

Comparative inventories are dropping slightly but a period of excessive oversupply continues. Source: Bloomberg Finance LP, XTB

Futures curve signals that the next two rollovers on natural gas futures will be very large, and should push the price above $3.00. Source: Bloomberg Finance LP

NATGAS jumped following the latest rollover and amid smaller-than expected inventory builds. Should the next 2-3 EIA reports show small inventory builds of 10-30 bcf, we may see price test $3.00 area, even before rollover in autumn. Seasonal patterns, however, hint that we should observe flat price performance until October. Source: xStation5

Gold

- Gold remains close to the $1920 USD per ounce level, despite a slightly higher likelihood of a Fed rate hike at the end of September

- The economic symposium in Jackson Hole left market expectations in a similar state as before the event. Powell stated that future decisions will depend on data, as inflation remains too high and further tightening might be necessary

- We did not receive any indication of an end to rate hikes, so the market will await further data in the form of US job market and CPI inflation figures

- Powell pointed out that inflation is more responsive to the labor market, making data like NFP (Non-Farm Payrolls) and JOLTS crucial in the Fed's upcoming decisions

- The upcoming data from the US job market in the form of the NFP report will be released this next Friday, September 1st

In spite of hawkish comments from Powell, gold managed to limit losses on Friday. On the other hand, price is reacting to the resistance at $1,925, where 38.2% retracement of the latest downward impulse can be found. It should be noted that latest gains in bond prices (TNOTE) have been relatively small compared to the rebound in gold prices. Moreover, USD remains strong (especially against JPY), and seasonal patterns hint at gold price declines until the third week of September. Source: xStation5

Coffee

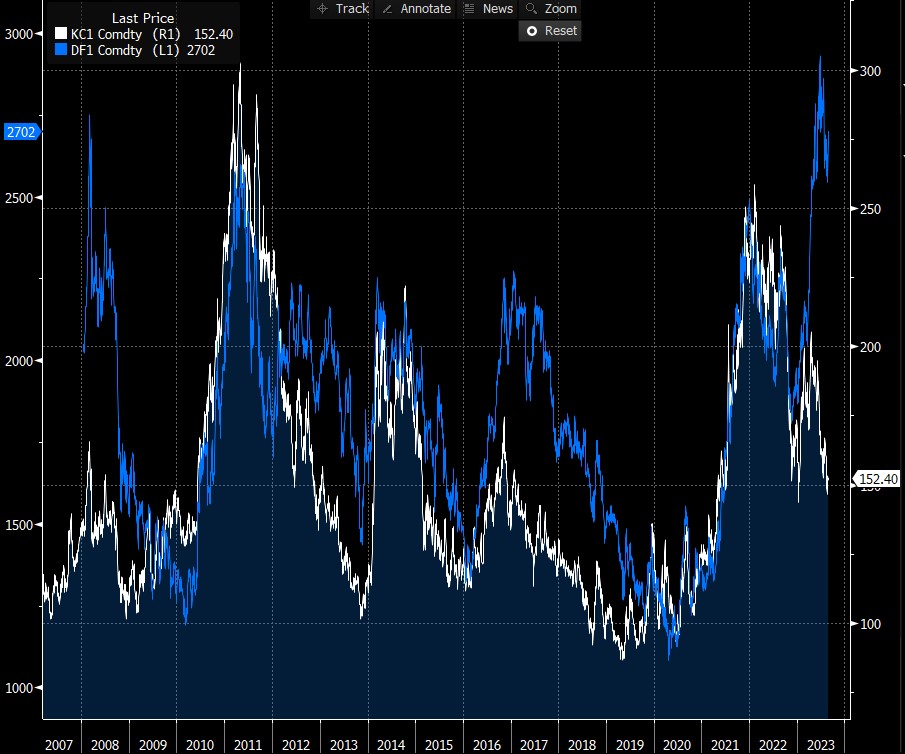

- Coffee remains under pressure, dropping below the crucial support level of 155 cents per pound

- Simultaneously, a further reduction in net positioning is observed. The positioning is nearing the January low when prices momentarily fell to around 140 cents per pound

- The 23/24 season is expected to bring significant oversupply to the market, leading to the current substantial sell-off. On the other hand, the 24/25 season is uncertain due to the potential impact of El Niño, which could change the situation

- Despite positive expectations for Arabica harvests, there is still considerable uncertainty regarding Robusta production in Asia (Indonesia, India, and Vietnam)

- According to producers in India, a 15-20% price increase for Robusta this season could drive increased demand for Arabica and lead to a rebound in prices by the end of this year

- Conversely, Robusta prices have recently reached historic highs, very close to the peaks from 2008 and 2011. The price retracement in those years coincided with a retracement in Arabica prices. Therefore, a stronger decline in Arabica prices cannot be ruled out if Robusta prices continue to fall from these historical highs

There is a significant spread between Robusta and Arabica prices. If Robusta deficit will be larger than expected, prices may once again reach historic highs and change the situation for Arabica. On the other hand, if Robusta prices experience similar corrections as in 2008 and 2011, Arabica prices may continue to drop. Last but not least, current fundamental situation doesn't justify prices dropping below 120 cents per pound, not to mention a drop below 100 cents per pound. Source: Bloomberg Finance LP

If bulls fail to push COFFEE back above 155 cents per pound area, downward pressure may persist. However, a break back above this support may lead to a test of the downward trendline in 175 cents per pound area. Source: xStation5