Oil

-

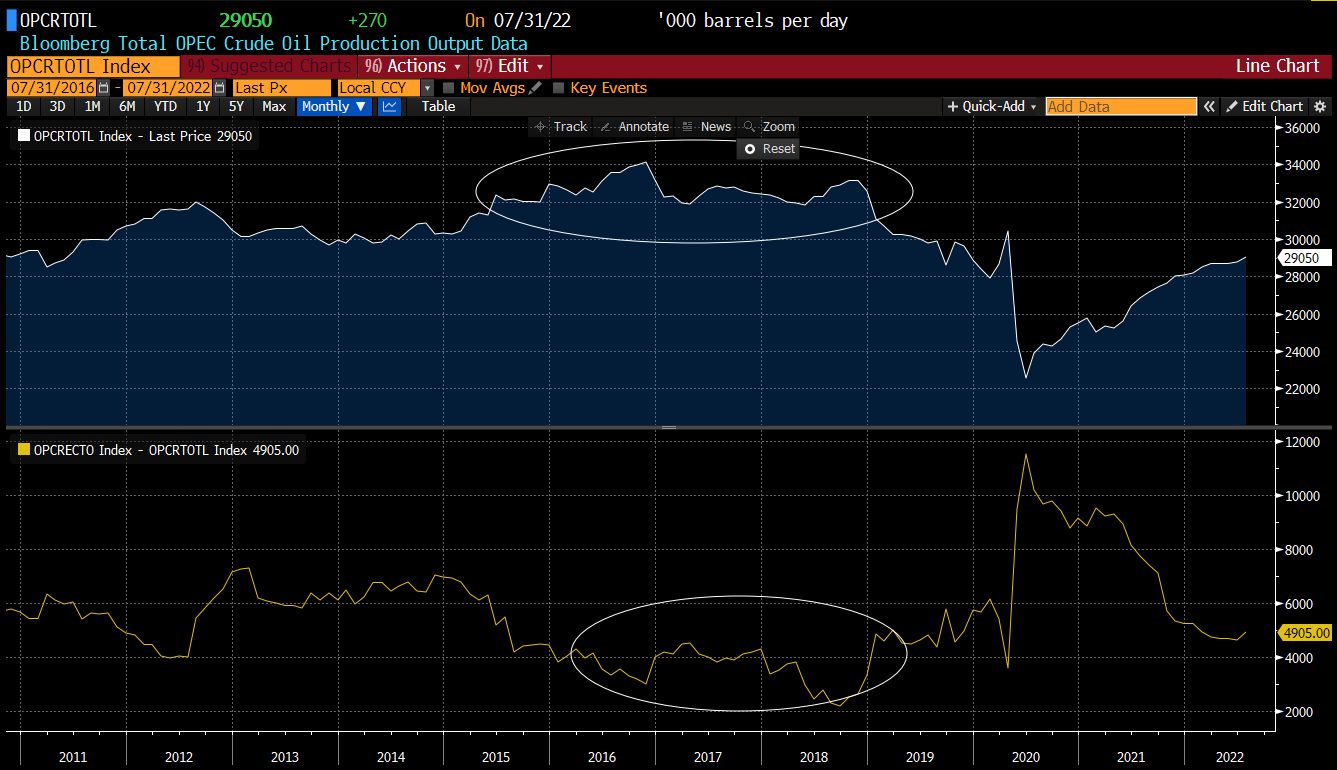

Oil prices move higher after Saudi Arabia said OPEC+ is ready to intervene as fundamentals and prices got disconnected

-

According to Saudi Arabia, current prices do not reflect very low spare production capacity

-

Moreover, Saudi Arabia says that current price levels do not encourage new investments, especially as economic slowdown is expected

-

OPEC+ policy changed completely compared to what Joe Biden wanted to achieve

-

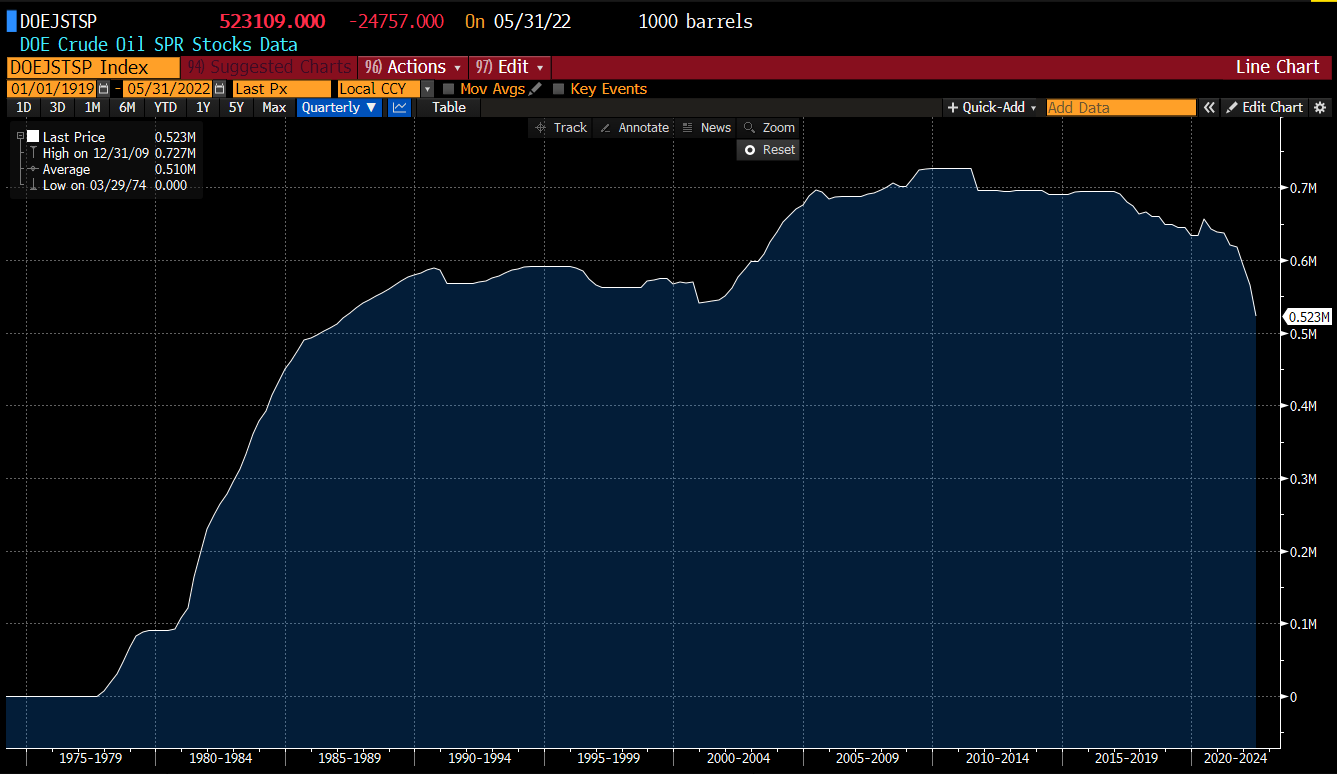

Releases from US Strategic Petroleum Reserves are expected to finish in October

-

Levels of strategic stockpiles in the US are the lowest since late-80s

-

United States looks better positioned to weather periods of commodity unavailability than Europe as it can completely satisfy its demand with in-house energy production

-

It is estimated that strategic US oil stockpiles decreased by around 8 million barrels last week, or at a record pace of more than 1 million barrels per day!

-

If SPR releases stop, oil market may become even tighter by the end of the year than it was at peak phase of Ukraine war related crisis

US Strategic Petroleum Reserves are dropping at a record pace and sit at the lowest levels since late-80s. Source: Bloomberg

US Strategic Petroleum Reserves are dropping at a record pace and sit at the lowest levels since late-80s. Source: Bloomberg

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app OPEC production is nowhere near as big as in 2017-2018 record period. However, spare production capacity is almost as low as it was back then, meaning that OPEC is unable to return to pre-pandemic output levels. Oil market will remain tight unless demand destruction occurs. Source: Bloomberg

OPEC production is nowhere near as big as in 2017-2018 record period. However, spare production capacity is almost as low as it was back then, meaning that OPEC is unable to return to pre-pandemic output levels. Oil market will remain tight unless demand destruction occurs. Source: Bloomberg

Oil prices bounced around 8% off the recent low. An attempt of breaking above a mid-term downward trendline can be spotted but price is yet to paint a higher high and a higher low. Source: xStation5

Oil prices bounced around 8% off the recent low. An attempt of breaking above a mid-term downward trendline can be spotted but price is yet to paint a higher high and a higher low. Source: xStation5

Natural Gas

-

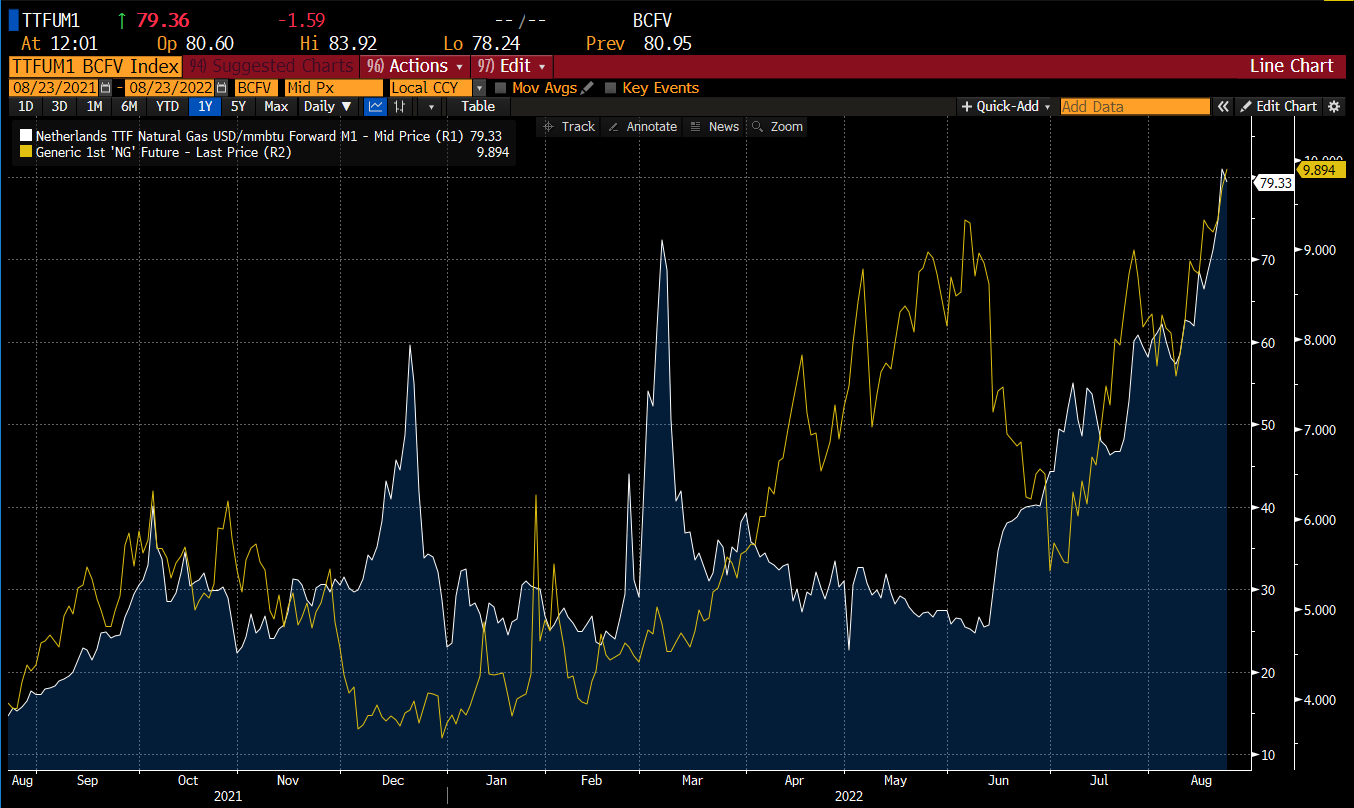

European gas prices reach fresh records. Prices exceed €270 per MWh, what translates to around $80 per MMBtu. This is an 8 times higher price than in the United States

-

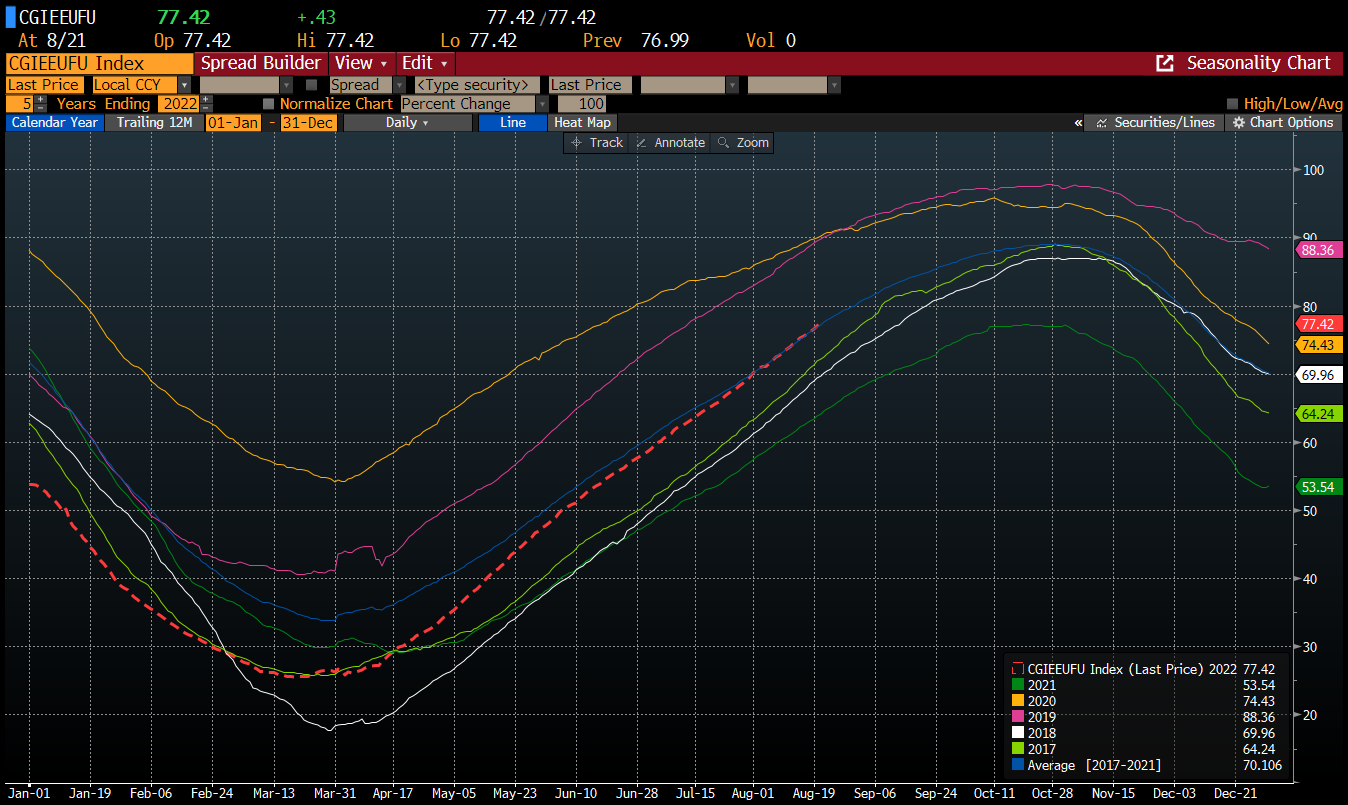

European gas storage is 77% full at the end of summer, and is already exceeding peak storage from whole-2021

-

On the other hand, gas exports from Russia to Germany via Nord Stream I pipeline remain uncertain

-

Nord Stream I gas flows will be completely halted from August 31 to September 2 for a turbine maintenance

-

However, there are concerns that Russia may not resume gas flows after maintenance in order to exert pressure on Europe

-

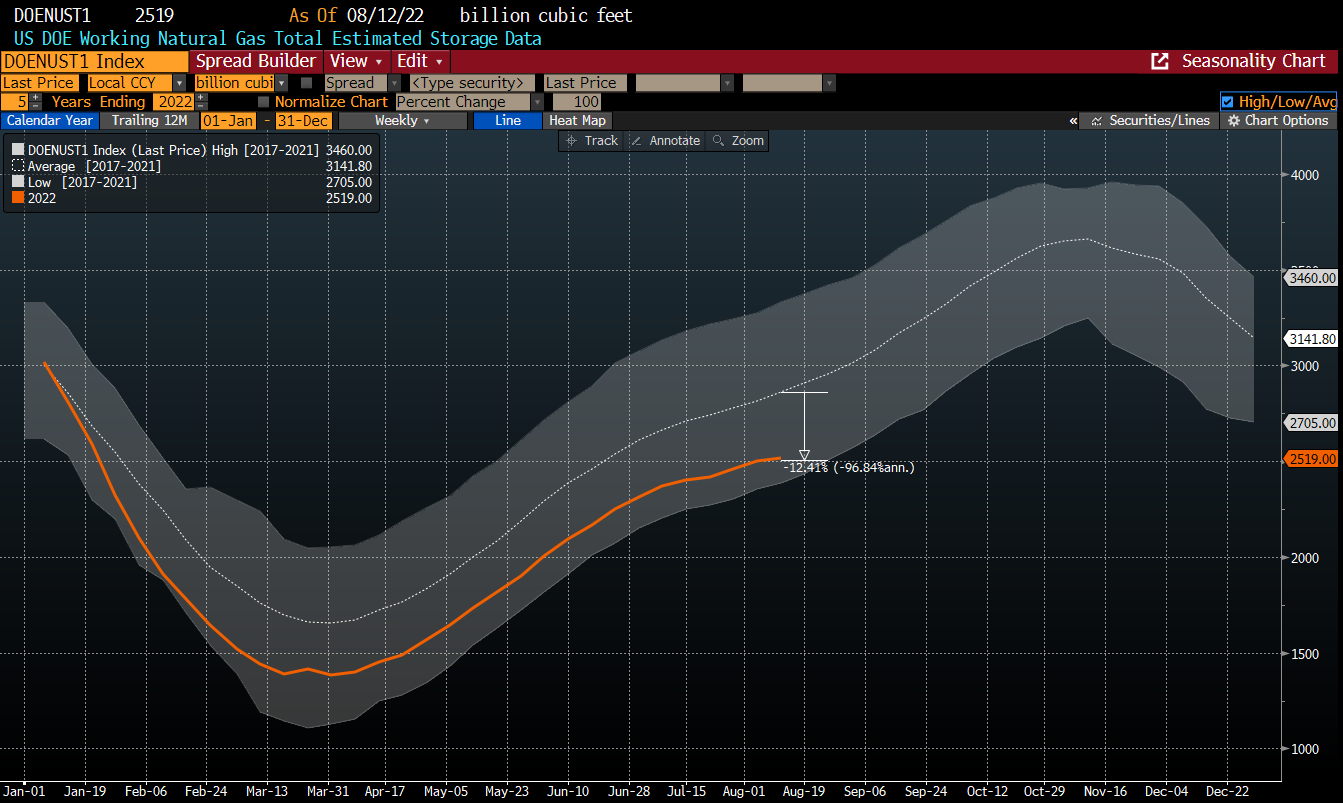

US natural gas stockpiles sit 12% below 5-year average and recent weekly builds were small than expected

European natural gas prices are around 8 times higher than US prices. Source: Bloomberg

European natural gas prices are around 8 times higher than US prices. Source: Bloomberg

European natural gas storage is more full now than it was at the peak point of whole-2021. Source: Bloomberg

European natural gas storage is more full now than it was at the peak point of whole-2021. Source: Bloomberg

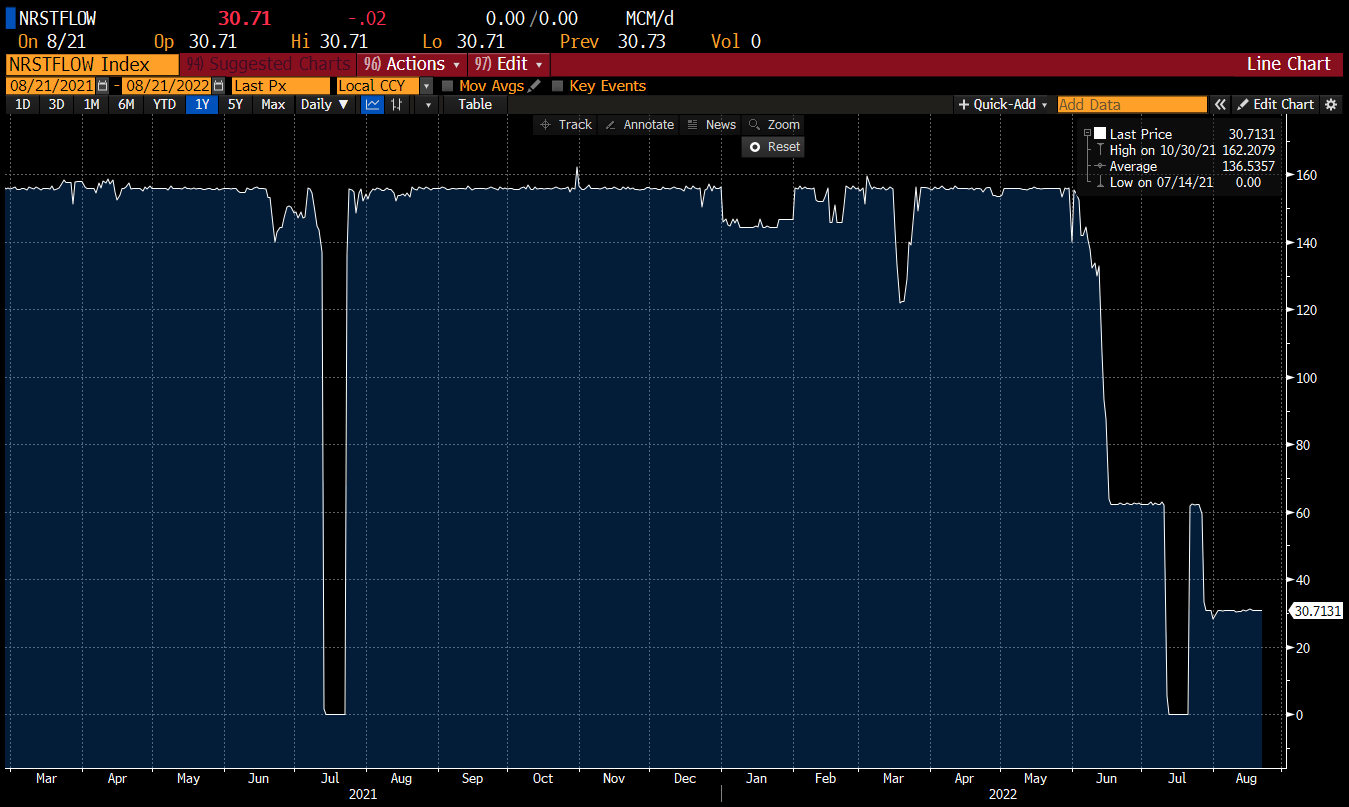

Russia sends extremely small volumes of natural gas via Nord Stream I pipeline. This means that even with current relatively high levels of storage, winter may be cold and expensive in Europe. Source: Bloomberg

Russia sends extremely small volumes of natural gas via Nord Stream I pipeline. This means that even with current relatively high levels of storage, winter may be cold and expensive in Europe. Source: Bloomberg

US natural gas storage sits around 12% below 5-year average. Such a shortfall cannot be offset ahead of the winter season given current fundamentals. Source: Bloomberg

US natural gas storage sits around 12% below 5-year average. Such a shortfall cannot be offset ahead of the winter season given current fundamentals. Source: Bloomberg

Gold

-

Metal prices remain under pressure amid strong US dollar and renewed pick-up in yields

-

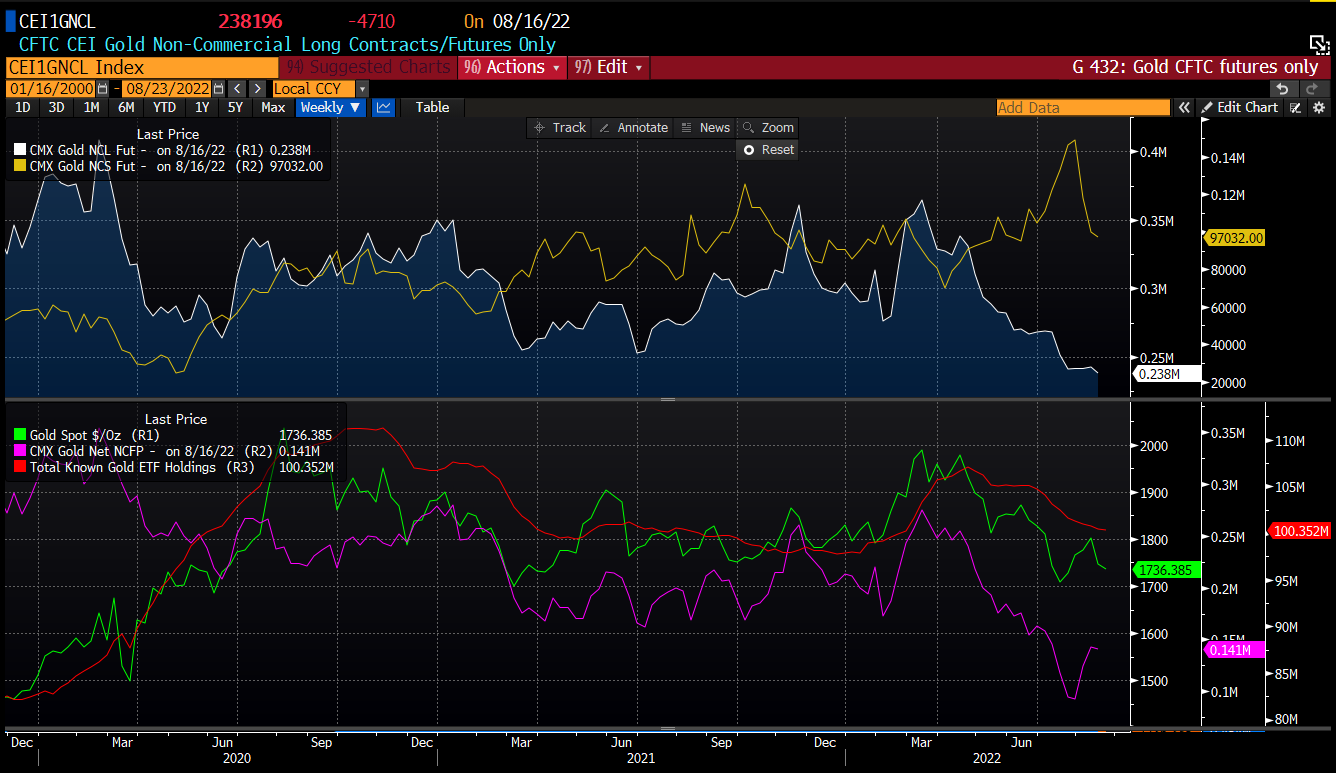

CFTC report pointed to a big reduction in the number of open short positions on gold in recent weeks

-

Copper-to-gold price ratio seems to be in-line with current levels of US yields

-

Should a so-called 'Fed-pivot' occur, yields may drops and provide some fuel for gold

Number of open short positions on gold dropped significantly in recent weeks. However, ETFs continue to sell gold holdings. Source: Bloomberg

Number of open short positions on gold dropped significantly in recent weeks. However, ETFs continue to sell gold holdings. Source: Bloomberg

Copper-to-gold price ratio (yellow line) looks to be priced in-line with fundamentals. Ratio sits where current yield levels suggest it should. In case of a 'Fed-pivot' yields would drop providing a boost for gold - this may push copper-to-gold price ratio towards 3.00 mark. Source: Bloomberg

Copper-to-gold price ratio (yellow line) looks to be priced in-line with fundamentals. Ratio sits where current yield levels suggest it should. In case of a 'Fed-pivot' yields would drop providing a boost for gold - this may push copper-to-gold price ratio towards 3.00 mark. Source: Bloomberg

CO2 Emissions (EMISS)

-

CO2 emission price have once again pulled back from the €99 area

-

European countries are attempting to offset lower natural gas supplies with increase energy production from coal and oil

-

This can be seen as a positive for emission prices as CO2 emission in case of energy production from coal and oil are higher than in case of natural gas

-

EMISS price gain in August were driven primarily by small number of auctions as well as repositioning of institutional investors

-

In theory, a some kind of stabilization may arrive in September but seasonal patterns hint that upward move should resume in December, when heating period starts and supply of emission contracts will once again be limited

EMISS prices saw a sharp reversal and a drop towards €80-85 area cannot be ruled out. Source: xStation5

EMISS prices saw a sharp reversal and a drop towards €80-85 area cannot be ruled out. Source: xStation5