Oil

-

Coronavirus vaccine could be an opportunity for oil prices. Quick approval of the vaccine could boost demand for oil via, for example, increased air traffic

-

On the other hand, this could also mean OPEC will not decide to halt tapering of oil cuts

-

Biden at the White House is mixed for oil - his infrastructure deal may boost demand but his policies may also mean return of Iranian supply to the markets. Apart from that, Biden will aim to boost share of "green" energy

-

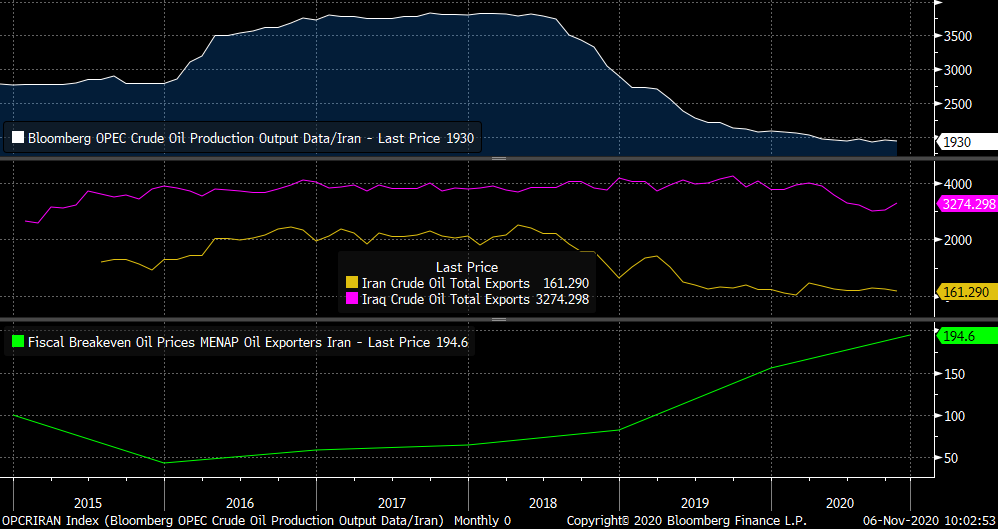

Returning Iranian output and exports could amount to 2 million barrels per day

-

Unit production cost in Iran sits at $15 per barrel. Currently budget break-even price is seen at $195 per barrel. Iran has the ability to quickly boost exports thanks to big amount of crude stored on tankers

Oil production in Iran (top chart) is at the lowest level in decades. Output decline below pre-nuclear deal levels following US sanctions. Exports (middle chart, yellow line) are extremely low. Exports sat at 2mbpd when the nuclear deal was in effect. Meanwhile, break-even price for Iranian budget is $195 per barrel. Source: Bloomberg

Oil production in Iran (top chart) is at the lowest level in decades. Output decline below pre-nuclear deal levels following US sanctions. Exports (middle chart, yellow line) are extremely low. Exports sat at 2mbpd when the nuclear deal was in effect. Meanwhile, break-even price for Iranian budget is $195 per barrel. Source: Bloomberg

Start investing today or test a free demo

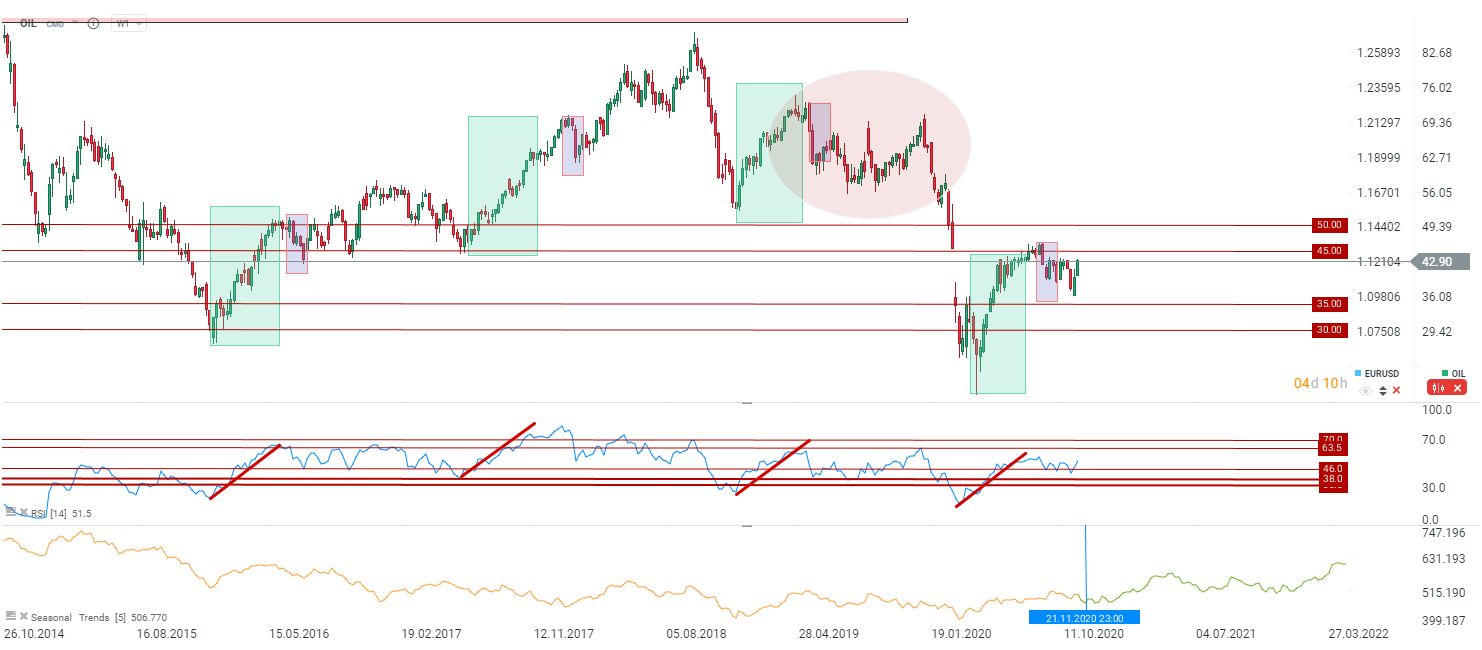

Open real account TRY DEMO Download mobile app Download mobile app Oil prices rallied on positive vaccine news. Nevertheless, in case demand recovery stalls in the next couple of months, prices may be set to experience similar consolidation to the one from the second half of 2019 (marked with red on the chart above). Source: xStation5

Oil prices rallied on positive vaccine news. Nevertheless, in case demand recovery stalls in the next couple of months, prices may be set to experience similar consolidation to the one from the second half of 2019 (marked with red on the chart above). Source: xStation5

Natural Gas

-

Natural gas looks strongly overbought by speculators. Situation is related to previous forecasts and expectations of high gas consumption

-

Natural gas stockpiles dropped slightly below 5-year range for a given period

-

Decline in the natural gas stockpiles is currently bigger than 5-year range - further decline will be a warning signal for sellers

-

Current weather forecasts project temperatures equal or higher than average, leading to lower gas consumption

-

Coronavirus vaccine could lead to rebound in prices. However, one should keep in mind that the natural gas market is driven by short-term factors

-

Natural gas futures will roll over next week but scale is likely to be smaller than last month

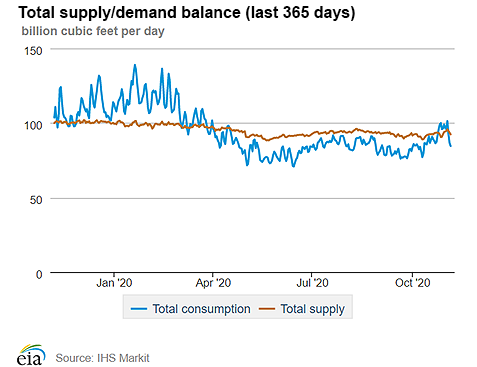

Natural gas consumption dropped below daily available supply hinting that stockpiles may start to increase soon. Source: EIA, IHS Markit

Natural gas consumption dropped below daily available supply hinting that stockpiles may start to increase soon. Source: EIA, IHS Markit

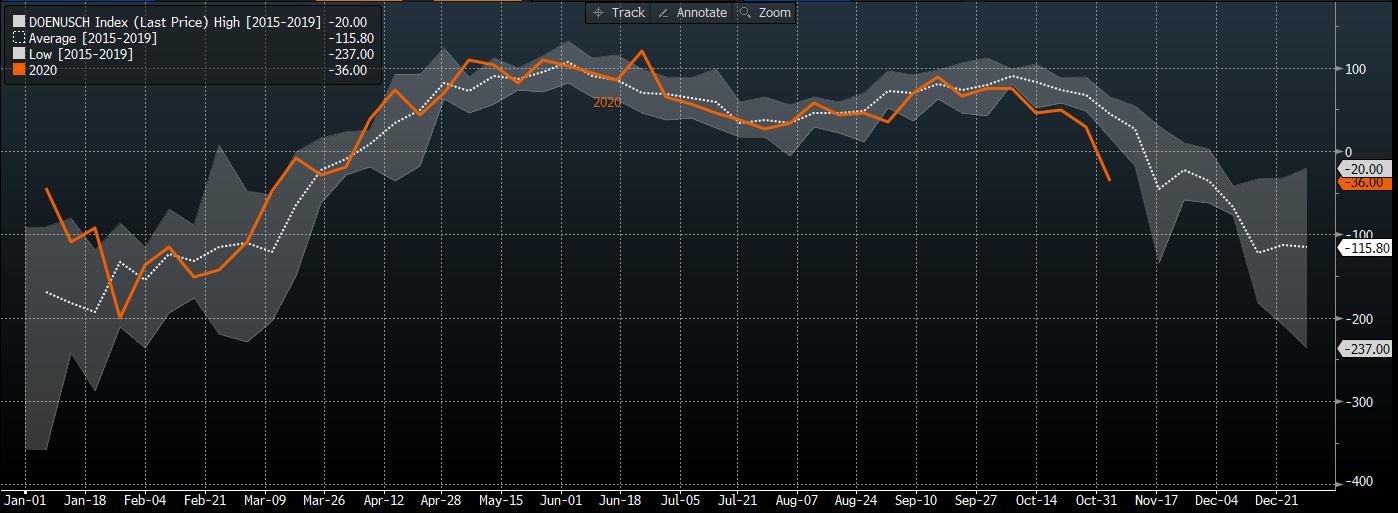

Decline in the natural gas stockpiles is larger than the 5-year range. However, recent drop in demand should reverse this trend. Situation should support further price declines. Source: Bloomberg

Decline in the natural gas stockpiles is larger than the 5-year range. However, recent drop in demand should reverse this trend. Situation should support further price declines. Source: Bloomberg

In theory, natural gas prices should be past their seasonal peak already, what coincides with extreme positioning. Traders should keep in mind that futures will roll over next week producing a 10-20 cent price gap. Source: xStation5

In theory, natural gas prices should be past their seasonal peak already, what coincides with extreme positioning. Traders should keep in mind that futures will roll over next week producing a 10-20 cent price gap. Source: xStation5

Coffee

-

Coffee prices rebounds on the back of vaccine optimism - demand recovery thanks to potential reopening of bars and restaurants

-

Additionally, USD weakness supports declines on the USDBRL currency pair

-

On the other hand, coffee stockpiles continue to rebound hinting that market is coping with significant supply

Recent price moves on the coffee market are mostly driven by the US dollar. Source: xStation5

Recent price moves on the coffee market are mostly driven by the US dollar. Source: xStation5

Coffee inventories are rebound, what may serve as a break for the coffee price rebound. Should the situation continue, reversal on the coffee market and a move towards 100 cents per pound cannot be ruled out. Source: Bloomberg

Coffee inventories are rebound, what may serve as a break for the coffee price rebound. Should the situation continue, reversal on the coffee market and a move towards 100 cents per pound cannot be ruled out. Source: Bloomberg

Gold

-

Gold with positive reaction to Biden win - USD drops

-

On the other hand, rising yields could be a hurdle for gold - Biden win means big increase in debt while Pfizer vaccine could significantly reduce risks and uncertainty

-

Gold price with positive reaction to $1,850 support

-

Long-term outlook remains driven by weak USD and extensive monetary policy easing by Fed, ECB and other central banks

Gold price remains stuck in consolidation range. We expect that such a situation may continue in the coming weeks. Seasonal price jump should take place in the December-January period. Source: xStation5

Gold price remains stuck in consolidation range. We expect that such a situation may continue in the coming weeks. Seasonal price jump should take place in the December-January period. Source: xStation5