Oil

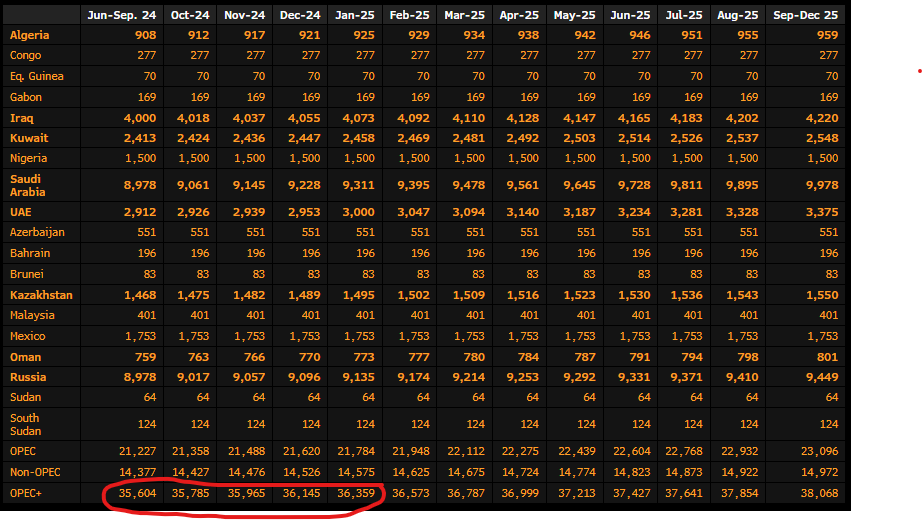

- OPEC+ extends major oil production cut of 3.66 million barrels per day until end of 2025 (previously until end of 2024)

- OPEC+ extends voluntary production cuts until the end of September this year, then plans to increase production until September next year

- The United Arab Emirates is set to raise its main production limit by 300,000 barrels per day next year but will still be able to continue voluntary cuts

- Countries that produce above their production limits have committed to increasing compliance. However, there are no official records regarding this process

- Saudi Arabia has begun selling shares of Saudi Aramco and intends to raise about $12 billion from the market

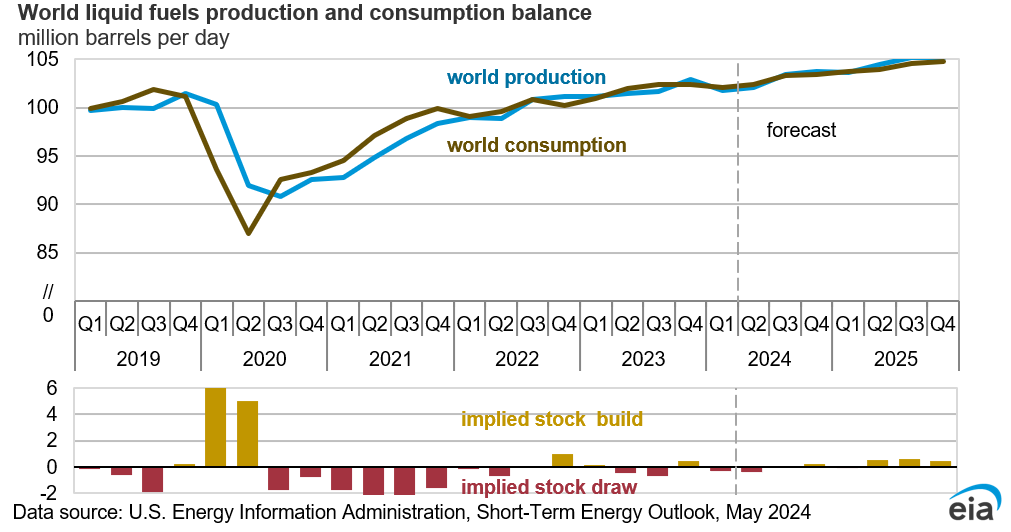

- The market fears that an increase in supply from OPEC+ countries may lead to a surplus by the end of the year. Furthermore, OPEC's expectations for demand growth this year are significantly higher than those of the EIA or IEA

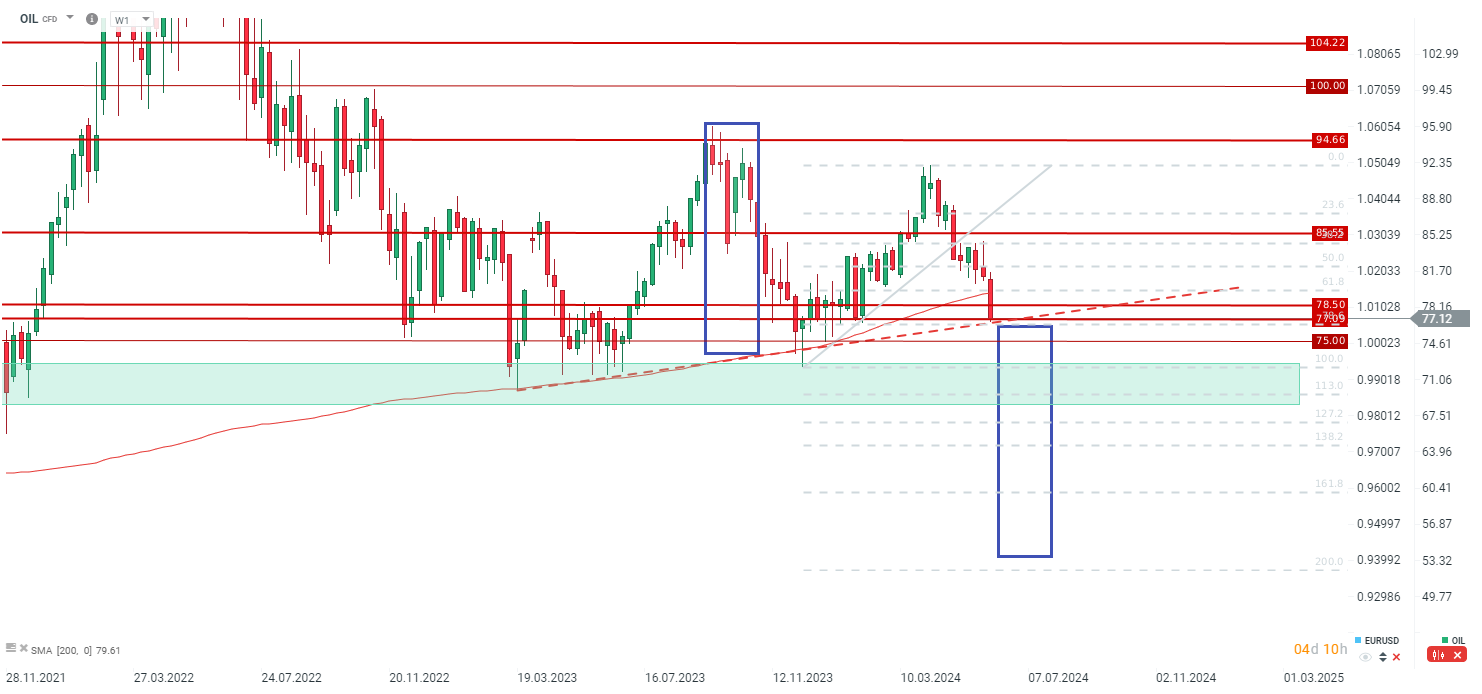

- Oil has already seen a 5% drop since OPEC+'s decision was announced, indicating that the market had entirely different expectations regarding OPEC's decision. However, this decision may still change depending on the price situation. Saudi Arabia needs oil at around $80 to balance the budget and even up to $100 to continue further expansive investments.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appThe OPEC+ plan involves a significant increase in supply from October to January next year. This factor was crucial in the clear drop in prices. Source: Bloomberg Finance LP

The latest EIA report shows a slight surplus in the third and fourth quarters of this year. Although in the third quarter, given OPEC+'s decision, we should experience a balance or a slight deficit, a substantial surplus is possible in the fourth quarter. Source: EIA

Brent oil saw a 5% price drop following OPEC+'s decision. Currently, important support levels are being tested around $77 per barrel, the 78.6% retracement of the last downward wave, and the upward trend line, which is also the neckline of the head and shoulders formation. The next important support level is around $69-72 per barrel. Source: Bloomberg Finance LP, XTB

Natural Gas

- European gas prices rebound over 10% at the start of this week amid production issues in Norway

- TTF gas prices reached 38 EUR/MWh. However, prices then retreated to around 35 EUR/MWh.

- Simultaneously, data shows that gas demand in Europe in 2023 was the lowest in 15 years. After abandoning Russian gas, Norway became the main supplier of gas to Europe, with a share of over 30%

- Nonetheless, LNG gas from the United States has significantly increased in importance, so rising prices in the USa can also be associated with higher gas prices in Europe this year

- Storage facilities in Europe are about 70% full before the cooling and heating season, indicating that there should be no concerns about a shortage of raw material for the next season either

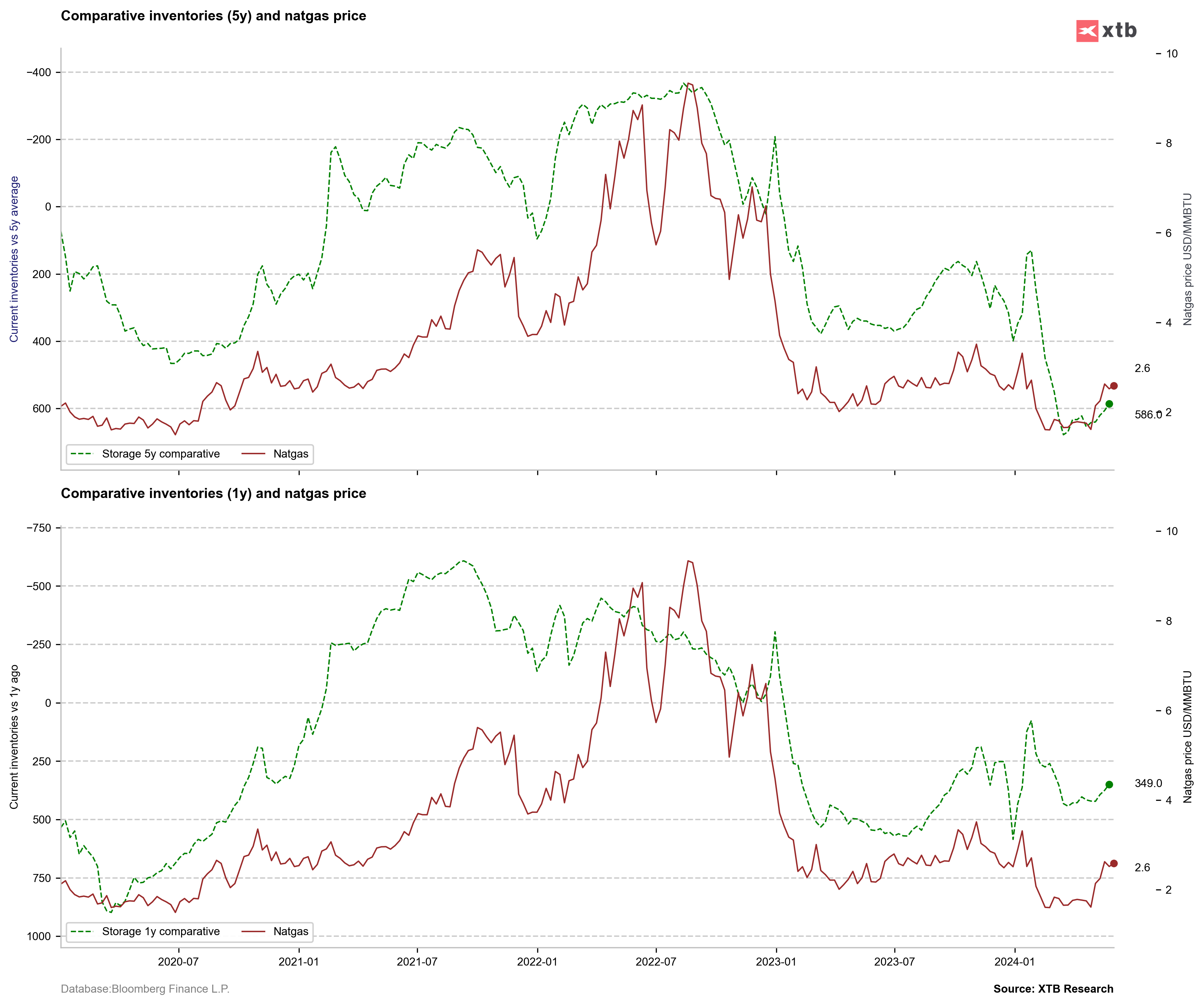

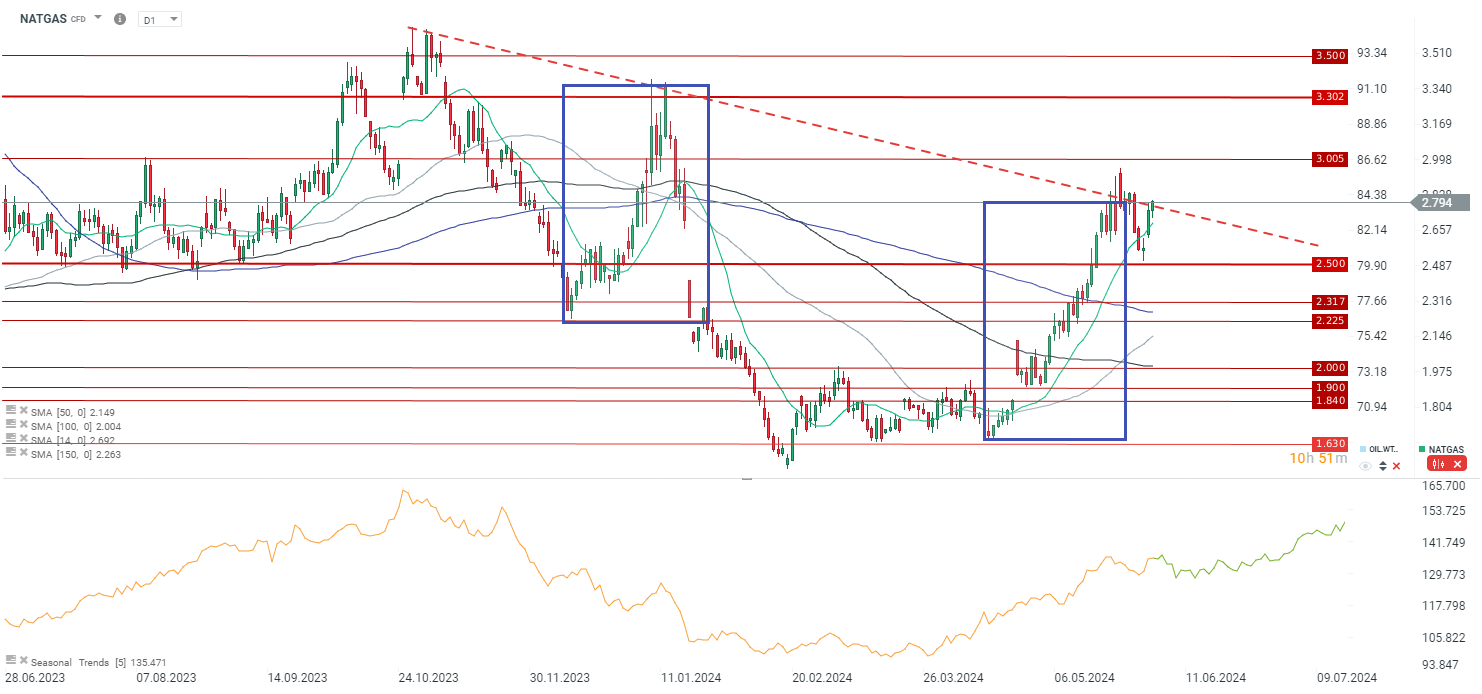

- Looking at the seasonality of US gas prices, we potentially find ourselves around the seasonal peak

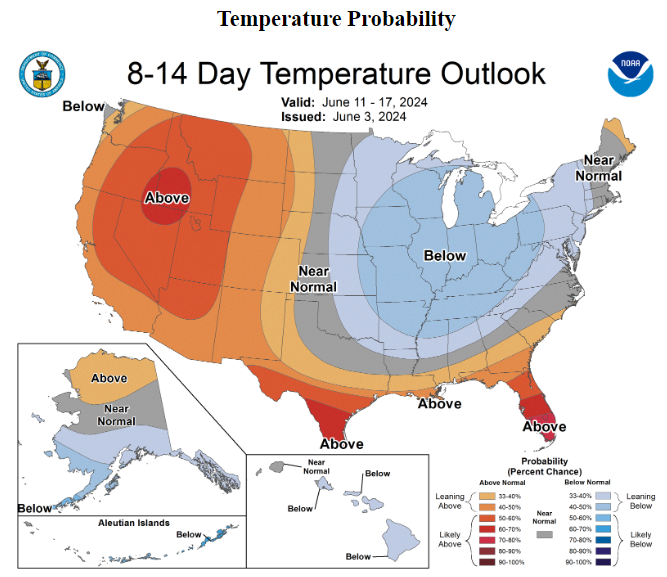

- Weather in the US shows significantly lower-than-standard temperatures in the central states and higher in the west. However, most people in the US live in the Midwest, the East Coast, and California. Therefore, gas consumption for cooling needs may be limited over the next two weeks

Natural gas reserves in the US are still very high, but comparative reserves are starting to decline. This can provide clear support during the period of excessive gas consumption, which falls in the second half of July and the first half of August. Source: Bloomberg Finance LP, XTB

Weather forecasts in the US for the next two weeks show lower temperatures in the Midwest and East Coast. Source: NOAA

Gas prices rebounded from the 14-period moving average, which is a rather positive signal. On the other hand, seasonality indicates that prices may fall in the upcoming sessions. Source: xStation5

Cocoa

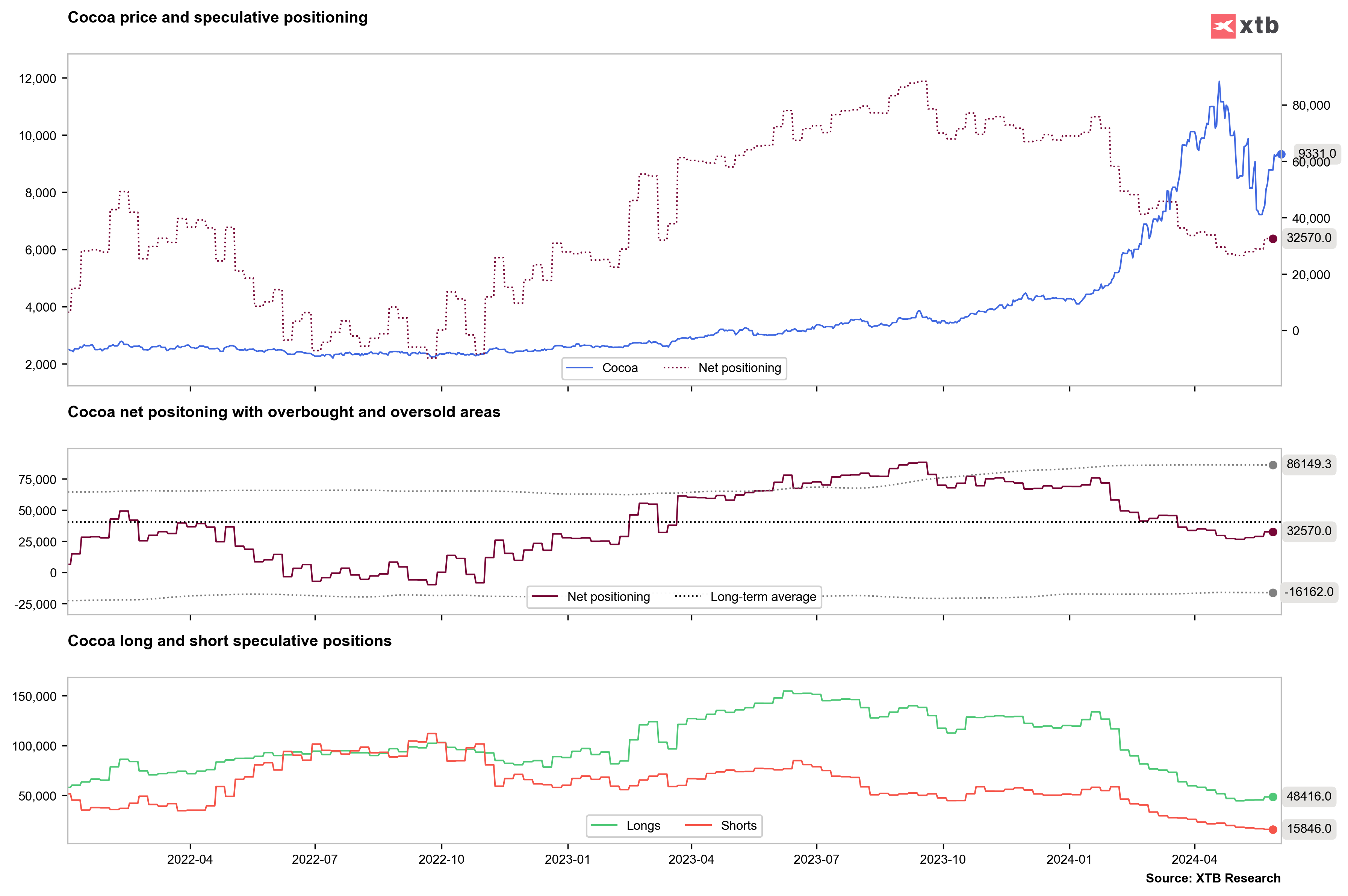

- Funds increase long positions but continue to reduce short positions

- Deliveries at ports remain about 30% lower than in the same period last year

- A decrease in rainfall in recent days may lead to a decline in the quality of cocoa beans harvested during the mid-season, which lasts from April to July

- In the latest ICCO report, the forecasted deficit has been increased. Cocoa production is expected to decrease by 11.7% year-on-year to 4.461 million tons, while processing is expected to drop by 4.3% year-on-year to 4.855 million barrels per day

- Cocoa stocks tracked by ICE continue to decline. At this rate, stocks will reach the December 2020 low this year, likely before the main production season starts in October. Continued stock declines may pressure prices to remain above $7,000 until the main season starts in October

Long positions in cocoa are rebounding, although it's a small rebound at the moment. Source: Bloomberg Finance LP, XTB

The price tests $10,000 per ton, forming a potential shooting star pattern. A pullback below $8,800 could lead to a test around $8,000. Source: xStation5

Sugar

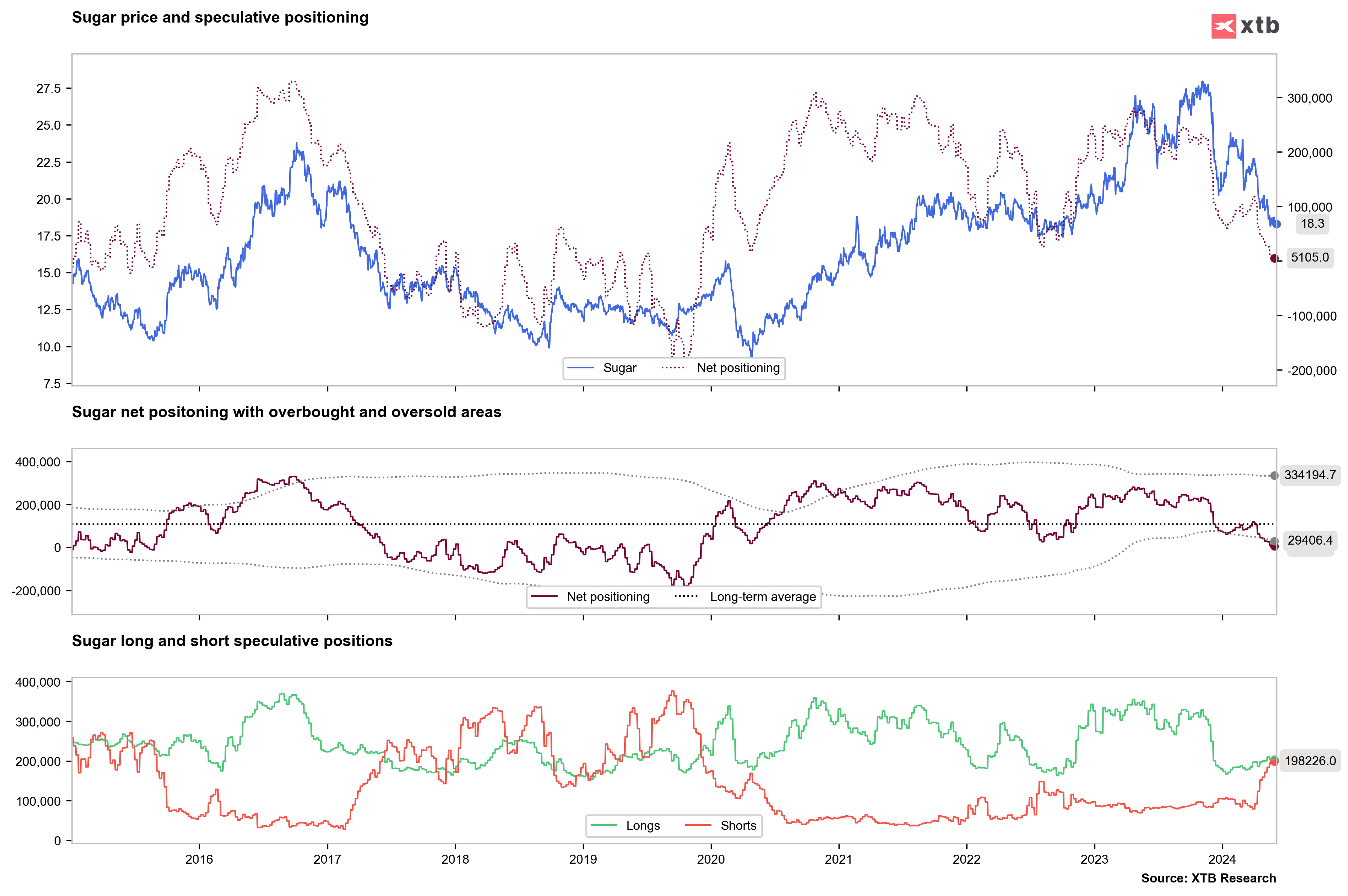

- Due to a significant increase in short positions, we observe a balance between long and short positions for the first time since 2020

- The current sharp rise in short positions is reminiscent of the situation in 2017. Back then, the price entered a consolidation phase but resumed to declines in 2018

- Production in May in Brazil is slightly lower than expected, which has provided support for prices after recent declines. On the other hand, dealers point to a significant expected rebound in Brazilian exports in the coming months due to high harvests

- High production is also occurring in European Union countries

Positioning in sugar shows that we have the first balance of speculators since 2020. If speculators continue to increase short positions, there is a chance for prices to fall to around 16-17 cents per pound. Source: Bloomberg Finance LP, XTB

The decline in oil prices is also a negative factor for sugar prices due to reduced demand for biofuel production from sugarcane. Source: xStation5