Oil

-

Oil recovered a big part of recent losses. However, the lower limit of the December-February trading range may now act as the upper limit of a new trading range

-

Drop in prices was driven by broad market concerns following collapse of US and European banks

-

Trend on the oil market remains bearish. Brent would need to break above $82-86 area for a trend reversal to occur

-

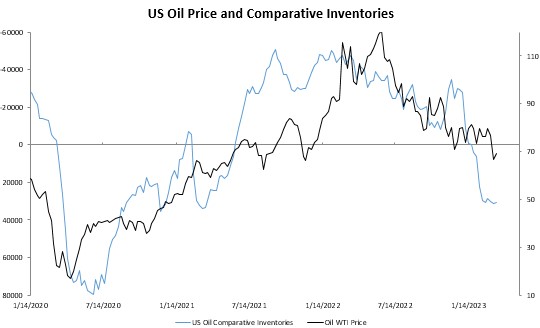

Comparative inventories (1-year nominal change in inventory level) remain relatively high (inverted axis on the chart below). On the other hand, pace of increases have slowed in recent weeks

-

Financial institutions are maintaining relatively forecasts for average oil price in 2023 ($80-90 per barrel)

-

OPEC+ did not react to a recent plunge in crude prices. On the other hand, comparing number of active oil drilling rigs in the United States and US oil production shows that output peak may be nearing

-

Russia expects its oil and gas production to drop in 2023 compared to 2022 levels

-

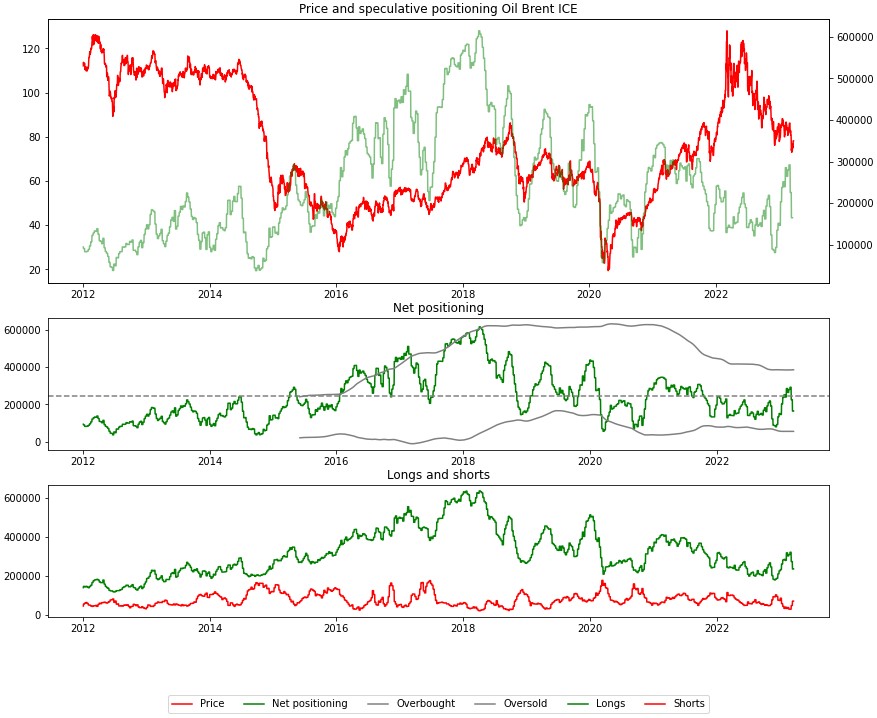

Data on positioning shows a very bearish sentiment recently - extremely low on WTI and drop in positioning on Brent

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appComparative inventories are suggesting that further drop is possible but stabilization of stockpiles cannot be ruled out either. Source: Bloomberg, XTB

Number of active oil drilling rigs in the United States suggests that oil output peak may be near (4-month lead in data). Source: Bloomberg, XTB

Oil recovered significantly but currently struggles to break above the lower limit of a previously broken trading range. Source: xStation5

Oil recovered significantly but currently struggles to break above the lower limit of a previously broken trading range. Source: xStation5

Speculative positioning on WTI is showing extremely bearish sentiment among investors. Net positioning is at the lowest level since April 2016. Source: Bloomberg, XTB

Speculative positioning on Brent at ICE exchange drop noticeably as well. Source: Bloomberg, XTB

Speculative positioning on Brent at ICE exchange drop noticeably as well. Source: Bloomberg, XTB

Gold

-

Gold benefited from a drop in US yields. However ,sellers appear as precious metal neared $2,000 per ounce

-

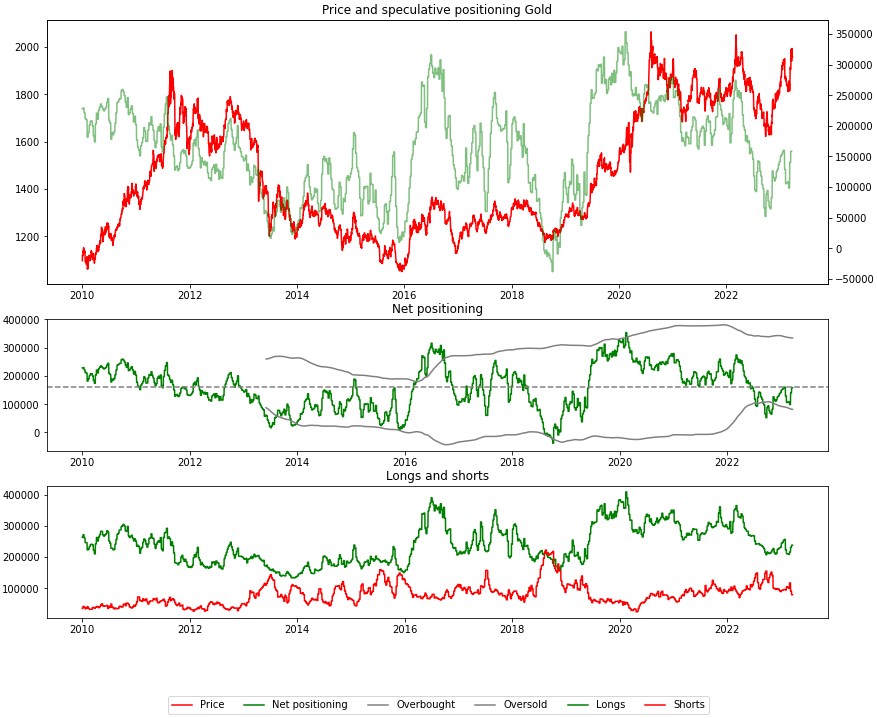

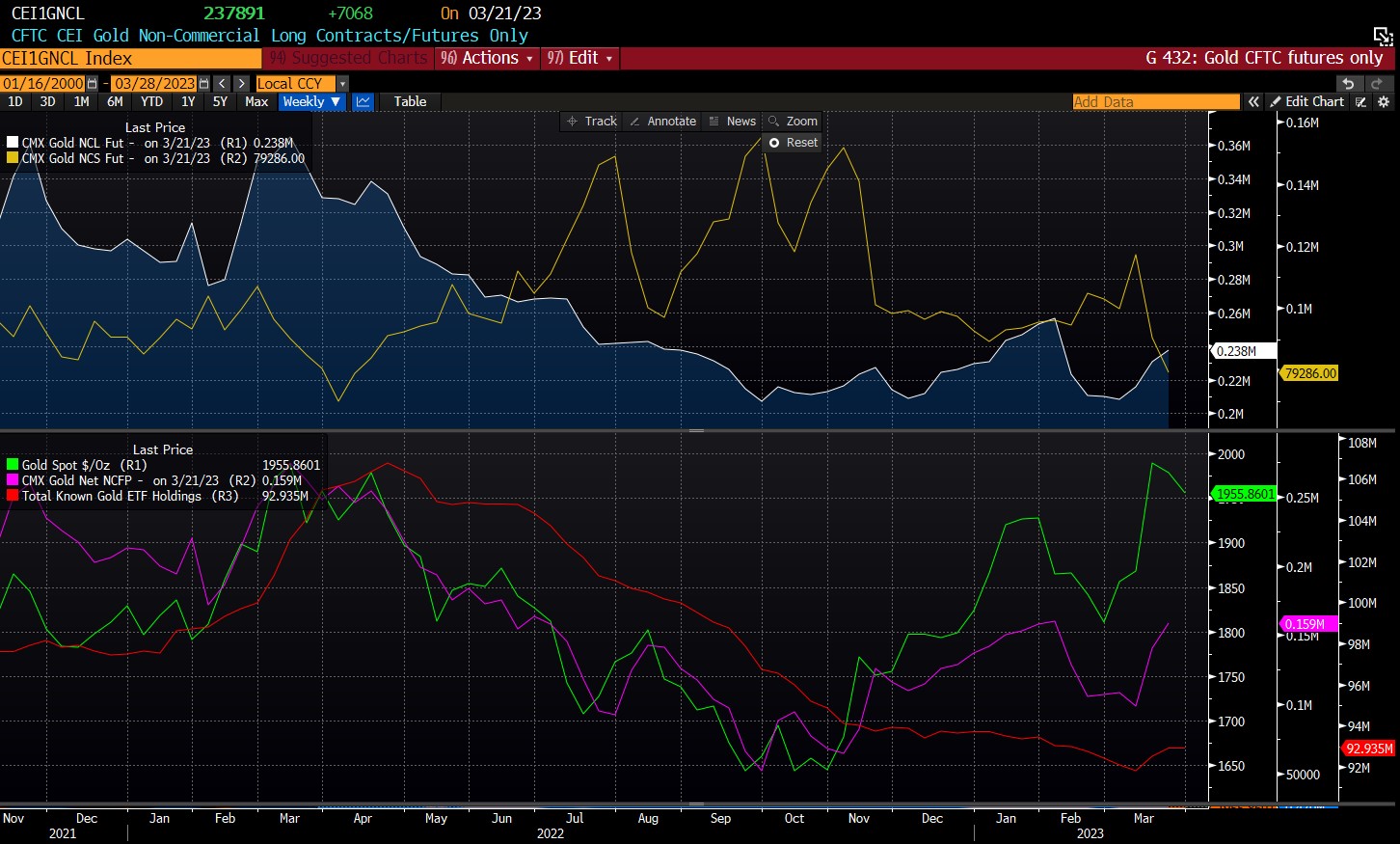

Positioning data shows a significant shift in investors' attitude - number of short positions has been reduced significantly. While the move could be driven by search for liquidity, number of open long positions climbed simultaneously

-

ETF gold holdings rebounded significantly. Gold may enjoy further gains should we see a more lasting change in ETF purchases trends

Speculative positioning on gold jumped significantly. Source: Bloomberg, XTB

ETF gold holdings also jumped noticeably. Source: Bloomberg, XTB

ETF gold holdings also jumped noticeably. Source: Bloomberg, XTB

GOLD is testing $1,950 per ounce area. Key demand zone can be found ranging between $1,915 and $1,940 per ounce. Source: xStation5

GOLD is testing $1,950 per ounce area. Key demand zone can be found ranging between $1,915 and $1,940 per ounce. Source: xStation5

Natural Gas

-

US natural gas prices (futures for April delivery) are testing $2,00 per MMBTu area

-

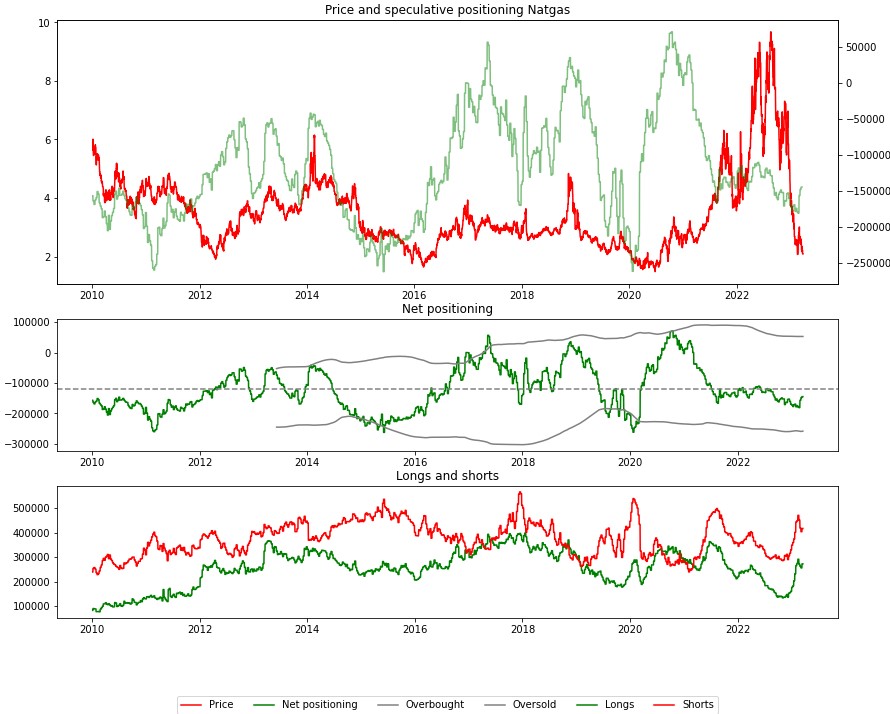

Speculative positioning on natural gas is recovering before extremely low levels have been reached

-

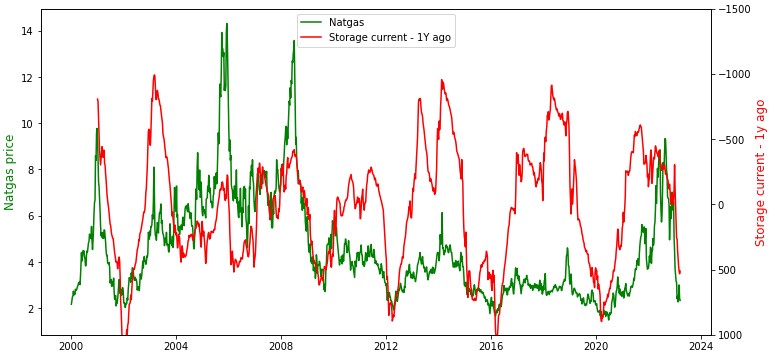

Comparative gas inventories are relatively high but contrarian signal is still some time away (inventories should be 800-1000 bcf above last year's levels)

-

Weather forecasts for the United States for the next two weeks point to warmer than average temperatures in southern and eastern states

-

Contango on the natural gas market deepened over the past month, signaling that short-term demand remains weakish

Speculative positioning on natural gas is rebounding, although not from extremely low levels, therefore it is too early to speak about contrarian signals. Source: Bloomberg, XTB

Speculative positioning on natural gas is rebounding, although not from extremely low levels, therefore it is too early to speak about contrarian signals. Source: Bloomberg, XTB

Comparative natural gas stockpiles are pointing to a significant oversupply compared to a year ago but it is not extreme yet. Source: Bloomberg, XTB

Comparative natural gas stockpiles are pointing to a significant oversupply compared to a year ago but it is not extreme yet. Source: Bloomberg, XTB

Copper

-

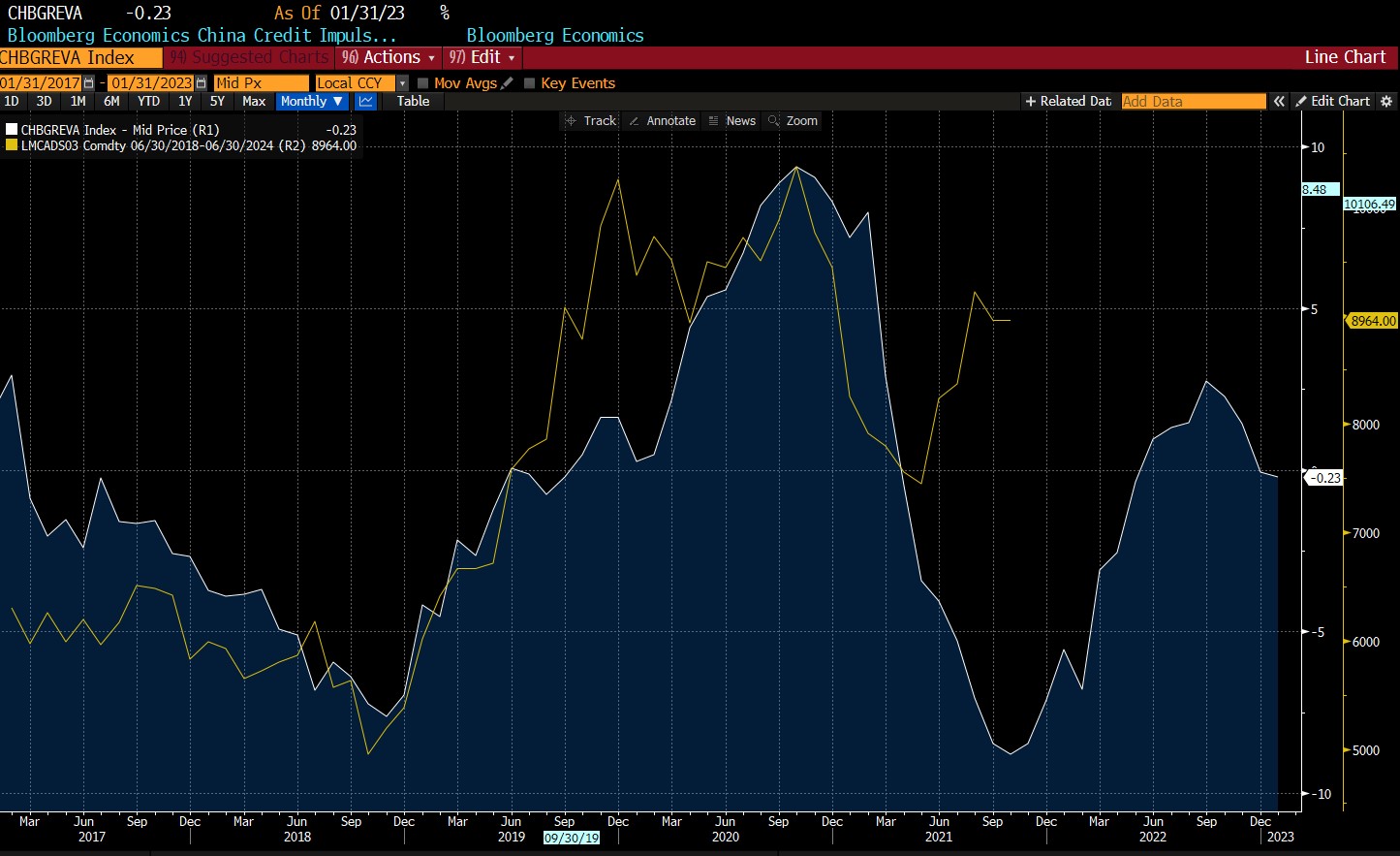

Current credit impulse is the weakest since 2006-2006 but back then copper prices rallied from $4,000 to $8,000 per tonne

-

Current credit impulse was also launched from very low levels with copper price jumping from $7,500 to $9,250 per tonne (12-month lead for credit impulse)

-

Taking a look at 18-month lead for credit impulse, current positive impact may yet to be seen. 18-month leading data is better aligned with changes in copper prices than 12-month lead over the past 20 years

-

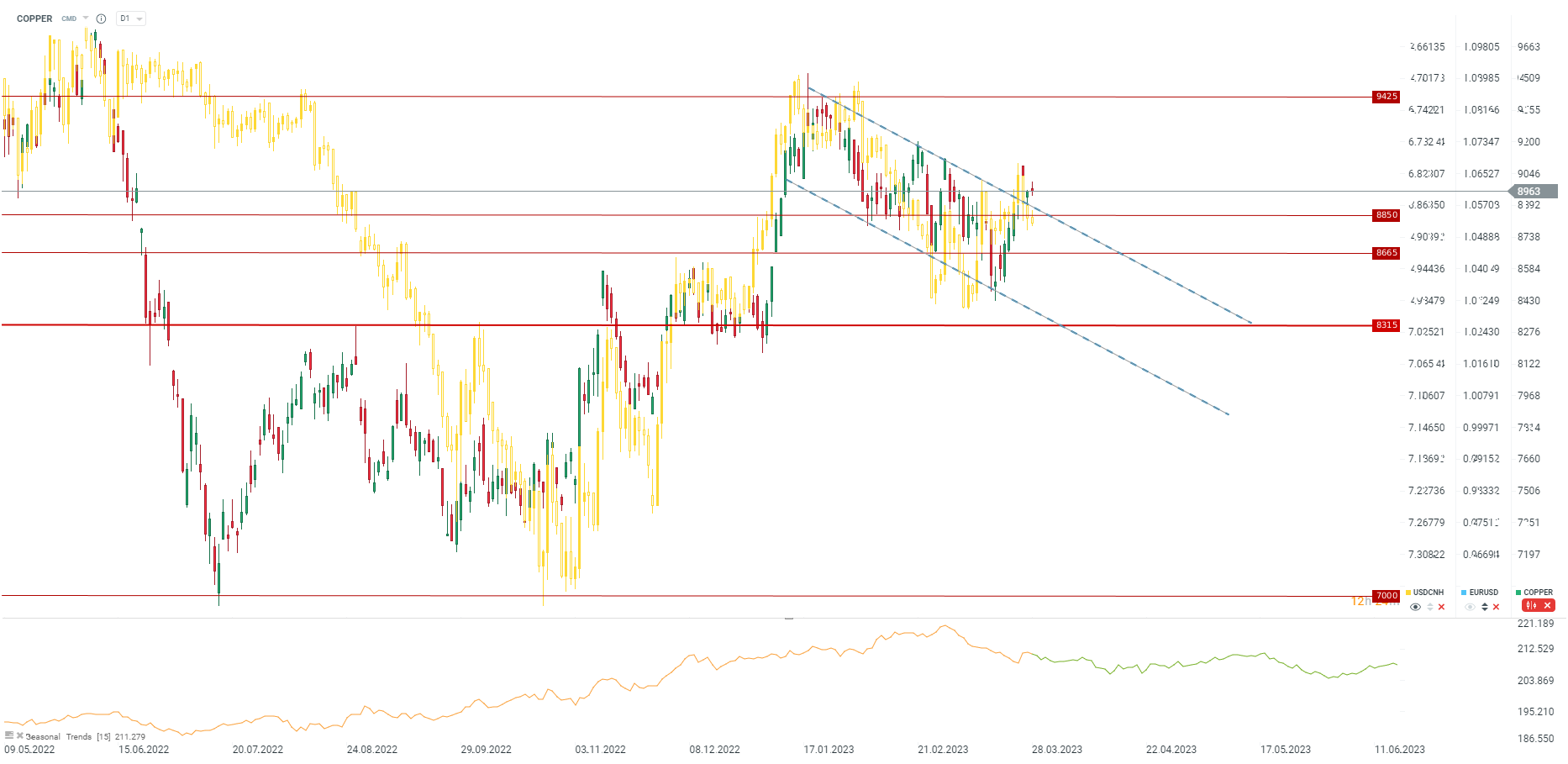

Chinese yuan is also rebounding what may motivate further price increases

-

Copper stockpiles remain at relatively low levels

-

Copper should have an upbeat long-term outlook thanks to potential for a limited supply going forward as well as strong outlook for demand from automotive sector and "green transformation"

18-month leading Chinese credit impulse data shows that price may be painting a local low now before the rally begins. On the other hand, the current recovery in credit impulse was a smaller recovery in the 2005-2006 period. Source: Bloomberg

18-month leading Chinese credit impulse data shows that price may be painting a local low now before the rally begins. On the other hand, the current recovery in credit impulse was a smaller recovery in the 2005-2006 period. Source: Bloomberg

Copper price continues to trade in tandem with the Chinese yuan. Soure: xStation5

Copper price continues to trade in tandem with the Chinese yuan. Soure: xStation5

Taking a look at different metrics of seasonality we do not see strong case for it on the copper market. Copper prices are more reliant on business or credit cycles, rather than calendar cycles. Source: Bloomberg, XTB