Oil

-

Supply disruptions in Libya and Kazakhstan were resolved

-

Saudi Arabia lowers exports prices for Asia by $1.0-1.3 per barrel

-

Lowering of prices may mean that there is not enough demand to absorb recent OPEC+ supply increases

-

Omicron remains a significant source of uncertainty for oil demand. However, pandemic situation in Asia looks stable compared to Europe or North America

-

Rumours surfaced saying that Saudi Arabia, and potentially Iraq and UAE, are the only oil producers able to consistently boost output each month

-

Russia kept its production unchanged in December, in spite of higher allowances from OPEC+ agreement. It may suggest that Russia also struggles to bring back more production

-

Goldman Sachs remains bullish on commodity markets and says that a major bull market began in 2020/21. Bank expects bull run on commodities to last few years even in spite of central banks' policy tightening

-

Speculative positioning on the commodity markets remain at low levels, flashing a potential contrarian signal

-

Goldman Sachs claims that Saudi Arabia and UAE are the only countries able to boost production compared to January 2020 levels

-

GS forecasted $85 per barrel in Q1 2022 under assumption that supply from Iran returns to market. However, it looks highly unlikely for now

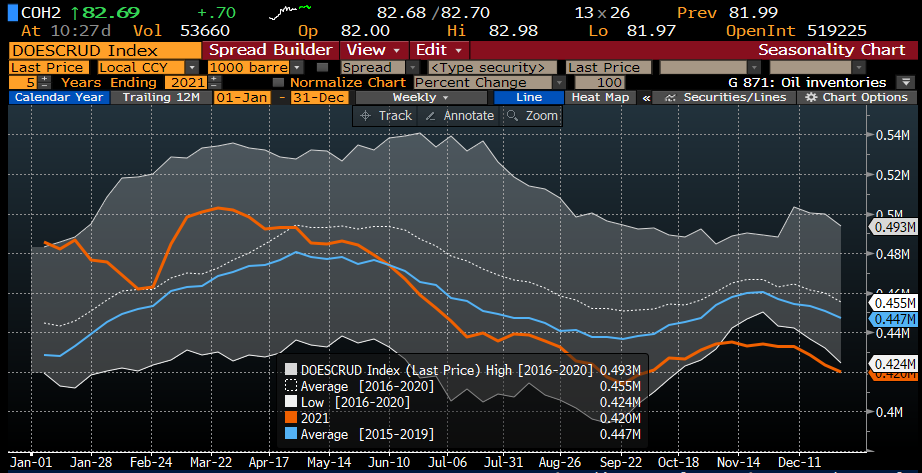

US oil inventories finished the year below 5-year seasonal lows. Source: Bloomberg

US oil inventories finished the year below 5-year seasonal lows. Source: Bloomberg

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app OPEC production increases are slowing. Only 2 cartel members have bigger production potential than in pre-pandemic times, which suggests that supply is unlikely to return to 30 million barrels per day this year. Source: Bloomberg

OPEC production increases are slowing. Only 2 cartel members have bigger production potential than in pre-pandemic times, which suggests that supply is unlikely to return to 30 million barrels per day this year. Source: Bloomberg

Gold

-

US yields sit at the highest level since March 2021

-

FOMC minutes suggest that US policy tightening may be quicker and more decisive

-

MInutes suggested that Fed is aware it was late with decision to begin policy normalization

-

Strong US jobs market allows Fed to focus more on price stability mandate

-

Gold price is about to book the deepest weekly drop since November

-

However, it should be noted that first rate hike in a cycle was a reversal point for gold price in the past

-

Gold holdings at central banks dropped in November for the first time in 11 months (-21.2 tonnes). Turkey, Russia, Kyrgyzstan and Uzbekistan sold gold holdings while Kazakstan, Poland, India and Ireland increased gold holdings

-

The World Gold Council points out that central banks remained net buyers of gold in 2021. However, net purchases were not as big as in 2020

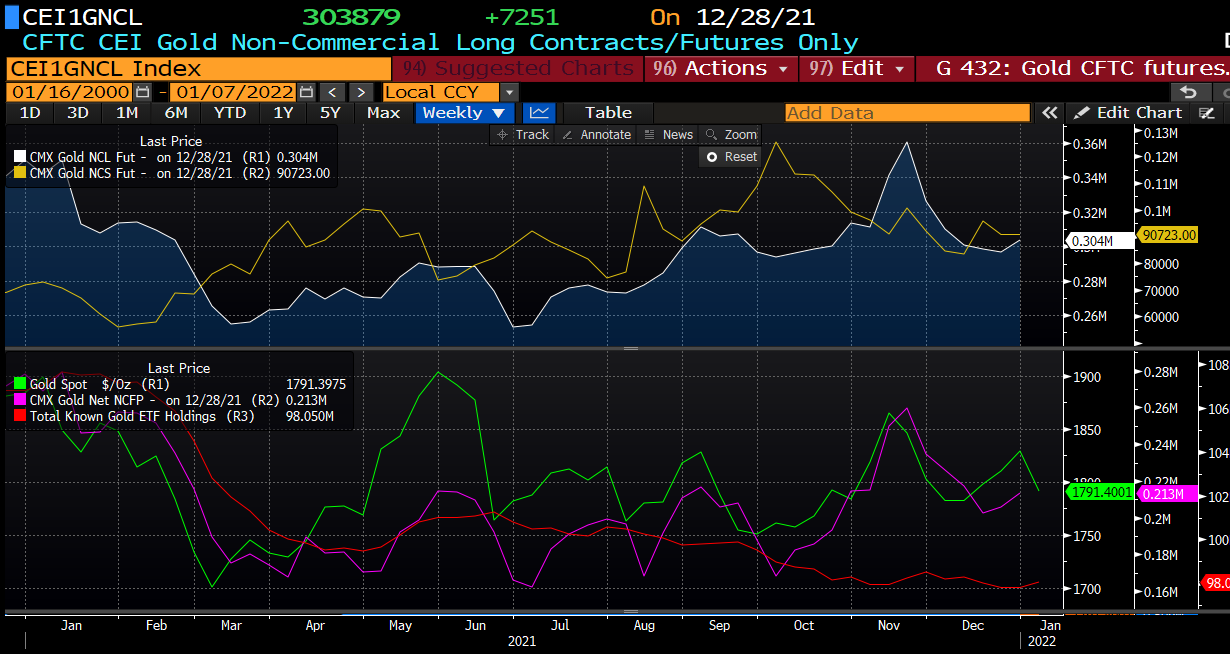

Activity of ETFs on the gold market was limited in recent weeks but the beginning of a new year brought some purchases. Activity of speculators on the futures market is also limited. Source: Bloomberg

Activity of ETFs on the gold market was limited in recent weeks but the beginning of a new year brought some purchases. Activity of speculators on the futures market is also limited. Source: Bloomberg

Gold tests key support at $1,790 per ounce. However, US yields justify lower price levels for gold. Source: xStation5

Gold tests key support at $1,790 per ounce. However, US yields justify lower price levels for gold. Source: xStation5