Oil:

- Geopolitical tensions near the Red Sea are pushing up oil market prices

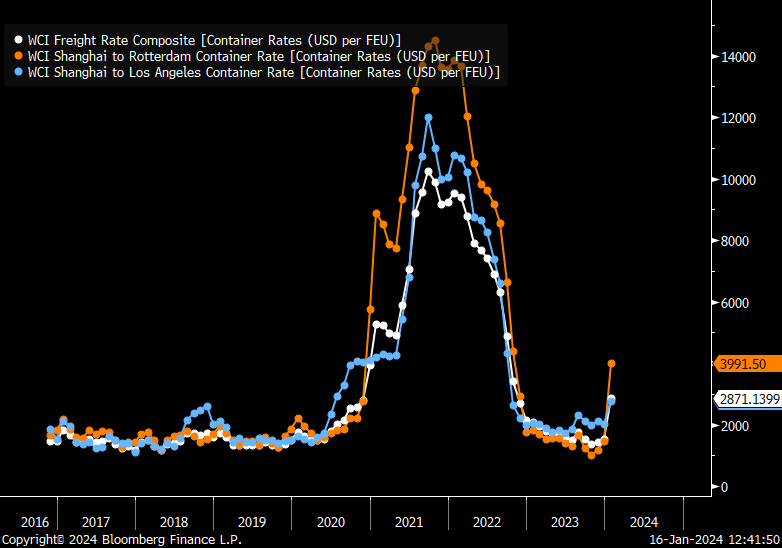

- Rates for transporting goods from Asia to Europe are rising significantly, although at the same time these levels are much lower than in 2021 and 2022

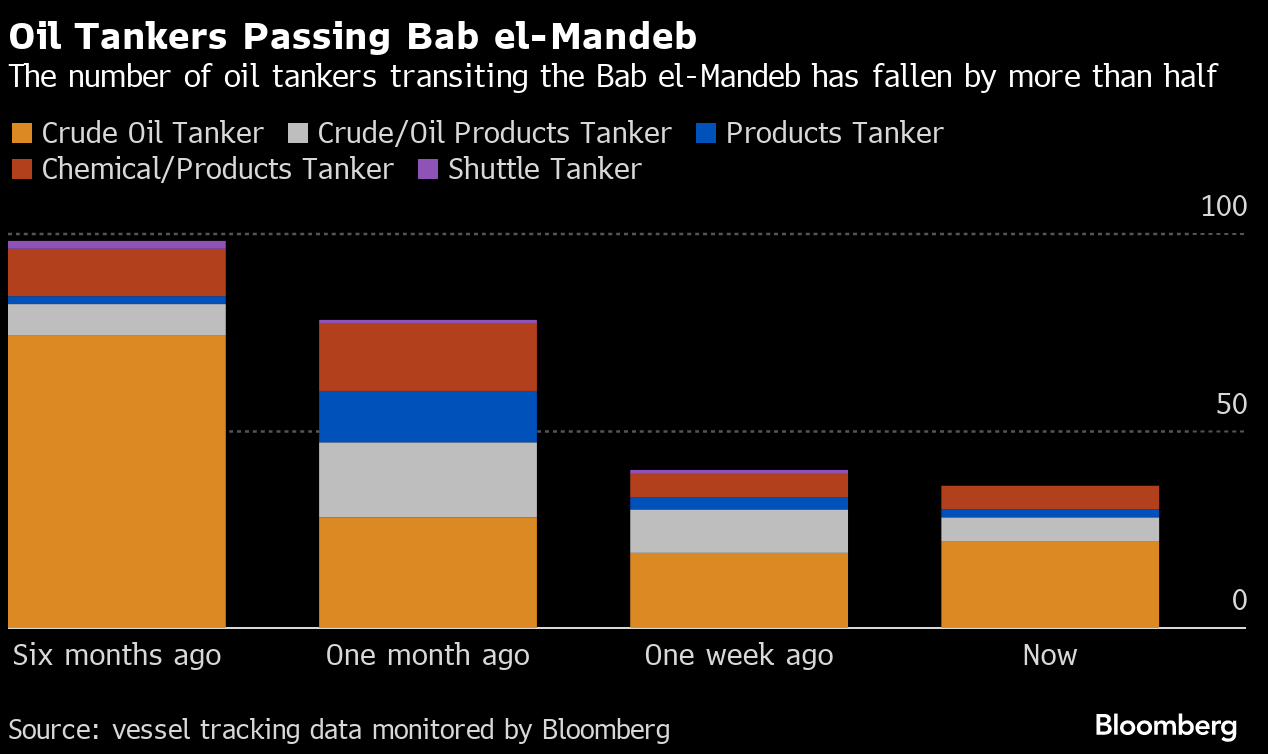

- The number of tankers crossing the Red Sea has halved compared to the number a month ago and even by 2/3 looking at the situation 6 months ago. This is partly the result of reduced exports from OPEC+, but in large part a situation related to Houthi attacks on merchant ships

- It is worth remembering, however, that tankers are taking a longer route, rather than a reduction in overall market supply. Indications are that the length of transportation by another route has increased by about 10 days and 3,000 nautical miles

- OPEC+ has implemented additional voluntary production cuts since the beginning of January, which could affect the deficit in the first quarter of this year

- OPEC+ is expected to extend the additional cuts into the second quarter of this year, but is likely to reduce or abandon them for the third quarter, which is usually characterized by the highest demand

- Citi indicates that tensions in the Middle East and balancing the market in Q1 will justify a Brent oil price of $80 per barrel

- Citi indicates that a greater escalation of the conflict between the US and Houthi is not the base scenario. At the same time, Citi stresses that a greater cause for concern is the involvement of Iran and Hezbollah in the situation in the Middle East

Freight rates are rising. Source: Bloomberg Finance LP

Freight rates are rising. Source: Bloomberg Finance LP

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app The number of tankers taking the Red Sea route has halved from a month ago. Source: Bloomberg Finance LP

The number of tankers taking the Red Sea route has halved from a month ago. Source: Bloomberg Finance LP

WTI crude oil is testing the area around $73 per barrel and is close to the downtrend line (potential neckline of the head and shoulders formation) and the 50-period average. If a breakout were to occur, then the buyers' target could be around the $75 per barrel level, just above the 23.6 retracement of the last downward wave. Source: xStation5

Gas:

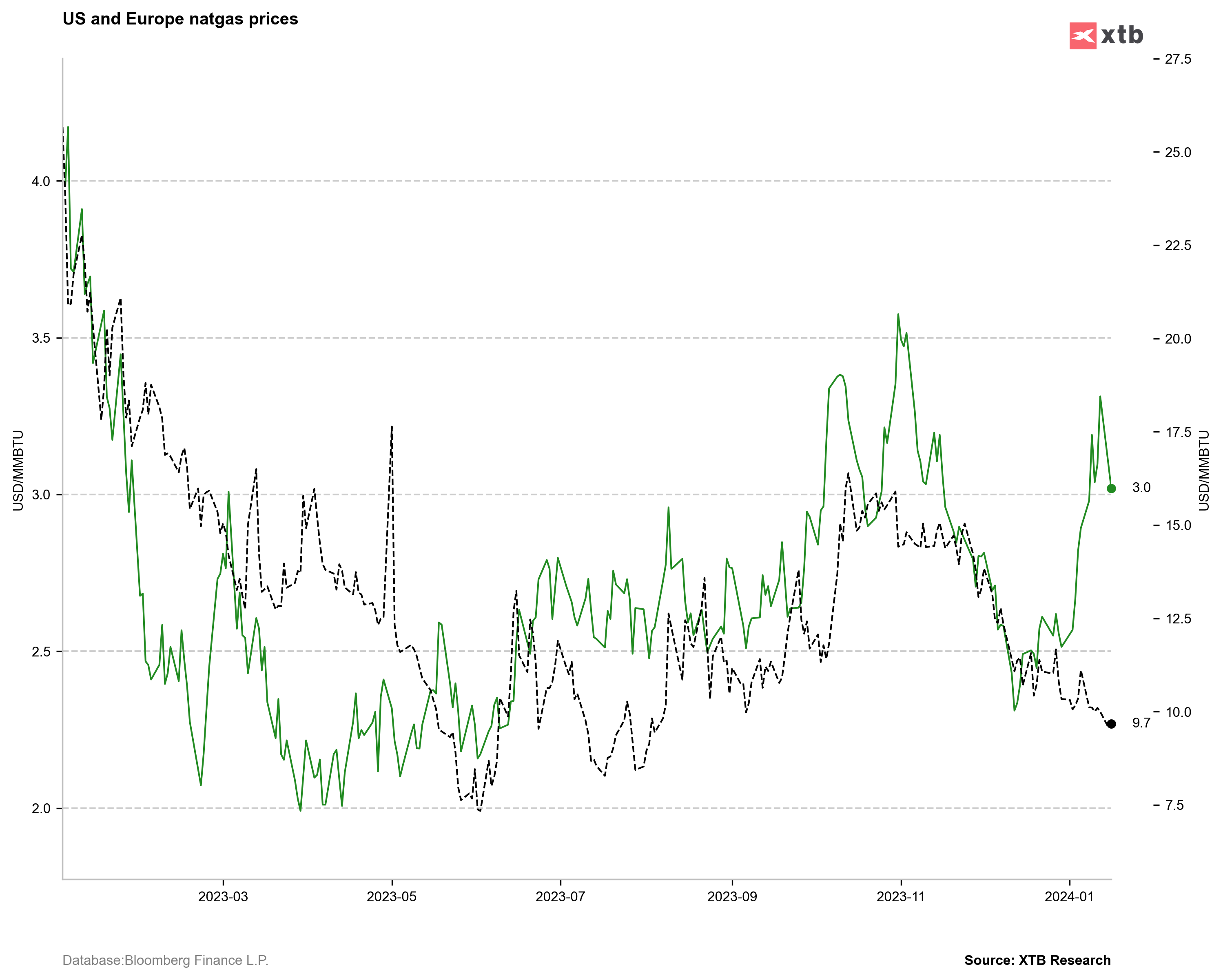

- The price of U.S. and European gas has remained under selling pressure since the beginning of this week.

- Inventories remain very high in Europe (and the US)

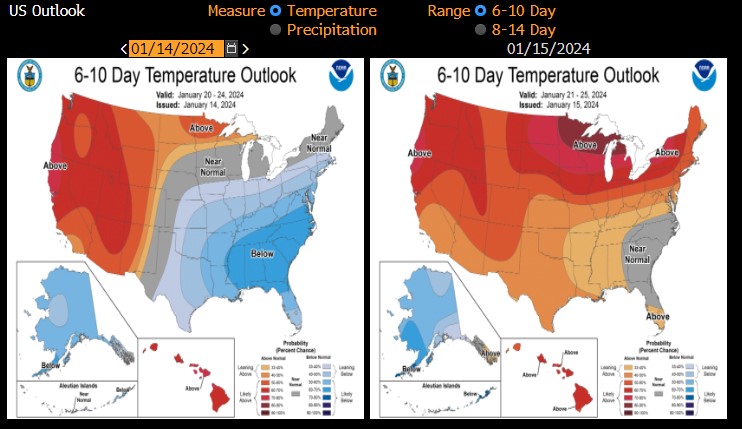

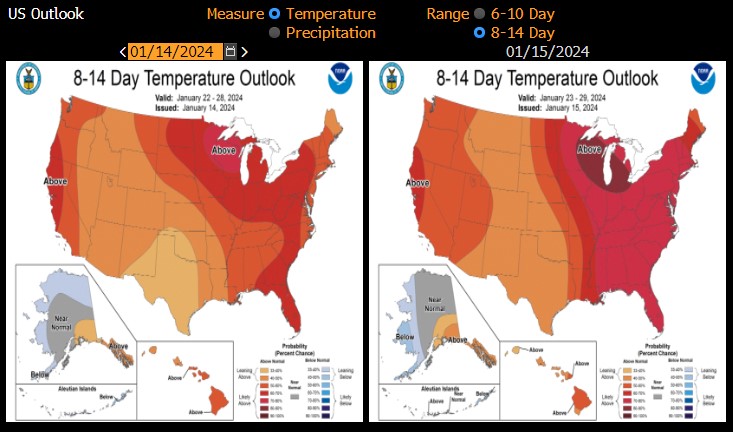

- In the U.S., weather forecasts point to a thaw in the outlook for late January and early February

- If the European price were to be a proxy for the U.S. price, we see a sizable divergence suggesting a possible decline in the U.S. price even to the $2.5-2.6/MMBTU level

- At the same time, however, we observe a significant increase in the price on the spot and on the traded contract (February contract), while the price of the March contract is around $2.5/MMBTU

- It is worth remembering, however, that the situation in the Middle East may minimally support prices in Europe, although, of course, it should be remembered that the situation in the gas market in Europe is not tense

Significant change in weather forecasts for 6-10 days ahead. Source: NOAA, Bloomberg

Weather outlook for 8-14 days indicates strong thaw. Source: NOAA, Bloomberg

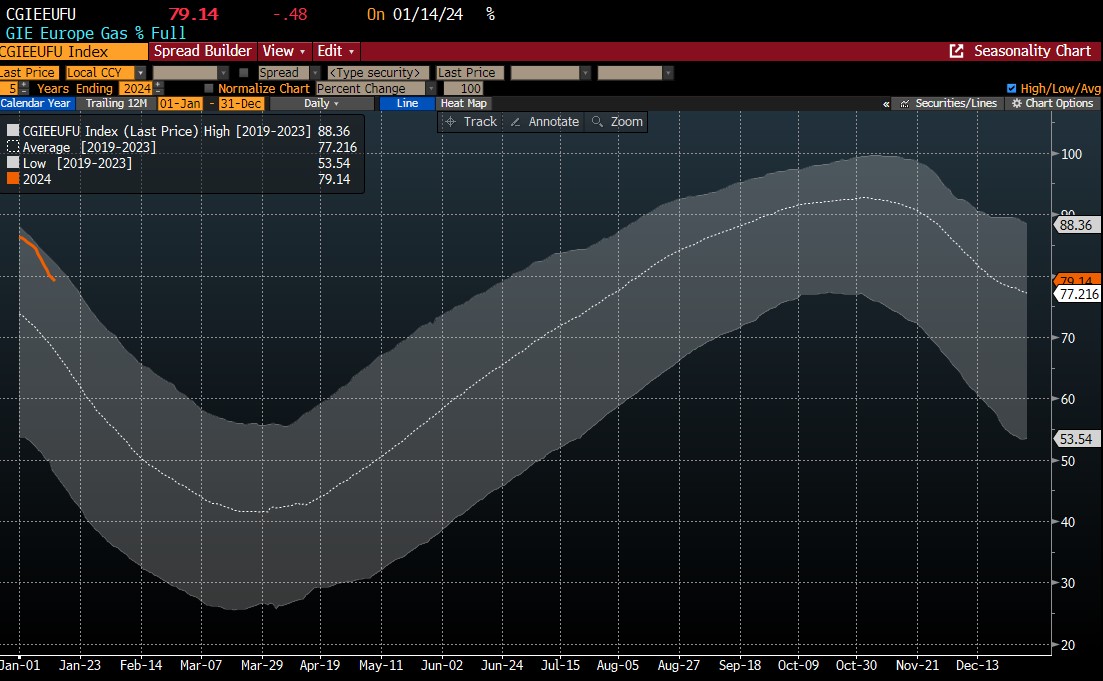

Gas volumes in Europe are near 5-year highs for the period. Source: Bloomberg Finance LP

We are seeing quite a divergence between gas in Europe and in the US. If gas prices in Europe were to be a determinant, gas prices could fall to $2.5-2.6/MMBTU. Source: Bloomberg Finance LP, XTB

We are seeing quite a divergence between gas in Europe and in the US. If gas prices in Europe were to be a determinant, gas prices could fall to $2.5-2.6/MMBTU. Source: Bloomberg Finance LP, XTB

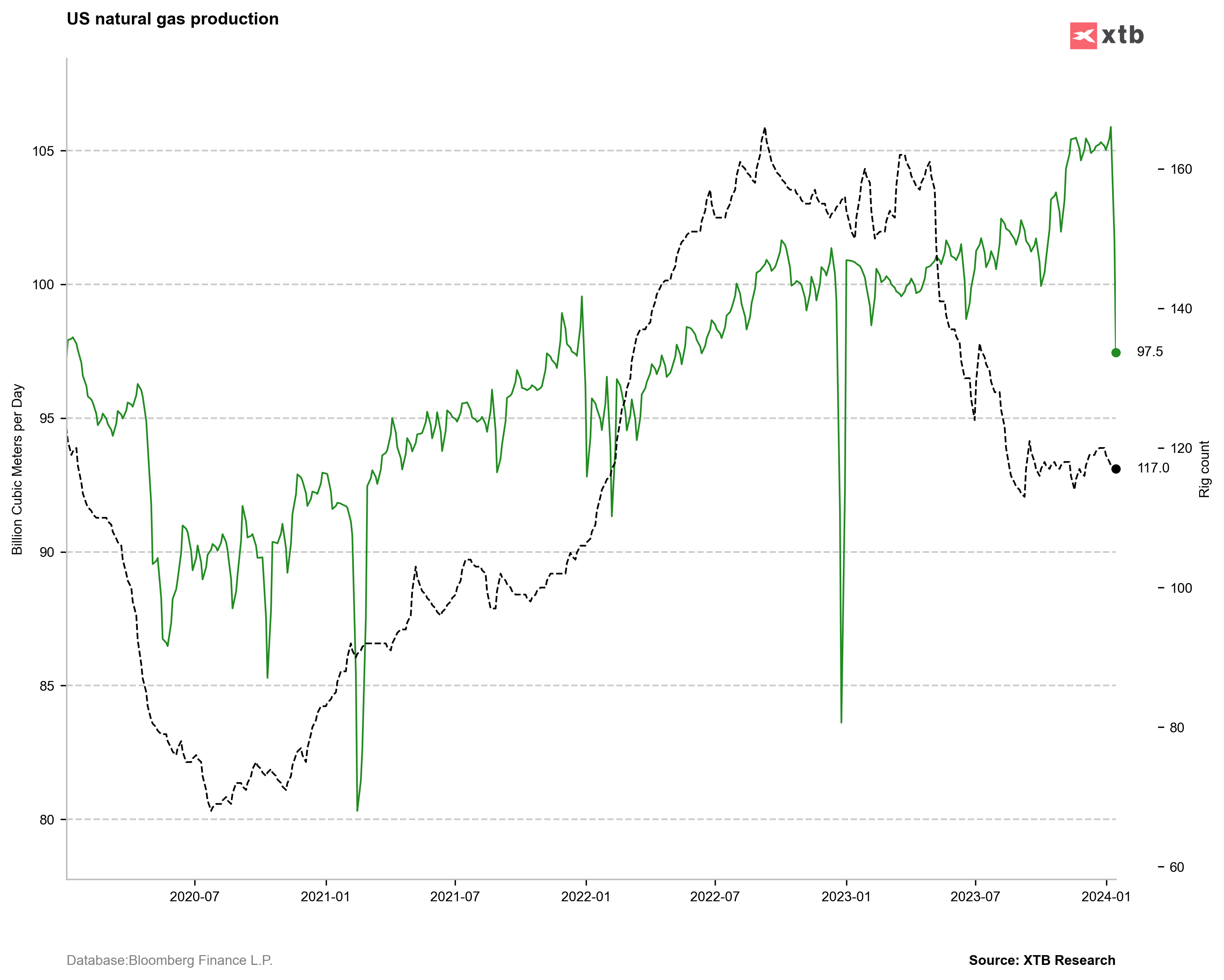

Gas production in the US remains very high. The current drop in production is only temporary. Source: Bloomberg Finance LP, XTB

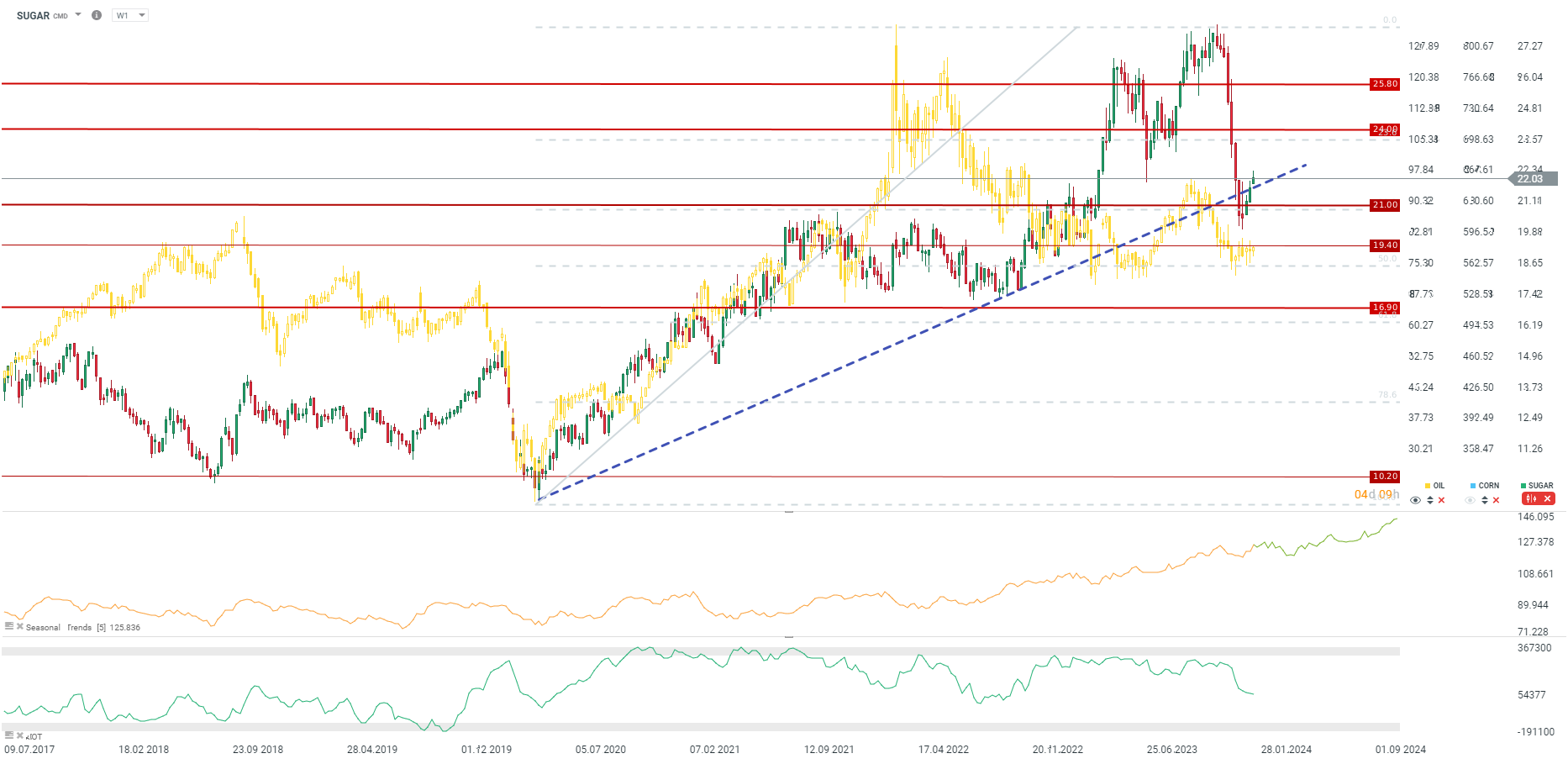

Sugar:

- India is reducing recent regulations on the production of ethanol from cane syrup, which could again reduce the supply of sugar on the market and increase the very desire to import more sugar into India

- India's sugarcane crop was badly damaged last season by lack of adequate rains

- The government will allow ethanol production in the 23/24 season with 1.7 million tons of sugar compared to 3.8 million tons of sugar in 22/23. Earlier regulations, however, were to completely ban the use of sugar for ethanol production

- It's worth noting that regulations went into effect this year that are expected to increase the amount of ethanol in fuel to 15%, further threatening the availability of the country's sugar supply

- Sugar is already rebounding about 10% from a local low

- The rate of reduction in positive net positions has slowed noticeably. The number of net positions is approaching levels similar to those in April 2020 and September 2022, when price bottoms were set after adjustments

The sugar price has already rebounded 10% from its local low, and net positions are beginning to indicate a possible signal of a further rebound. Prospects for a stronger rebound would be bolstered, with a stronger rise in oil prices. Source: xStation5

Gold:

- Gold is losing more than 1% since the beginning of the year, due to the US dollar's attempt to regain its luster and greater interest in Bitcoin

- We are again seeing rising yields in the U.S. and reduced chances of a March interest rate cut could lead to a further correction in the gold market

- Seasonality points to further gains in gold by the end of the month, but further fate may depend on the US dollar

- Key support for gold is around 2015 USD per ounce at the 38.2% retracement

Gold reacts to clear declines on the EURUSD pair. The key support is around 2015 USD/ounce, right at the lower limit of the upward trend channel. Source: xStation5