- OPEC's decision to extend the larger production cut was postponed to Thursday, December 3

- December 1 is a continuation of consultations, but possibly without a formal meeting

- A key issue is also the overproduction within OPEC +, which in the case of cheating countries amounted to nearly 2.5 million barrels per day (Russia - 0.531 mbd, Iraq - 0.6 mbd)

- This situation shows that it is still difficult to reach consensus, which may put additional pressure on oil

- Production in the United States is rebounding - the number of drilling rigs and the number of factional teams are increasing

- Goldman Sachs has recently indicated that a drop in demand in the winter by up to 3 million barrels per day is possible due to new restrictions

- On the other hand, it points to a rebound in demand next year, which is expected to increase the price of Brent crude oil to USD 65 per barrel

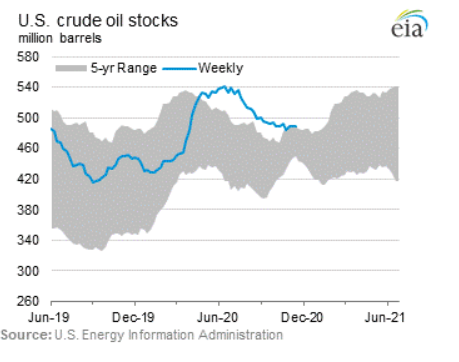

- Despite the fact that oil inventories are still above the 5-year average, the distance has shrunk significantly compared to the first lockdown

- Next year should bring a significant rebound in demand, which should support prices in the event of further reduction of production by OPEC +

The OECD assesses economic growth lower, which may call into question a revival in oil demand. Some indicate that oil demand will peak around the middle of the next decade, and will be slightly higher than before the pandemic. Source: OECD, Bloomberg

The OECD assesses economic growth lower, which may call into question a revival in oil demand. Some indicate that oil demand will peak around the middle of the next decade, and will be slightly higher than before the pandemic. Source: OECD, Bloomberg

The WTI price remains around USD 45 per barrel. At the moment, the lower bound of the largest correction is not threatened. The $ 44 region remains a key support. Subsequent support levels are located at $ 41 per barrel, around the upper limit of September consolidation zone, along with a 50 and 100 day moving averages. Source: xStation5

The WTI price remains around USD 45 per barrel. At the moment, the lower bound of the largest correction is not threatened. The $ 44 region remains a key support. Subsequent support levels are located at $ 41 per barrel, around the upper limit of September consolidation zone, along with a 50 and 100 day moving averages. Source: xStation5- Recent data showed a clear decline in inventories, marking the start of the full heating season

- However, the price has consolidated after the reaching recent highs, failing to hit $ 3.00 per contract

- However, the weather forecast for the next week points to colder temperatures

- Seasonality still shows a continuation of declines

- Recent forecasts indicate that this week the number of inventoriess will shrink by 21 billion cubic feet per day, double the 5-year average

Price is consolidating after the recent attempt to break above the $ 3.00 contract level. Nevertheless, it is worth noting that the forecasts for the next two weeks indicate lower temperatures, which could lead to a price increase. On the other hand, the seasonality indicates that we should expect a continuation of declines. Source: xStation5

Price is consolidating after the recent attempt to break above the $ 3.00 contract level. Nevertheless, it is worth noting that the forecasts for the next two weeks indicate lower temperatures, which could lead to a price increase. On the other hand, the seasonality indicates that we should expect a continuation of declines. Source: xStation5

Gold:

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app- Gold began to stabilize around $ 1,800 an ounce

- Negative real interest rates should rather support gold in the longer term

- The current situation is very similar to the end of 2016 - risk mitigation, which weakened gold, but then additionally strengthened the dollar (higher yields). Currently, the situation is different - risk reduction weakens the dollar, which should be an additional factor that will support gold in the near future

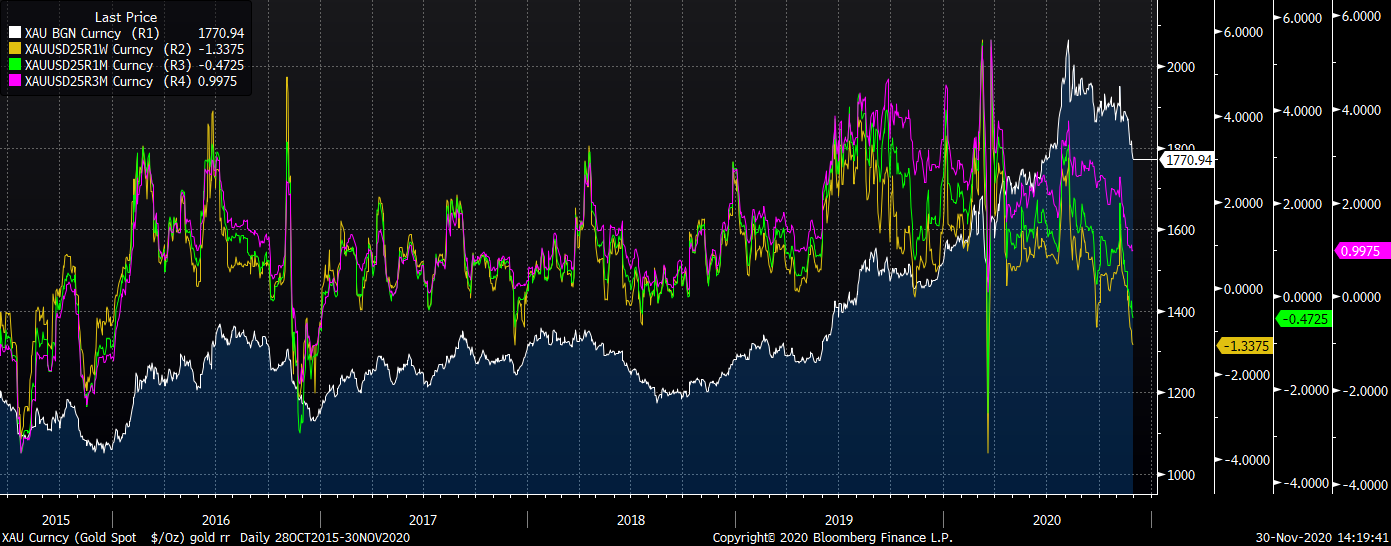

- The Reverse Ratio Indexes are in a similar position to the end of 2016 as well as during the March gold sale

- For now, ETFs are getting rid of gold, but speculative positioning has stabilized

Reverse Ratio indices are at very low levels, suggesting that market is over-optimistic. This could be a potential signal for a rebound in gold prices. Source: Bloomberg

Reverse Ratio indices are at very low levels, suggesting that market is over-optimistic. This could be a potential signal for a rebound in gold prices. Source: Bloomberg

ETFs are getting rid of gold, but positioning is stabilizing. Currently, the weak dollar supports the recovery in the gold market. A weak dollar could mean an increase in demand in Asian countries if the pandemic is brought under control. Source: Bloomberg

ETFs are getting rid of gold, but positioning is stabilizing. Currently, the weak dollar supports the recovery in the gold market. A weak dollar could mean an increase in demand in Asian countries if the pandemic is brought under control. Source: Bloomberg

Coffee:

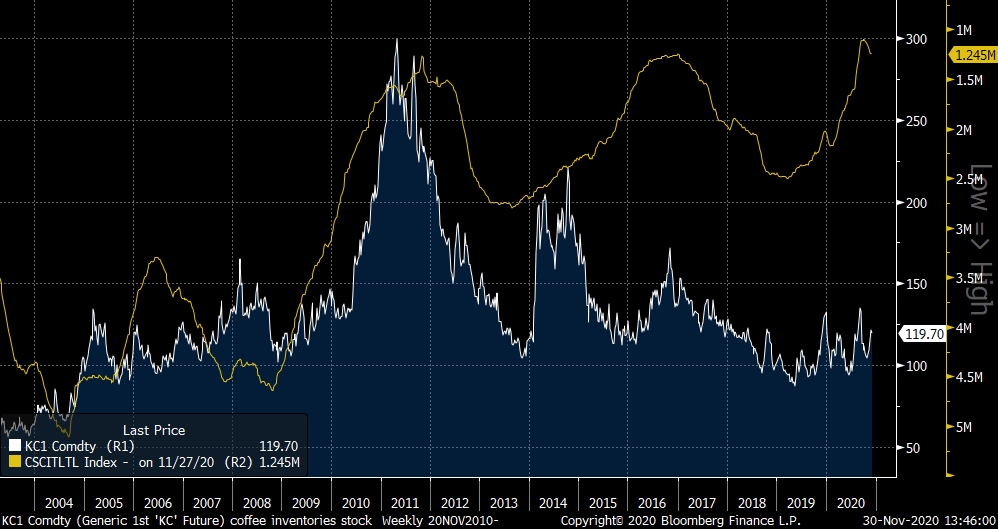

- Coffee inventries continue to increase, although remain relatively low compare to historical data

- Prices are back above 120 cents a pound, largely due to the weakening US dollar

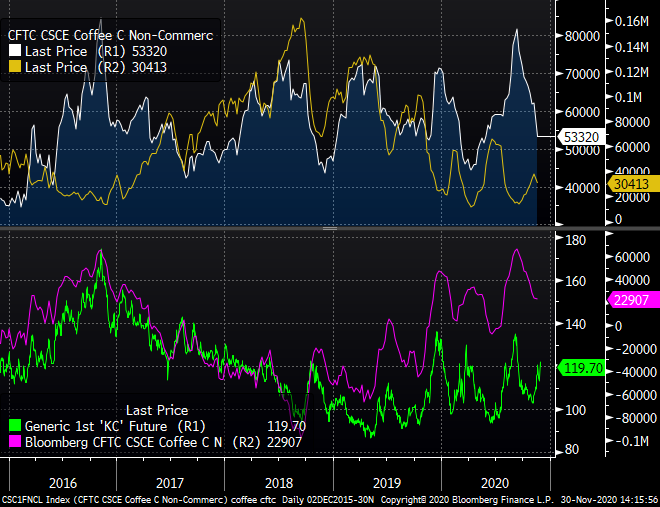

- The current positioning, however, does not support the continuation of the rebound. Moreover, even a weaker dollar alone should not necessarily lead to higher coffee prices, which is related to the large oversupply currently present on the market, in particular from Brazil (due to the large amount of inventories, this country must continue exporting even despite the strong Real)

Coffee inventories are rising around the world, but growth is too slow to raise concerns about large oversupply issues (which is, however, the case when looking at the harvest in Brazil). Source: Bloomberg

Coffee inventories are rising around the world, but growth is too slow to raise concerns about large oversupply issues (which is, however, the case when looking at the harvest in Brazil). Source: Bloomberg

Positioning no longer supports high prices. Very large reduction in long positions. Source: Bloomberg

Positioning no longer supports high prices. Very large reduction in long positions. Source: Bloomberg

Real has strengthened over the past few weeks, however still remains around the level of 5.3. Seasonality indicates a possible peak in the coming days. Source: xStation5

Real has strengthened over the past few weeks, however still remains around the level of 5.3. Seasonality indicates a possible peak in the coming days. Source: xStation5