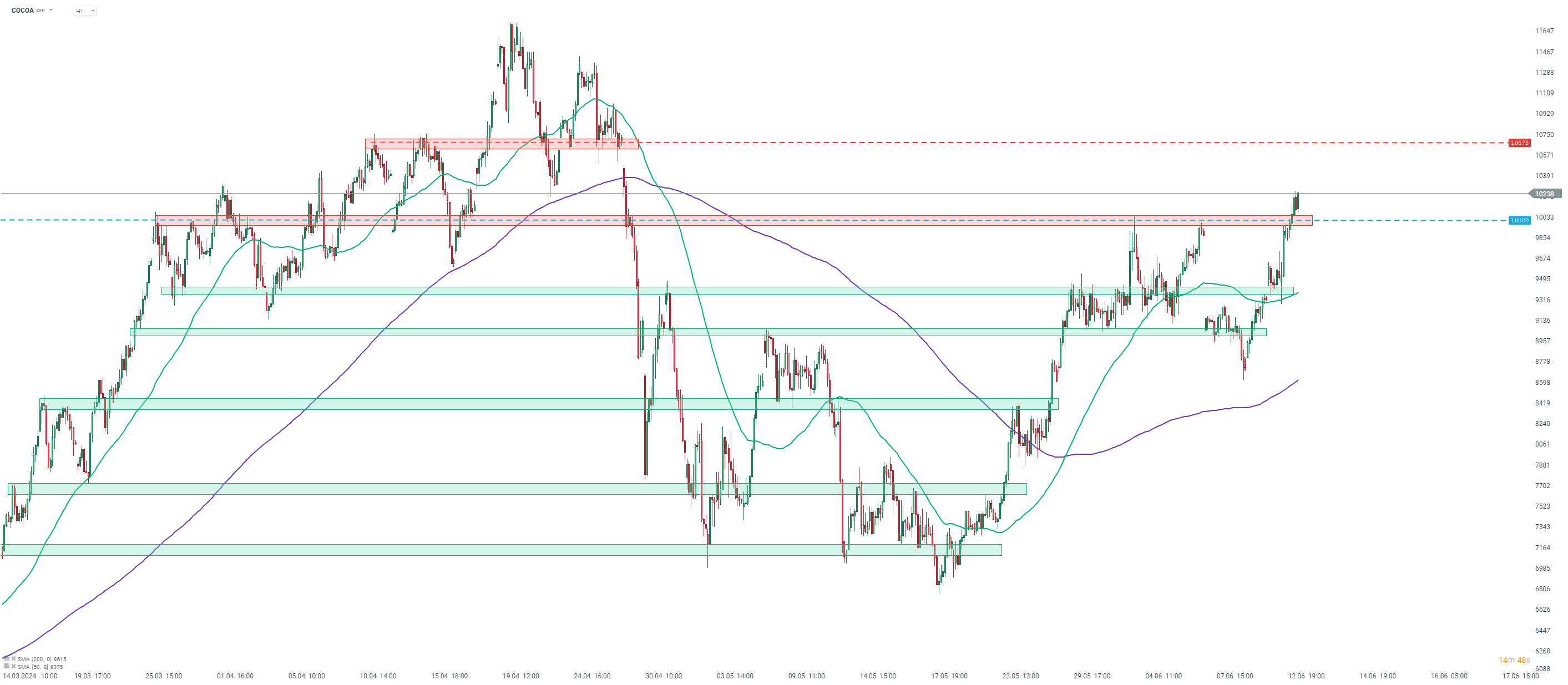

Cocoa prices extend recent rebound and add another 3% today. COCOA returns above $10,000 per metric ton for the first time since June 3, 2024. Price even moved above early-June local high and climbed to the level not seen since late-April 2024. Fundamental reasons behind the move higher remain unchanged - concerns over available supply.

Reuters reported that Ghana, second largest cocoa producer in the world, is considering delaying delivering of up to 350 thousand tonnes of cocoa beans to the next season in response to poor crops this season. Reuters reported that out of 785 thousand tons of beans that were pre-sold for 2023/24 season, only around 435 thousand are expected to be delivered.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appLet us recall that as recently as last week it was reported by Bloomberg that Ivory Coast, world's largest cocoa producer, has taken measures aimed at boosting availability of cocoa bean to local grinders. As harvest this season has been poor, this means that there is a high risk of exports being restricted, and it would further limit supply in the global cocoa market.

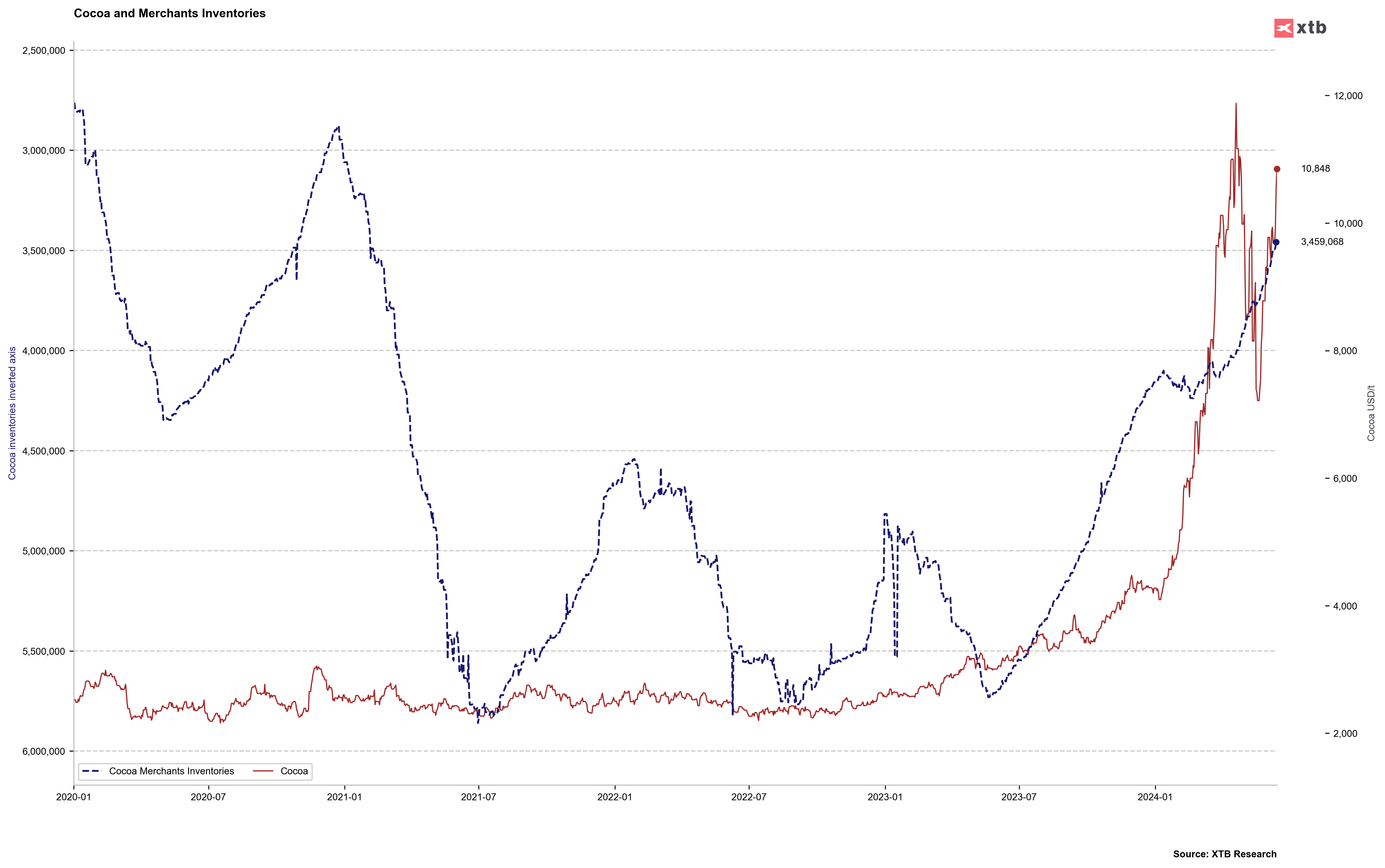

On top of that, it should be said that merchant inventories continue to drop and are now below 3.5 million bags - the lowest level since early-February 2021. Another point to note is that traders seem to be discouraged by significant pick-up in cocoa market volatility at the end of 2023 and in 2024 so far. This is evidence by speculative long and short positions being at multi-year lows. Low liquidity on the market further exacerbates risk of more volatile price moves.

Taking a look at COCOA chart at H1 interval, we can see price jumped above $10,000 resistance zone today and is trading at the highest level in month and a half. Should bulls remain in control over the market and price continues to move higher, the next potential resistance zone to watch can be found in the $10,675 area

Source: xStation5

Source: xStation5