As the first Friday of a new month has arrived, the time has come for release of the US jobs data. Report for April may have less gravity than usual as the Fed has already set out guidance for rate hikes at coming meetings. Nevertheless, some short-term volatility on the USD market is likely to be present, especially if headline NFP data shows a big miss as ADP did. A point to note is that wage growth is expected to decelerate, what would support Powell's claims that he does not see evidence of wage-price spiral. Simultaneously to the US release, Canada will publish its jobs figures for April. In this case a moderate increase in employment and further drop in unemployment rate.

US, NFP report for April.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app-

Non-farm payrolls. Expected: 385k. Previous: 431k

-

Wage growth. Expected: 5.5% YoY. Previous: 5.6% YoY

-

Unemployment rate. Expected: 3.5%. Previous: 3.6%

Canada, jobs market report for April.

-

Employment change. Expected: 57.5k. Previous: 72.5k

-

Unemployment rate. Expected: 5.2%. Previous: 5.3%

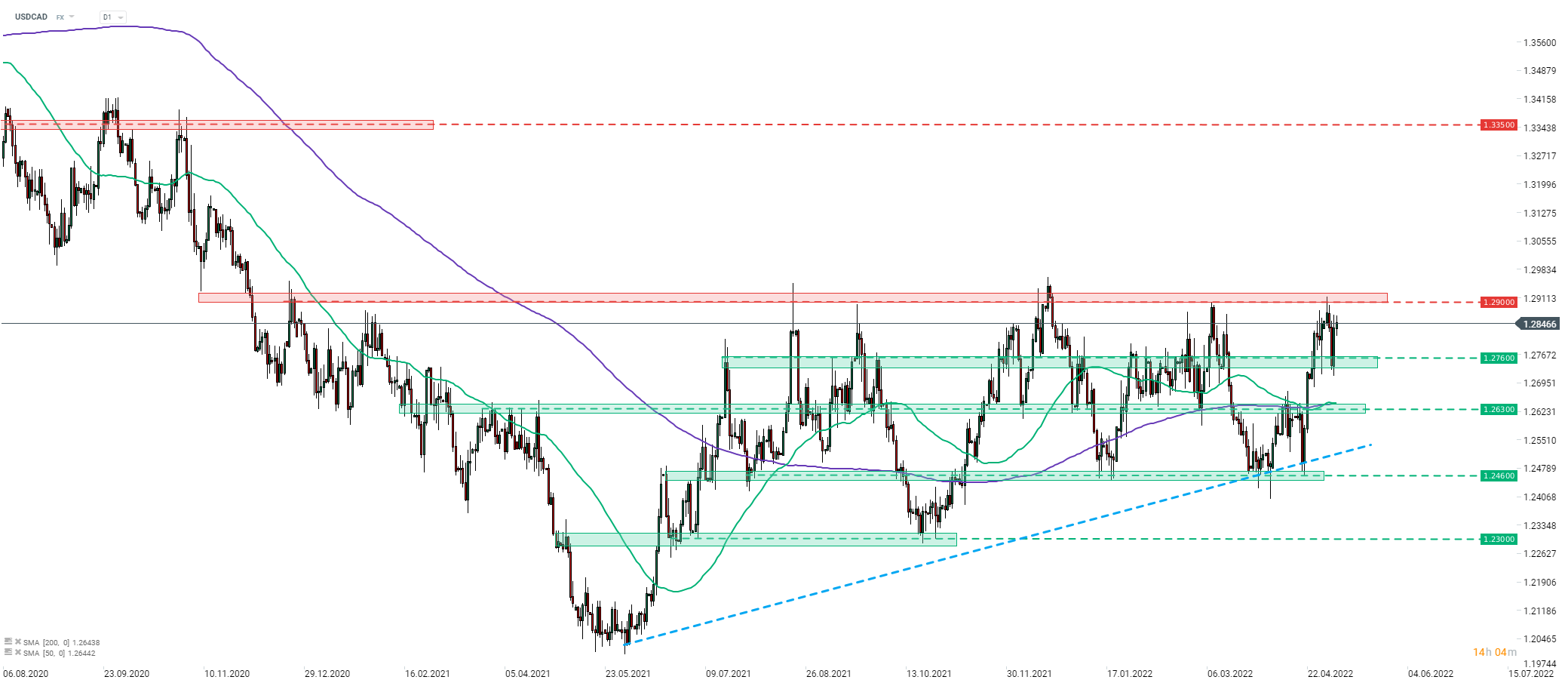

A simultaneous release of US and Canadian jobs data is making today's early afternoon a very interesting one for USDCAD traders. Taking a look at the pair at D1 interval, we can see that it continues to trade in an ascending triangle pattern. Pair pulled back from the upper limit of the pattern in the 1.29 area earlier this week and a drop was magnified by post-FOMC USD weakening. However, bulls managed to halt declines at the 1.2760 support zone and an upward move was resumed. USDCAD is once again looking to test the upper limit of the pattern and a high-volatility event like release of jobs data may facilitate a breakout. In such a scenario, the next resistance to watch can be found in the 1.3350 area - zone that saw numerous price reactions in 2019 and 2020.

Source: xStation5

Source: xStation5