- The US500 contract rose nearly 2.5% yesterday, and the S&P 500 index posted a 2.3% gain, marking a record session since 2022. As a result, investors felt a breath of optimism, driven by better-than-forecast macro readings from the U.S. economy; fears of a recession eased (although as the scale of the rebound after recent declines shows - not fully).

- First, the ISM of services for July came in above expectations (much stronger than the weak ISM of manufacturing), and lower-than-forecast benefit claims put a question mark over whether the US economy is just slipping into recession. At the same time, the rise in unemployment to 4.3% from 4.1% in July is a wake-up call for the market, and it is unclear how Wall Street's case would be explained by the Fed to maintain a consistently hawkish stance, with unemployment set to rise, according to the Fed's Barkin.

- According to the Richmond Fed chairman, higher unemployment does not yet mean that the labour market should seriously worry the Federal Reserve - as long as the Fed does not see a significant drop in new jobs in the economy. Stock valuations indicate that the market is still not fully pricing in a scenario in which the Federal Reserve is wrong to observe 'lagging' labour market data relative to the real health of the economy. If the next important macro data are weaker, the discount in valuations of U.S. equities may gradually deepen, as the probability of a recession increases (even if this, ultimately, will not happen)

- On the other hand, if the economy is in for a soft landing, the recent sell-off, which we would rather call an attempt to 'discount' the higher risk of a slowdown in the economy in the coming months, seems to carry a tactical opportunity to accumulate some heavily oversold stocks of technology companies, among others. All in all, the final direction for the US500 ahead of the US elections remains uncertain; another downward impulse cannot be ruled out, and the market could still react emotionally if further readings were to disappoint.

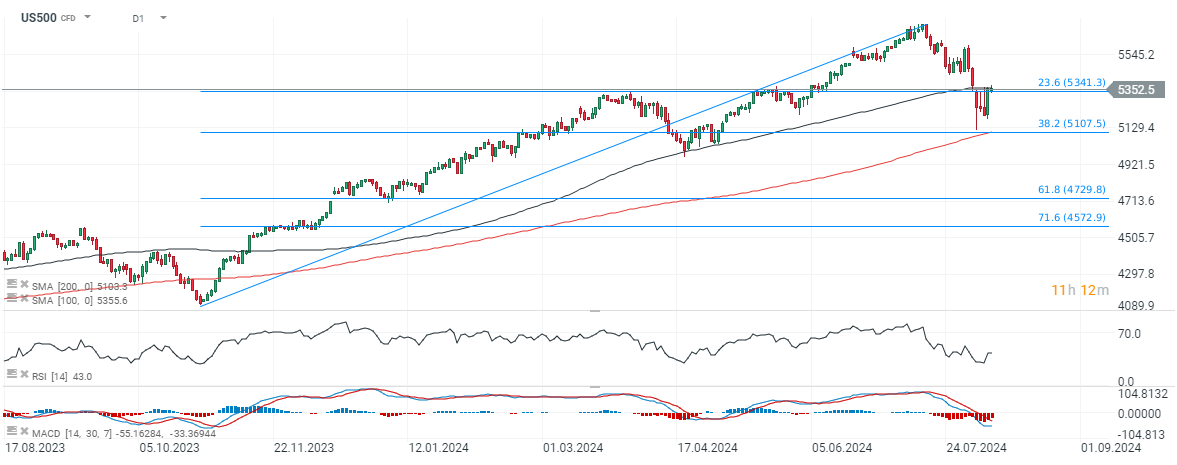

US500 (D1 interval)

The S&P 500 (US500) contract is trading with relatively modest gains today, after yesterday's record session since 2022. The index broke above 5340 points, where we see the 23.6 Fibonacci retracement of the upward wave from the fall of 2023 and the SMA100 (black line). Key resistance is located around 5500 points. A drop below, the 23.6 Fibo, confirmed by high volume could suggest pressure for a retest around 5100 points, where we see the SMA200 (red line) and the 38.2 Fibo. The last time the contract was below the SMA200 was in autumn, last year.

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appCurrently, the index is trading in a bearish flag formation, which, if confirmed, a drop below 5200 points could be a signal for another downward impulse. On the other hand, a rebound above 5500 points would suggest a V-shaped exit from the short-term downward trend.

Source: xStation5