Swiss banks are in the center of news attention at the beginning of a new week. UBS agreed to buy Credit Suisse in a government-brokered deal aimed at restoring calm and confidence in the European banking sector. UBS will purchase Credit Suisse for 3 billion CHF and receive additional 9 billion CHF in government guarantees. On top of that, additional liquidity to a combined entity will also be provided. Government guarantees to UBS should not come as a surprise given that the bank will also assume around 5 billion CHF in Credit Suisse losses.

UBS takeover of Credit Suisse leads to an interesting and potentially dangerous situation in the Swiss banking sector. Tie-up of two largest Swiss banks means that over 50% of bank deposits in the country will be held by a single institution! This is a massive concentration and could have grave consequences for Swiss banking sector stability should UBS encounter a bank run. However, UBS is not Credit Suisse and has a much better record of not getting involved in market scandals and other suspicious activities. Not to mention that Swiss regulators are likely to pay double attention not to let this behemoth fail. On the other hand, it means that once current turmoil is over, discussions about splitting up UBS may commence.

Start investing today or test a free demo

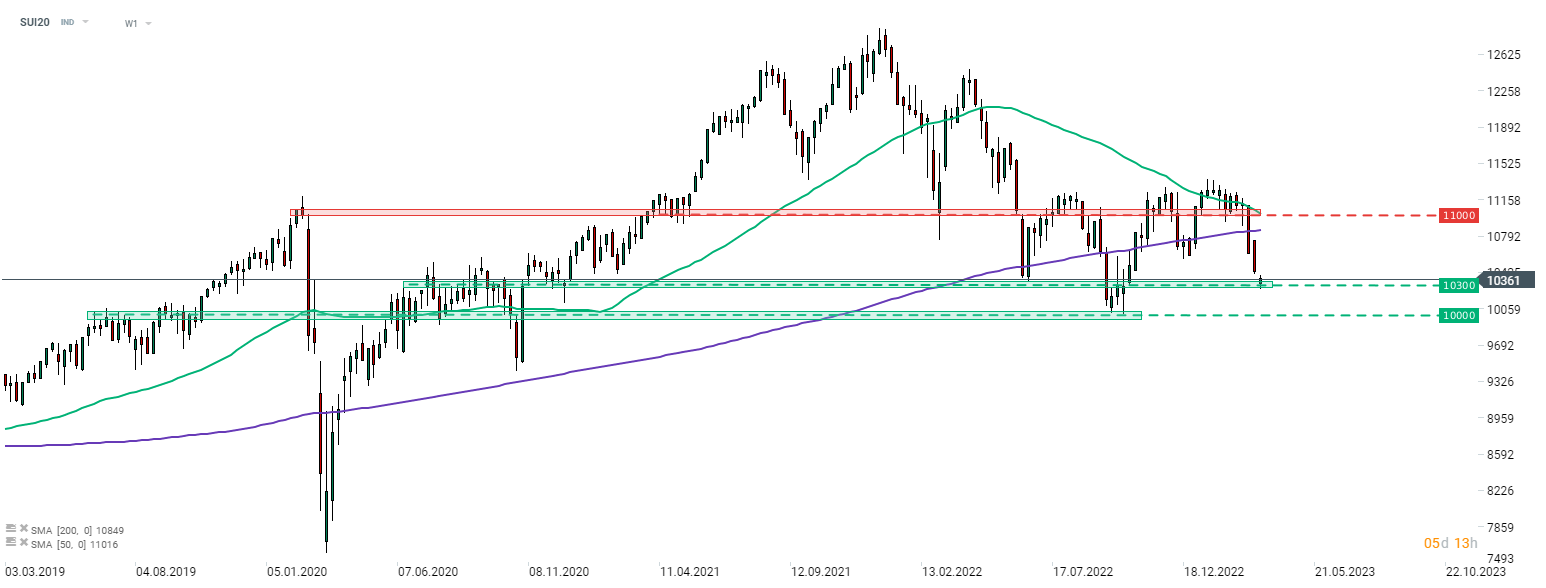

Create account Try a demo Download mobile app Download mobile appIn spite of being two largest banks in Switzerland, Credit Suisse and UBS had a less than 10% combined share in SMI (SUI20) - index of 20 largest Swiss stocks. This index is dropping slightly over 1% today and is one of Europe's top laggards. Taking a look at SUI20 chart at weekly interval (W1), we can see that the index launched a new week with a bearish price gap and tested the 10,300 pts support zone. Bulls managed to defend the area on the first attempt and now attempt to launch a recovery move.

Source: xStation5

Source: xStation5