Copper managed to defend major support despite prospects of slowing demand from China. The world’s second largest economy reported disappointing industrial production, fixed asset investments and retail sales figures for July, which forced PBOC to lower key lending rates in order to revive demand. On the other hand, low inventories and ongoing supply problems support market bulls. Stockpiles on London and Shanghai exchanges are dwindling, while major producers flagged various supply disruptions that reduced output.

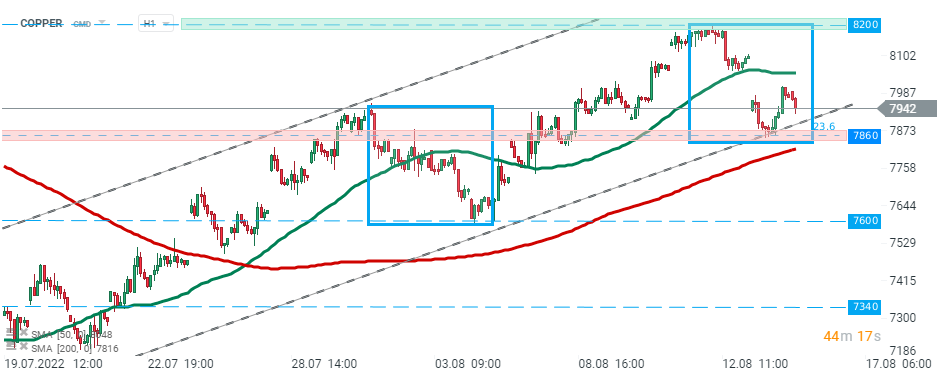

From a technical point of view, as long as price sits above support at $7860, the short term sentiment remains bullish and another upward impulse towards resistance at 8200 may be launched. The aforementioned support is marked with a lower limit of the 1:1 structure and 23.6% Fibonacci retracement of the last downward correction. On the other hand, should break lower occur, the next support to watch is located around $7600.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

Copper, H1 interval. Source: xStation5