An awaited pack of Chinese data was released today. Data turned out to be better-than-expected with activity data for December as well as Q4 and full-2022 GDP numbers beating estimates.

Activity data for December

-

Industrial Production: 1.3% YoY vs 0.2% YoY expected

-

Retail Sales: -1.8% MoM vs -8.5% MoM expected

-

Urban Area Investments: 5.1% YoY vs 5.0% YoY expected

GDP data

-

Q4 2022: 2.9% YoY vs 1.8% YoY expected

-

Q4 2022: 0.0% QoQ vs -0.8% QoQ expected

-

Full-2022: 3%

While beats in the data are always welcome, Chinese stock market indices did not reflect any optimism and finished today's trading lower. Some analysts already noted that not everything seems right in the data. UBS pointed that a 2.9% YoY GDP growth in Q4 2022 would more likely point to full-2022 GDP growth being below 2%! Moreover, the Chinese National Bureau of Statistics said that the population of China dropped by 850k in 2022 - the first annual population drop since 1961!

It is nothing new that official Chinese data is seen as shady. However, the first population drop since 1961 is certainly something new and could have important implications for the Chinese economy in the long run. Should it be the beginning of a new trend with China, just as Western countries, struggling to grow its population, the economic outlook would deteriorate significantly.

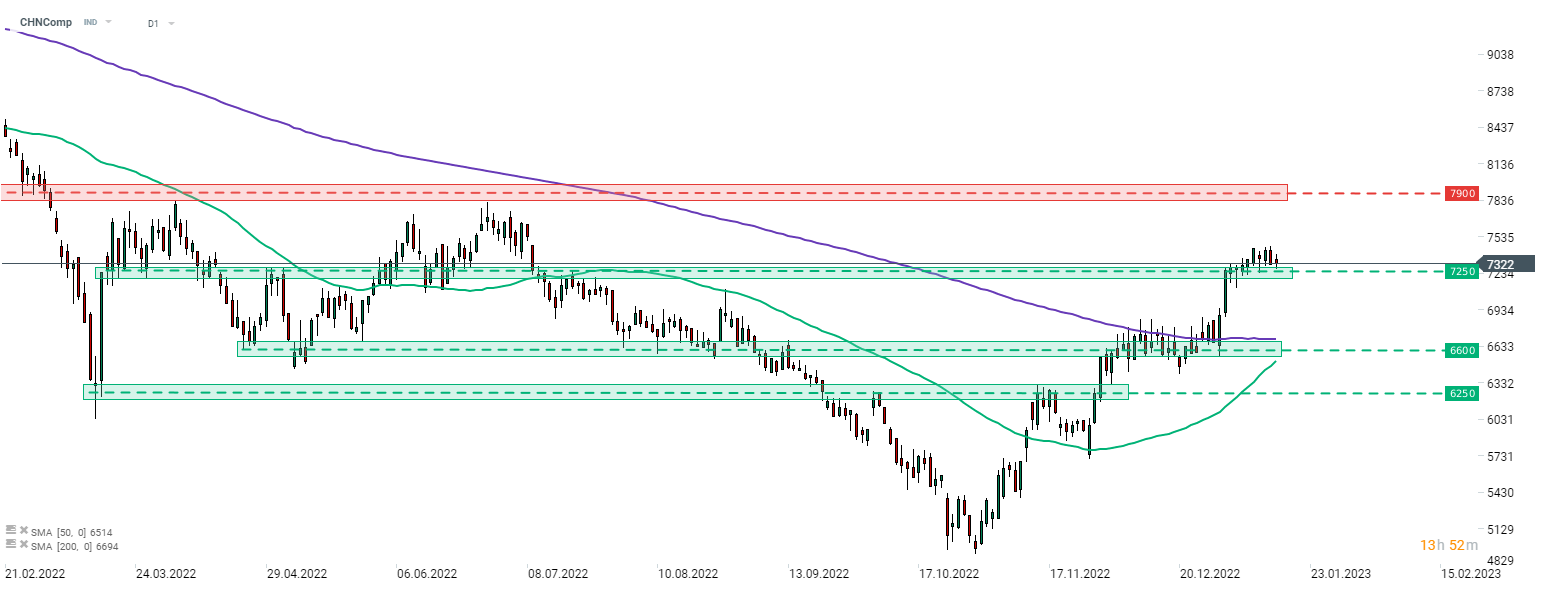

Taking a look at CHNComp at D1 interval, we can see that the index has recently climbed above 7,250 pts resistance zone but has struggled to maintain bullish momentum later on. Pullback launched this week led to a retest of the aforementioned 7,250 pts zone - this time as a support. No break below occurred yet but should such a break occur, drop may deepend with the 6,600 pts zone being the first target for sellers.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report