The upcoming Federal Open Market Committee (FOMC) decision is poised to significantly impact Bitcoin's price. With the market pricing in a 67% probability of a 50 basis point rate cut, up from 35% a week ago, expectations are high for a substantial policy shift.

Bitcoin has historically performed well following Fed rate cuts, as seen after the March 2020 reductions. However, the current situation presents unique challenges. Bitcoin has retreated to around $58,000 from recent highs of $60,660, reflecting market uncertainty. A 25 basis point cut might be viewed as a measured approach, potentially stabilizing Bitcoin. However, a 50 basis point cut could be interpreted as a sign of economic concern, possibly negatively impacting risk assets like Bitcoin or provide higher upside based on the lower cost of capital.

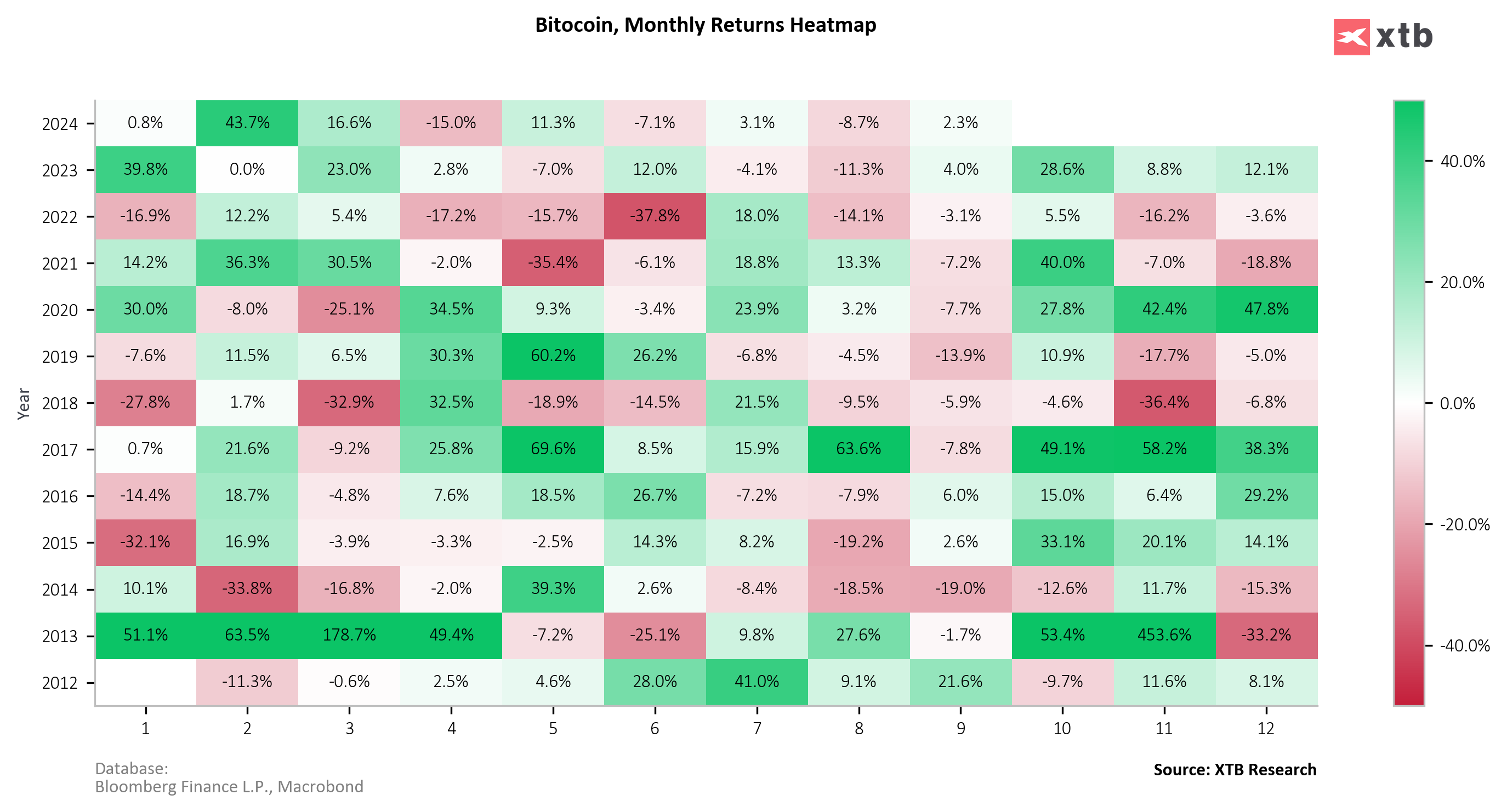

September has historically been a seasonally weak month for Bitcoin, with an average monthly return of -2%. However, October has been one of the best months historically, which could pair well with a potential softening of monetary policy.

Investors should prepare for increased volatility around the FOMC announcement and subsequent press conference. The Fed's forward guidance and updated dot plot will be critical in shaping market sentiment beyond the immediate rate decision.

Bitcoin (D1 interval)

The price of Bitcoin crossed the 50-day SMA yesterday and remains above this level today. Currently, the 50% Fibonacci retracement level is acting as support. For bulls, breaking the 100-day SMA at $61 237 would present a good opportunity to test the 61.8% Fibonacci retracement level. Beyond that, there is potential to retest the 200-day SMA. A clear bullish divergence began two weeks ago. The RSI is now in neutral territory, which, combined with positive price action, still offers upside potential. The MACD is also diverging positively. Additionally, the convergence of DI+ and DI- has typically signaled a potential trend reversal.

Source: xStation

Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?