The US dollar weakened while equites moved higher after Fed Chair Powell dovish comments. During his speech at the Brookings Institution, Powell said:

-

Policy will most likely need to remain restrictive for some time.

-

It makes sense to moderate pace of interest rate increases.

-

The time to slow the pace of rate hikes could come as soon as the December meeting.

-

Have made significant progress toward a sufficiently restrictive policy, but still have much ground to cover.

-

It seems to me probable to me rates need to ultimately go somewhat higher than policymakers thought in September

-

October inflation data was a welcome surprise, but it will require much more evidence to give reassurance that inflation is actually dropping.

- We estimate that the PCE price index rose 6% in the 12 months to October, core PCE rose 5%.

- The route ahead for inflation is very uncertain.

- Economic activity growth has slowed to well below the longer-run trend, and this must be maintained.

US100 broke above the local downtrend line and is currently testing a major resistance zone at 11700 pts. Source: xStation5

US100 broke above the local downtrend line and is currently testing a major resistance zone at 11700 pts. Source: xStation5

Start investing today or test a free demo

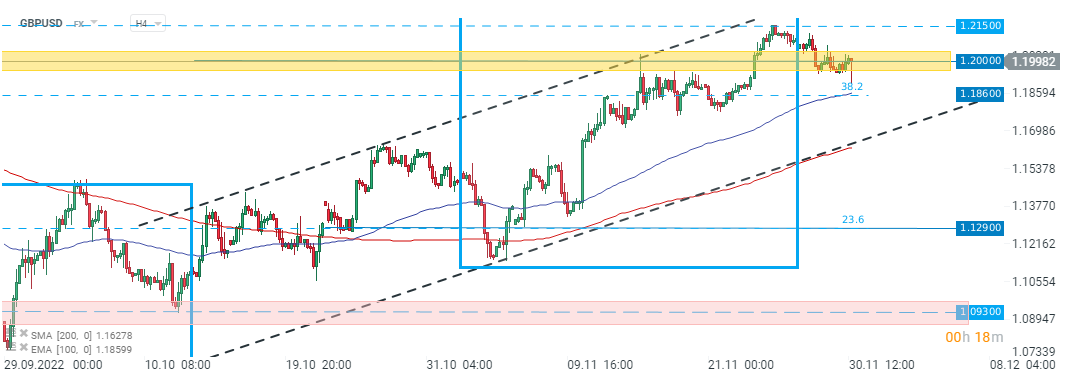

Open real account TRY DEMO Download mobile app Download mobile app GBPUSD erased early losses and once again approached resistance at 1.20. Source: xStation5

GBPUSD erased early losses and once again approached resistance at 1.20. Source: xStation5