Find out when the Bank of England will cut UK interest rates, and what this means for the pound.

The Bank of England held interest rates steady on Thursday at 5.25%, but they did perform their own ‘dovish pivot’, they have removed the reference to further tightening in their statement. However, the market is finding out that dovish pivots do not mean rate cuts. The BOE Governor Andrew Bailey has pointed out that even if inflation does fall back to 2% this year, it is not job done. The problem with CPI is that the good news on price declines, mostly from falling oil and gas prices, will fall out of the index in the coming months. The BOE is concerned that inflation could do its own pivot, although they see inflation falling to 2% in the next few months, they are worried about it rising again.

The hawks aren’t for turning

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appWe mentioned in our preview that one of the things to watch in this meeting is the vote split. This is fascinating, the BOE is more divided than ever, with one member voting for a cut, two members voting for a rate hike, and 6 members sitting on the fence. Megan Greene, who voted for a hike at the last meeting, shifted her stance to keeping rates unchanged, while Swati Dhingra voted to cut rates. The decision to hike rates by two MPC members was a shock to the market, as some were expecting all the hawks to shift to a neutral stance. They have justified their decision, according to the BOE meeting minutes, by saying that they are still worried about a tight labour market, rising wages and persistent inflation pressure. Considering wage growth remains well above the BOE’s target rate and CPI ticked higher in December, it doesn’t sound lik

e they will be appeased on the inflation front any time soon. The BOE has made a slight dovish tilt, however the bar is still high for rate cuts. Like with the Fed, the market seemed more comfortable with rate cuts than the BOE, and it’s worth remembering that 6 members of the BOE voted for no change.

BOE walks the tightrope of forward guidance

The BOE is firmly on hold, and the BOE’s guidance is also not straightforward. In the meeting minutes they said that they will review the amount of time that ‘Bank Rate should be maintained at the current level’, and they also said that policy will need to remain ‘restrictive for sufficiently long’ to suppress inflation pressures. This does not support near term rate hikes, it suggests that the BOE is on hold, but the ‘higher for longer’ mantra has been put on notice, and if they see inflation pressures subside then they will cut rates.

The market impact of a less dovish Fed

The BOE’s message is less dovish than expected, and the market has responded by pushing up Gilt yields along the curve, the 2-year yield is currently up by 4 basis points and the 10-year yield is higher by 3 basis points. GBP/USD is clawing back some earlier losses, and is testing $1.27, and the FTSE 350, which contains domestically focused companies, is backing away from daily highs. The market is also recalibrating expectations of when the BOE will first cut interest rates. The market has pushed back the chance of the first rate cut from May to June, with a small chance of a cut in May. The market now sees rates ending 2024 at 4.07%, with just over 4 rate cuts priced in for next year.

Chart 1:

Source: Bloomberg

BOE and the Fed seem less dovish than the ECB

Andrew Bailey has struck a similar tone to the Fed, saying that they want to see further evidence of a sustained decline in inflation before they cut rates. In this way, the BOE and the Fed seem to be less dovish than the ECB. The BOE and the Fed are not willing to pre-commit to a rate hike at a certain time, in contrast, Christine Lagarde at the ECB has pointed to the summer as a good time for the ECB to cut rates. The BOE is following the Fed and is in data-watch mode, with Bailey saying that any rate cut will depend on how the outlook evolves. This increases the volatility around key UK data announcements like CPI, wage data and PPI.

UK only major economy predicting inflation falling below target

The BOE’s inflation forecast was unexpected and highlights how the BOE does not think that inflation will fall in a straight line. The BOE said in its Monetary Policy Report that the speed of price decreases is slowing, which is to be expected. The Bank thinks that lower oil and gas prices could push inflation below the 2% target rate in the near term, but only for a brief period, before inflation rises again. The BOE is the only major central bank currently predicting inflation to fall below its target rate this year, however, it is also the only major central bank predicting a bumpy path with highs and lows for inflation in the coming year. Overall, the BOE sees the disinflation trend continuing and it now sees CPI at 2.75% by year end, down from the current rate of 4%.

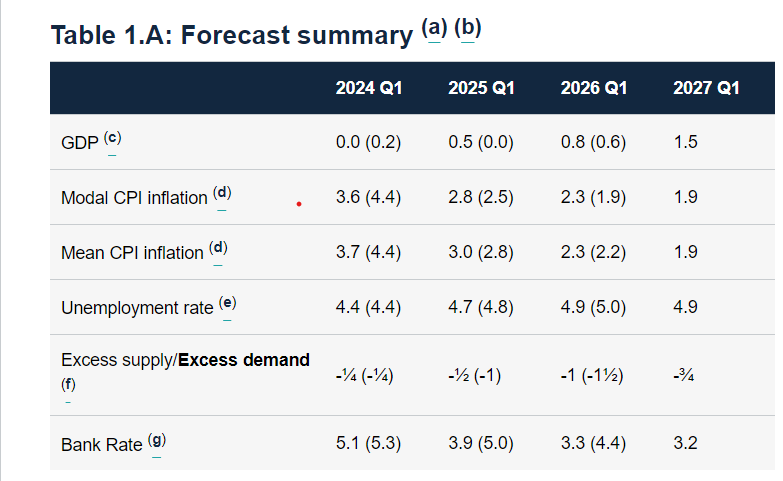

The forecast summary included in the Monetary policy report includes an upgrade for growth forecasts. The UK economy is now forecast to grow by 0.5% in Q1 2025, the previous forecast was for flat growth. However, the Bank’s modal projections for inflation have been revised lower in the near term, and higher in the longer term. The BOE now expects Q1 CPI to be 3.6%, previously it expected 4.4%. However, for Q1 2025, the BOE has revised its projection, with 2.8% CPI growth expected, previously it was expected to be 2.5%. The forecast for Q1 2026 has also been revised higher, previously this was expected to be 1.9%, which is below the BOE’s target rate, now it is expected to be 2.3%, with inflation not falling below the target 2% until Q1 2027.

Chart 2: Bank of England forecast summary Feb 2024