Investments in silver and all precious metals are seen as safe by investors from all over the world and they are very popular nowadays. Silver is a desirable asset by day traders, speculators and investors, and one of the most popular precious metals in the world. But not everyone knows that more than half of silver demand comes from industries. This precious metal has plenty of practical applications and great prospects are ahead of it. This article is a quick overview of silver trading basics and after reading it you will know more about investing in silver.

A short History of Silver Trading

The history of the silver trade is very long, dating back almost 4,500 years. Ancient Egyptians valued silver more than gold, because silver bullion was very rare in North Africa. The ancient Phoenicians, known as the most skillful traders of the ancient world, imported silver from Cadiz and Tartessos, and then traded silver in the Mediterranean area, which brought them a fortune.

The history of the silver trade is very long, dating back almost 4,500 years. Ancient Egyptians valued silver more than gold, because silver bullion was very rare in North Africa. The ancient Phoenicians, known as the most skillful traders of the ancient world, imported silver from Cadiz and Tartessos, and then traded silver in the Mediterranean area, which brought them a fortune.

In the 5th century BC, a large deposit of silver was discovered near Athens, and the city flourished. The ancient Lydians were the first who melted coins from electrum, a natural alloy of silver and gold. In the 8th century, the Anglo-Saxons minted silver coins called 'sterling' (240 coins per pound of silver). That's why now the currency of Great Britain is called the 'pound sterling'.

Powerful deposits of silver were discovered in Mexico, Bolivia and Peru after Christopher Columbus' expedition to the New World in 1492. This provided Spain a world hegemony and wealth for the next 300 years. Partially also due to silver trading, Spain became the largest economy in the world. The name of the U.S. dollar has its origins in the silver trade. The most popular currency in Europe were silver thalers. The Dutch called them 'daalder' and after founding the city of New Amsterdam on the island of Manhattan they brought the silver 'daalder' there. The inhabitants called it 'dollar'. New Amsterdam is now the city of New York, and the investing in silver is part of its history.

After the discovery of the Comstock Lode deposit in 1859, the United States became the largest silver producer in the world and the silver trading had to be regulated. In 1967, the United States stopped minting new silver coins and ended its program of buying back silver-plated securities.

For thousands of years silver has been a very important part of world history and currencies. The silver trade has made a powerful contribution to the financial evolution of developed nations. In the coming years, we will see a continuation of the great story of silver investments and trading this special metal.

The Benefits and Use of Silver

Silver metal prices are affected by fluctuations in the supply and demand of the precious metal. Silver has a very wide range of adoption in healthcare, electronics, energy, jewellery, and automotive industries. As a result, the situation in specific industries can cause demand for silver to increase or decrease in prices – which then affects its price.

Silver has the most uses of all raw materials. Silver is needed in production of i.a. computers (malleability), laptops, telephones, water filters, mirrors, batteries and medical equipment (silver is antibacterial). Silver has several thousand uses and currently there are no known alternatives to it, which could potentially make investing in silver profitable. Also important is the lack of price elasticity, because a certain amount of silver is required to produce, for example, laptops or phones. Even if the price of silver increases several times in the future, the producer of a telephone or a computer will still need the same amount of silver, so the demand will be constant or even higher. The silver stock could potentially cause electronics manufacturers to compete for its resources, driving up its price.

Silver has the most uses of all raw materials. Silver is needed in production of i.a. computers (malleability), laptops, telephones, water filters, mirrors, batteries and medical equipment (silver is antibacterial). Silver has several thousand uses and currently there are no known alternatives to it, which could potentially make investing in silver profitable. Also important is the lack of price elasticity, because a certain amount of silver is required to produce, for example, laptops or phones. Even if the price of silver increases several times in the future, the producer of a telephone or a computer will still need the same amount of silver, so the demand will be constant or even higher. The silver stock could potentially cause electronics manufacturers to compete for its resources, driving up its price.

Silver and gold are the metals that are shrinking the fastest. According to the United States Geological Survey, at the current rate of extraction, silver could run out in as little as 25 years. Most silver is used up irrevocably. That’s why silver trading could be more and more popular in the future and attract both investors and speculators.

Silver and gold are the metals that are shrinking the fastest. According to the United States Geological Survey, at the current rate of extraction, silver could run out in as little as 25 years. Most silver is used up irrevocably. That’s why silver trading could be more and more popular in the future and attract both investors and speculators.

How to Buy Silver

You have the option of investing in silver or trading silver. There are several differences between these methods.

Investing in Silver

Investing in silver is done through the actual purchase of ETFs, shares of silver companies (e.g. silver mining companies), through the purchase of physical bullion or assets that give you ownership of the underlying instrument - silver.

Trading Silver

Trading silver is speculative and only moves of the silver price are relevant and important here. You can trade silver by entering into transactions on Silver CFD (contract for differences) and using the potential of financial leverage. This kind of contract is a financial contract that pays the differences in the settlement price between the open and closing trades without any physical supply of traded instruments.

Online or Physical?

The traditional way of buying and investing in silver was purchasing physical bars or coins. Over the years, the storage and insurance costs have caused this method to decline in value.

The problems with this type of silver investment are also the high commissions with those kinds of transactions and a large spread (the difference between the buying price and the selling price). Also, delivery of coins and bars can be time-consuming and its physical storage creates a risk of theft and takes up a lot of space in the case of a larger investment. 100 kilograms of silver is currently worth about 75 thousand dollars. Due to its heavy weight, this can create a problem with transporting such a quantity of silver. There is also the risk of buying counterfeit silver coins and products.

Silver investment in physical coins is not very comfortable. When you want to sell your silver investment, you have to find a dealer first; a dealer who will buy your silver. And they can always change their mind.

For these reasons, online silver trading and a modern type of silver investment is becoming increasingly popular. There is a whole range of instruments, such as the ETF’s ,which give you exposure to physical silver price or a group of mining companies, individual shares of listed companies, certificates backed by physical silver which the investor doesn’t have to store in their house or pay for deposit place and of course contracts for difference, the so-called silver CFDs.

Trading silver online is also cheaper, the spread and transaction costs are much lower than in case of trading physical silver. Also, because of market liquidity, you can close your position by one mouse click at any moment when the silver market is open.

That’s why trading silver online has so many advantages and it’s the most popular kind of silver trading nowadays.

Trading Silver CFDs

This kind of trading is addressing risk conscious traders and speculators.

Trading silver CFD gives the advantages of low fees and commissions, very low spread, and possibility of using financial leverage. Thanks to the leverage, trading silver requires only a certain percentage of the whole position. For example using 1:10 leverage gives you the opportunity to open a 10,000 USD contract by using only 1000 USD. This option is for high risk investors and day traders. Using leverage can result in a higher profit but also, of course, a bigger loss on open positions.

Spot price of silver is the price at which silver is currently quoted - buying at this price would mean that silver could be exchanged and delivered "on the spot" in physical form. CFDs on silver spot prices gives you exposure to the current price of silver without the need to own physical assets.

Silver CFD trading also gives an opportunity to open short positions, in which traders earn money when prices of the instrument are falling. This allows implementation of many different strategies during trading sessions on silver price. We also provide a lot of different indicators on our trading platform like RSI ‘Relative strength index” or Fibonacci levels which can make Your silver trading more efficient.

Silver Stocks and ETFs

Stocks

One way to invest in silver is to buy shares of gold mining companies. In this case, investors gain exposure to the stock market of silver mining related companies, such as Silvercorp Metals (SVM.US), Hecla Mining Company (HL.US) or Endeavour Silver Corp (EXK.US) from NYSE.

One way to invest in silver is to buy shares of gold mining companies. In this case, investors gain exposure to the stock market of silver mining related companies, such as Silvercorp Metals (SVM.US), Hecla Mining Company (HL.US) or Endeavour Silver Corp (EXK.US) from NYSE.

Silver producers are heavily dependent on the current market price of silver. When silver prices rise, the outlook for such companies is usually good because the financial performance of such companies is also expected to rise. The shares of such companies are highly volatile, but can give a much higher rate of return than the price of the commodity itself.

Therefore, there is a significant positive correlation between silver prices and some mining companies. It is worth noting that gold mining companies can also pay dividends, which is a huge advantage over direct investment in precious metals. This factor may be particularly important for long-term dividend investors and suggests that in some cases, buying shares of mining companies may be a very wise type of silver investment.

ETF’s

Silver investment by purchasing Exchange traded funds (ETFs) can make your silver portfolio more diversified and can track the movement of physical silver bullion or price of a group of companies within the silver industry. Trading in silver ETFs gives you a broader exposure than what you’d get from a position on singular stock.

This kind of silver trading is more balanced and also gives the opportunity to receive dividends from distributing ETFs or buying accumulating ETFs, and create diversified portfolios with lower risk, but also with lower growth potential.

This kind of silver trading is more balanced and also gives the opportunity to receive dividends from distributing ETFs or buying accumulating ETFs, and create diversified portfolios with lower risk, but also with lower growth potential.

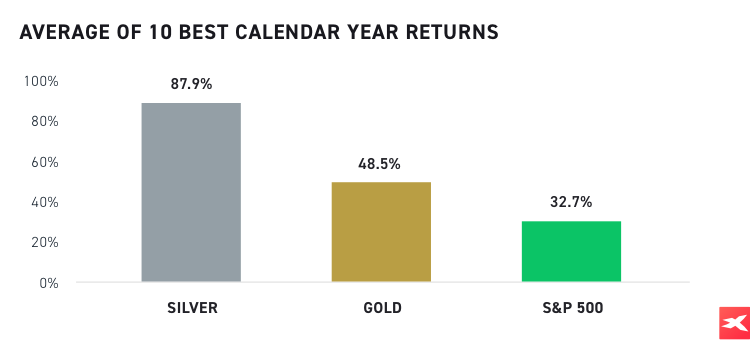

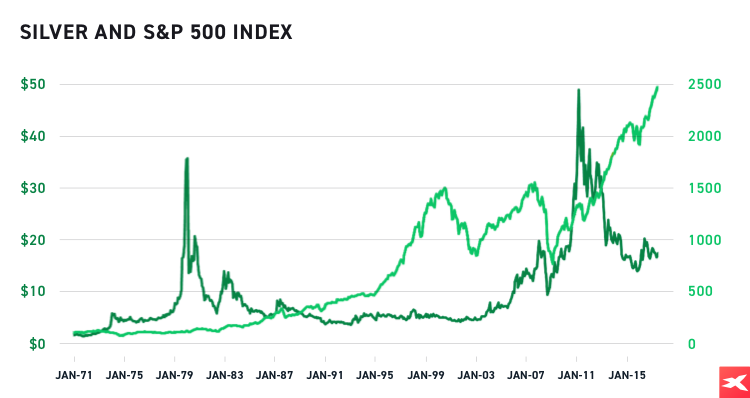

Best Time to Start Trading Silver

Many market participants and silver traders wonder what the best time to invest in silver is. Traders are comparing silver investments to gold investments, which is well known as a “safe haven”. This means that it is regarded as a relatively safe asset during tough times, such as during financial crises or recessions. Silver is more volatile than gold and of course there is a correlation between these two precious metals, but not in every case.

Many market participants and silver traders wonder what the best time to invest in silver is. Traders are comparing silver investments to gold investments, which is well known as a “safe haven”. This means that it is regarded as a relatively safe asset during tough times, such as during financial crises or recessions. Silver is more volatile than gold and of course there is a correlation between these two precious metals, but not in every case.

Silver may become popular during high inflation periods, because inflation usually makes people concerned about the shrinking value of their money. Some of them are looking for good investments in well known assets, which can probably have high demand in the future.

In nature there is only 16 times more silver than gold, but at the same time silver is 75 times cheaper than gold per ounce. This shows that silver could potentially be undervalued given the main factor driving the price of the precious metal, which is rarity. Silver also has several thousand uses in industry and many other branches, gold doesn't have it.

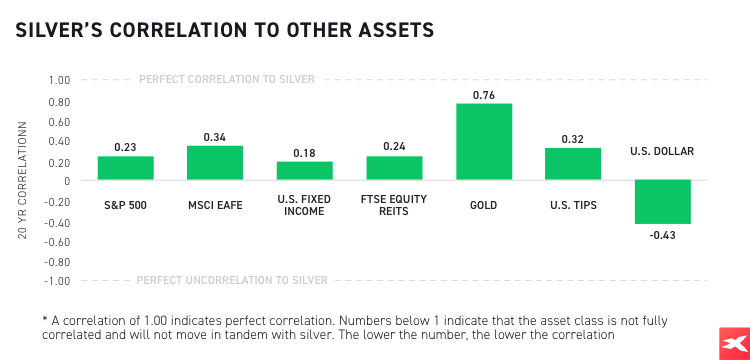

Silver is an asset which is liked by long-term investors and risk-taking speculators. Silver investment could help investors build a well-balanced portfolio.

Silver is an asset which is liked by long-term investors and risk-taking speculators. Silver investment could help investors build a well-balanced portfolio.

The relationship between silver and US yields is very important in trading silver and also for long-term investment in silver. It emerged after the global financial crisis. When investors are buying US government bonds (US Treasuries), US yields sometimes fall and it may be a positive signal for silver prices (also for gold prices). But when investors decide to sell US Treasury bonds yields tend to rise. This is negative for both silver and gold prices. Precious metal speculators should closely observe this correlation in the future to find the best time for buying or trading silver.

Silver prices probably have higher growth potential than gold, but also the market of this asset is more volatile which makes it liked by speculators, funds but also by retail investors. There seems to be still a great future ahead of silver investment, in this case nothing has changed since almost 4500 years ago.

Silver prices probably have higher growth potential than gold, but also the market of this asset is more volatile which makes it liked by speculators, funds but also by retail investors. There seems to be still a great future ahead of silver investment, in this case nothing has changed since almost 4500 years ago.

Silver Trading Hours

What about available silver trading hours? This information is especially important for day traders. Spot gold and silver trading is available 23 hours a day from 6pm ET Sunday through 5pm ET Friday. Trading silver is closed from 5pm to 6pm ET daily. Spot silver trading follows CME holiday closures. The spot price is static when the market is closed. At all other times the prices of silver are fluctuating.

Of course the best time for silver trading is during periods of very high liquidity, when market volatility is higher. When there are high trading volumes in the market, volatility increases. It could be influenced by publishing important political or company news but also because of overlapping trading hours of different locations. But If you treat silver investment as a long term You don’t need to follow temporary market volatility.