In this article you will learn:

- How to Trade Crude Oil via CFDs?

- What are the basic differences between Brent oil and WTI oil?

- Other options for investing in oil with XTB

- What to look for when investing in oil

- What else should you keep in mind?

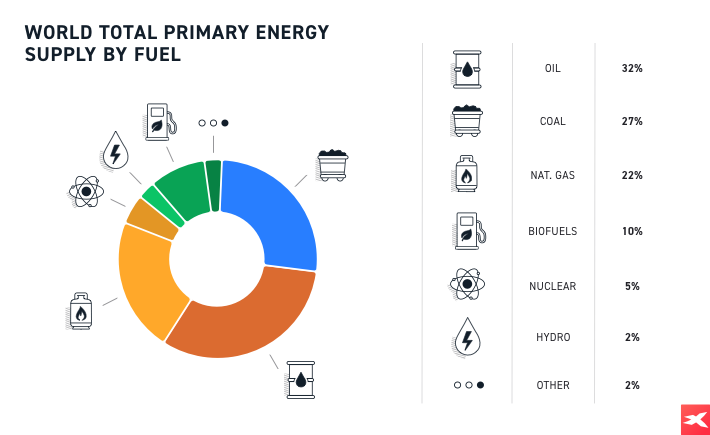

Crude Oil is recognised as the No.1 commodity in the world, primarily due to the fact that it is used to produce liquid fuels, which are used in various means of transport; water, land and air. Oil is also used in the production of other important goods, such as synthetic materials, asphalt, and more. However, the most important use of oil is to obtain energy. Currently, it accounts for about 1/3 of global energy supply! Little wonder it is the most-traded commodity in the world, providing great market liquidity and, therefore, great investing opportunities.

Source: IEA World Energy Balance Review 2019

Source: IEA World Energy Balance Review 2019

How to Trade Crude Oil via CFDs with XTB

One of the many ways to get exposure to oil is to trade Contracts for Differences (CFDs) on OIL or OIL.WTI. CFDs are extremely fascinating instruments with many interesting features that affects the uniqueness of this product, such as:

- CFDs are derivatives products - you don’t actually own the underlying product, you’re simply speculating whether the price will rise or decline.

- CFDs are leveraged - which means you can make a trade without having to deposit the full value of an asset in order to place a trade. Therefore, when using the financial leverage mechanism, it should be remembered that both the chances of potential profits and the size of the possible loss are increased.

- CFDs allow investing on both the rising prices and falling prices.

- The possibility of taking long positions (BUY) or short positions (SELL) in combination with the use of the financial leverage mechanism makes these types of contracts currently one of the most flexible and popular types of trading on financial markets.

- CFDs allow you to invest even in small parts of the lot, so you can adjust the size of the transaction to your own investment opportunities.

XTB offers trading with CFDs for Brent crude oil (OIL) and CFDs for WTI crude oil (OIL.WTI), i.e. instruments whose price is based on the current crude oil price Brent and WTI, listed on the organised market.

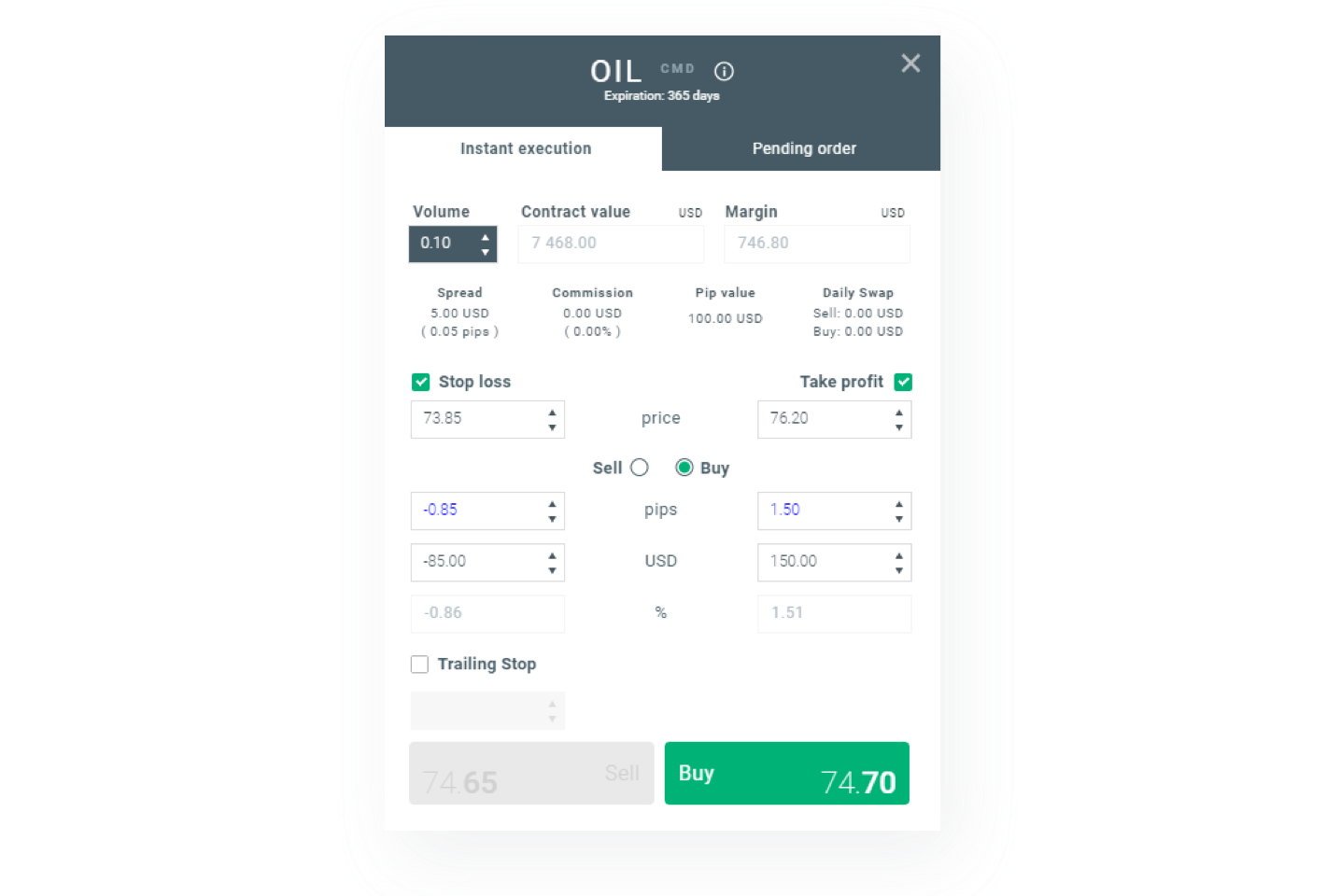

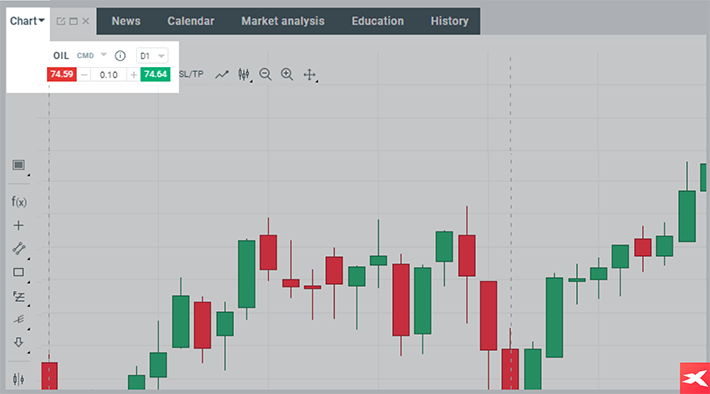

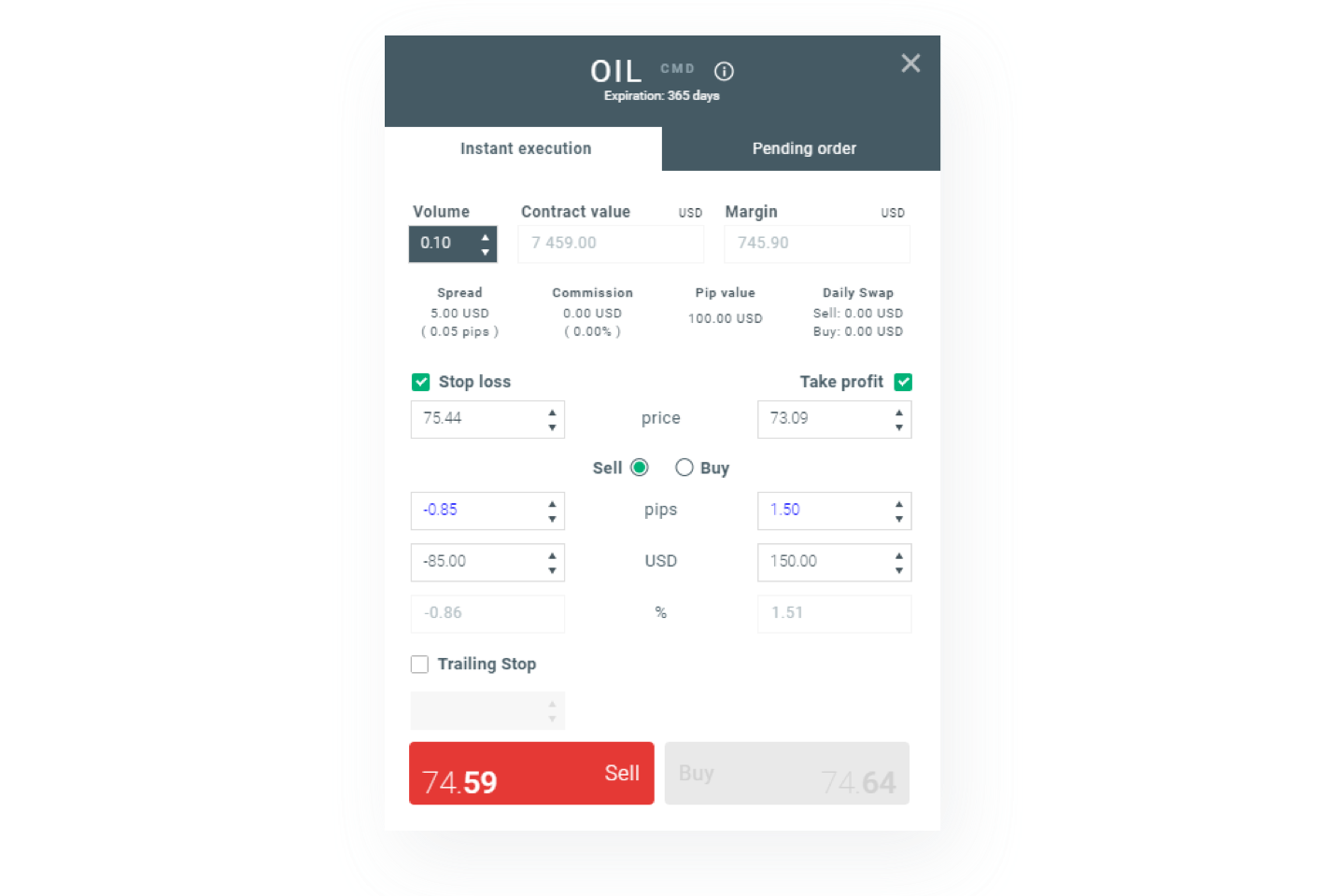

The easiest way to trade in the oil market is to use our XTB trading platform, which is a complete trading tool that gives you the opportunity to invest in a wide range of financial instruments. Thanks to the calculator built into the order window, you can set the Stop Loss or Take Profit order in accordance with the assumptions resulting from your own investment strategy.

First, let's look at how to place a buy order, otherwise known as a long position. Let us assume that, after analysing the market, you believe that the price of oil is going to rise in the near term. Initially, you should determine the size of the transaction. Next, you could set up a Stop Loss order to limit your potential losses and a Take Profit order that will close the order when you make a profit. The easiest way to enter into a new transaction is by selecting the chart positions in the click & trade panel, which can be found on the left side of your screen in the Market Watch module.

Source: xStation5

Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

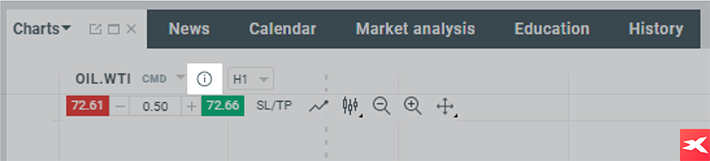

Alternatively, the click & trade panel is also located above the chart, in the upper left part of the Chart Window.

Source: xStation5

Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

After you specify the above mentioned data, just click on the green Buy button.

In order to profit from falling prices, you could enter a short position. The process of concluding transactions is similar to the one described above, except that after setting all parameters, you need to click the "Sell" button.

Source: xStation5

Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

If the market is open, then the order should normally be filled. The status of the transaction is visible in the Open Positions window below the chart. Once it’s time to close your position, you can either click “Close” or reverse your initial trade.

Source: xStation5

Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

What are the basic differences between Brent oil and WTI oil?

The following two oil benchmarks are most commonly talked about on the oil market: Brent and WTI. Nevertheless, there are more types of Oil, depending on its properties or the place of its extraction. Price also depends on its properties, location or transport.

The most important oil benchmarks. Source: Intercontinental Exchange (ICE)

The most important oil benchmarks. Source: Intercontinental Exchange (ICE)

Brent crude oil (OIL) - comes from 15 oil fields located in the North Sea. The low sulfur content, which is below 0.37%, indicates that it is sweet oil, and its low density allows it to be described as light, ideally suited for the production of diesel oil and gasoline. It is estimated that nearly 70% of global oil transactions are made on Brent oil. The Brent crude futures contracts are listed on the London Intercontinental Exchange (ICE).

WTI crude oil (OIL.WTI) - West Texas Intermediate, is extracted in the United States, Texas. Due to the sulfur content, which is below 0.24%, it is referred to as sweet and light oil, because of its low density. WTI crude is the underlying instrument for futures contracts on the New York Mercantile Exchange (NYMEX). It is characterised by high quality, one of the highest in the world.

The difference in value between Brent crude oil and WTI crude oil, i.e. differential, technically suggests superiority of WTI oil due to its better technical parameters. However, Brent prices are actually often higher due to supply and demand conditions.

Other options for investing in Oil with XTB

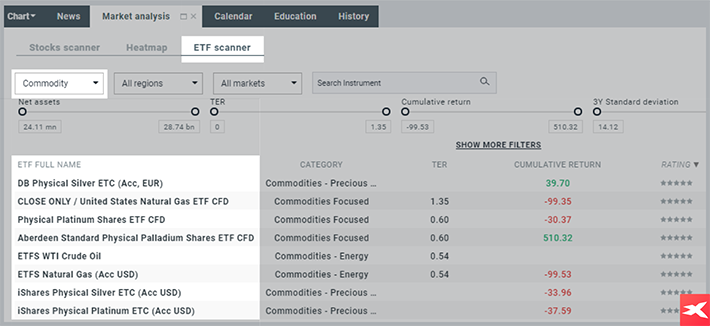

In addition to CFDs, there are also several ETFs that allow investors to gain exposure to the oil market. Apart from that, investors might also seek indirect exposure to the prices of oil. Investing in CFD stocks of the largest oil mining companies is another way of creating a diversified portfolio. It is worth pointing out that such a solution may have an advantage over direct investment in commodities, as some companies may also pay dividends.

Our ETF and Oil Stock scanners may be found helpful when looking for investment opportunities on the Oil market. Source: xStation5

Our ETF and Oil Stock scanners may be found helpful when looking for investment opportunities on the Oil market. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

What to look for when investing in oil

Oil prices are constantly changing due to fluctuations in demand and supply, both in the economies of individual countries and around the world. There are several factors that affect oil prices, including: natural disasters, war, civil unrest, currency movements, global economic growth, transportation and storage costs. Moreover, the recent alternative fuel developments have also been influencing the oil market.

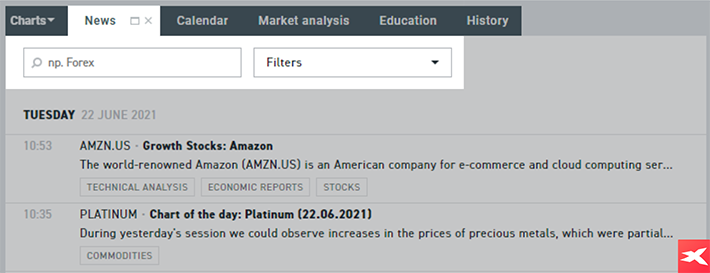

Therefore, it is important to keep up to date with any news or data releases that could move the price of oil. Investors have access to the most crucial information from the oil market thanks to our market “News" section in which, apart from the publication of the most important macroeconomic data, our analysts present a general picture of the market and indicate potential investment opportunities. When analysing the market, it is also important to have access to real-time oil prices, which is possible thanks to our xStation5 platform.

In order to gain access to the latest information from the oil market, simply click on the "News" section on the platform.

Source: xStation5

Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

What else should you keep in mind?

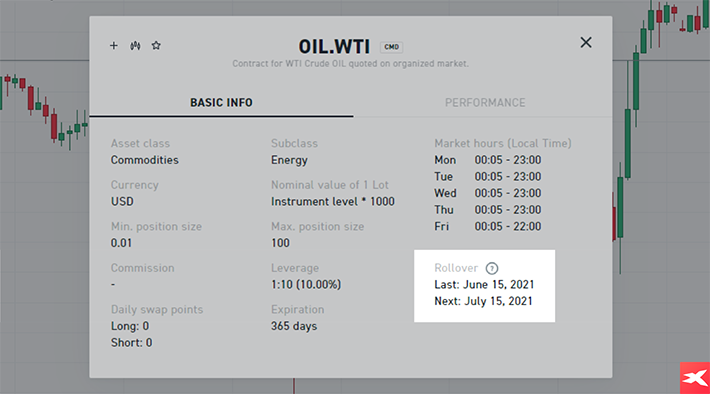

At XTB, Oil CFDs are based on futures contracts listed on the exchanges, which expire each month. XTB offers CFDs with a 365-day expiry date (does not apply to share-based CFDs and ETFs) so that our clients do not have to close a position based on an expiring contract series every month and open another. In this way, customers can continuously, for up to 365 days, keep one CFD based on the price of oil, without having to open new positions every month, as is the case in the underlying market. Usually, the transition to the next series of contracts occurs a few days before the expiry date of the current series of futures contracts on the underlying market. We will inform you about upcoming rollover dates in trade news.The date of the last and the next rollover can also be found on our platform by clicking on the "Instrument information" icon located in the "click & trade panel."

Source: xStation5

Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Source: xStation5

Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Summary

Oil will be a strategic energy resource for a long time to come. The relationship between demand and supply can have a huge impact on the price. In the case of the oil market, it is extremely important to track the publication of important reports that may increase market volatility. Oil CFDs, which are available at XTB, provide additional opportunities to spot new interesting investment opportunities both when the price of this commodity increases, as well as when it falls. The situation on the financial markets will be linked to the oil market for a long time.

To start investing in the oil market, all you need to do is open an investment account. The process of opening an account with XTB takes place completely online. In order to check the xStation transaction system and test your own investment strategy, it is worth opening a free demo account with virtual funds.

Access to the transaction system is possible through a browser, desktop version and mobile application, thanks to which you can quickly and easily control your transactions from anywhere in the world and from all devices that support Android and iOS systems.